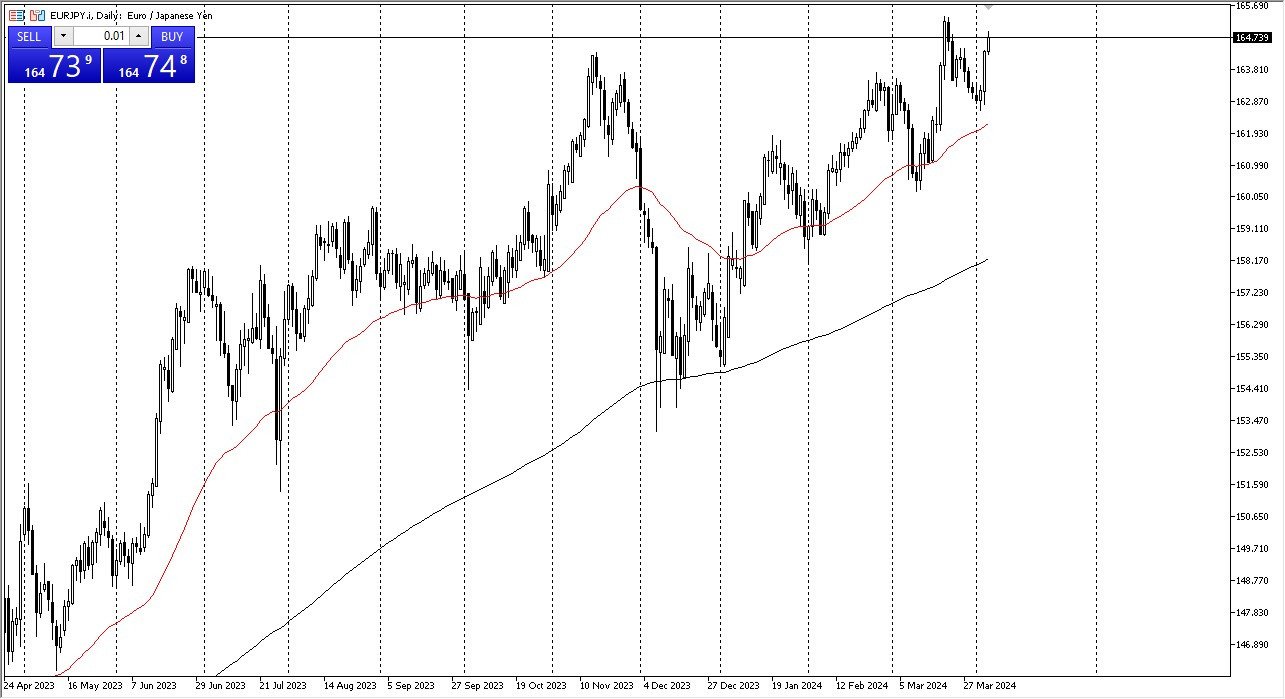

- The euro has rallied slightly during the trading session on Thursday, as we continue to see the Japanese yen taken on the chin.

- After all, the Bank of Japan has zero interest rates, while the euro at least offer some type of return.

- You get paid to hang on to this market and therefore short-term pullbacks continue to be buying opportunities.

- The ¥165 level is an area that a lot of people will be paying close attention to, as it is a large, round, psychologically significant figure.

Keep in mind that the market did pull back a bit and therefore shows signs of exhaustion there, and I think there would be a certain amount of “market memory” to pay attention to. However, I think the trend is firmly ensconced in this market and therefore anytime you do get a pullback there will be plenty of people willing to step in and pick up this market as you get paid at the end of every day in order to hold this pair. It’s the interest rate differential that will continue to drive this market, and of course it is a market that continues to look very healthy.

Top Regulated Brokers

Buying on the dips

The EUR JPY market continues to be one where we find plenty of value hunters coming into the market, and after the massive candlestick that we saw on the Wednesday session, it shows just how strong this market truly is. Underneath, we have the 50-Day EMA offering support, as the market continues to see that region as a hard floor in the market. If we were to break down below there, then it’s likely that the market could continue to see the ¥160 level underneath as a floor. If we were to break down below there, then it would be a huge change in attitude, but ultimately, I think it’s more likely that we break above the ¥165.50 level, and then go look into the ¥170 level over the longer term. Obviously, it would take quite a bit of effort to make that happen, but it certainly looks like it’s more likely than some type of meltdown.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.