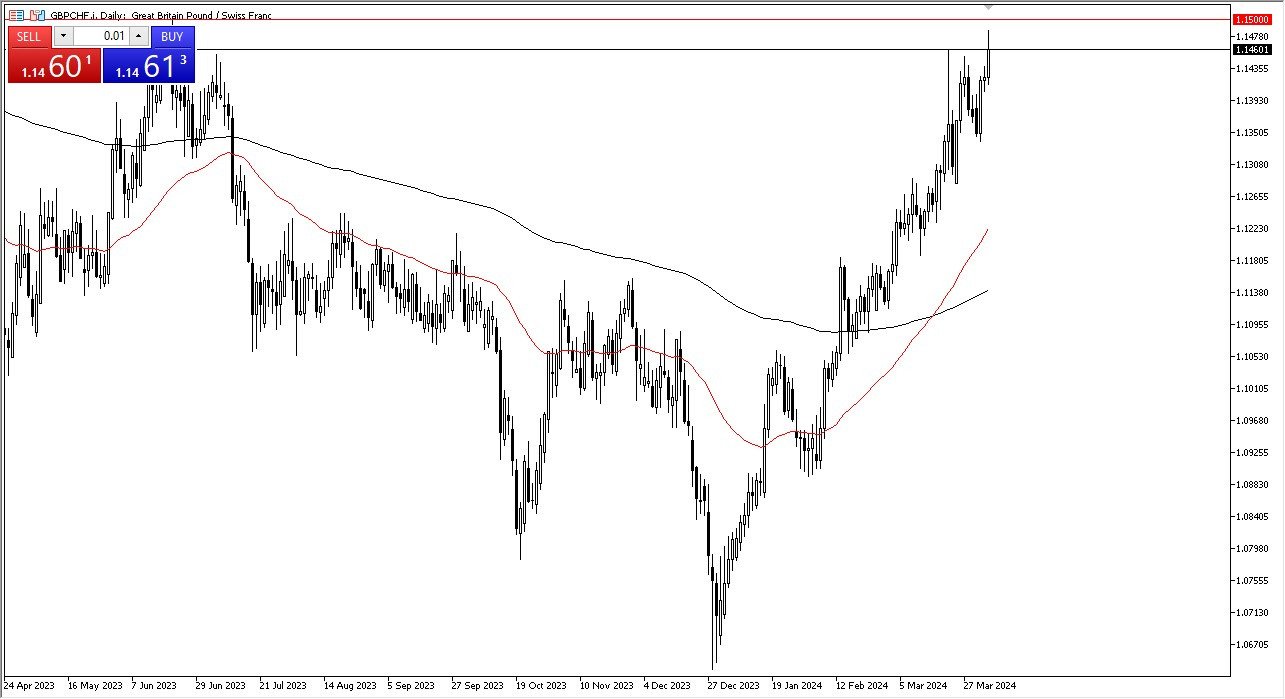

- The British pound has risen against the Swiss franc during the trading session on Friday again, as the so-called “carry trade” continues to be a factor in the Forex markets.

- With that being said, it’s worth noting that the Swiss National Bank has shown itself to be the first of major central banks to cut rates.

- While I do believe that several other central banks around the world are getting ready to cut, the Swiss are more likely than not going to be much more aggressive than some of the other major central banks like the Federal Reserve, Bank of England, etc.

In general, I think this is a situation where we continue to see more or less a “buy on the dips” attitude, which does make quite a bit of sense considering you get paid swap at the end of every day. With this being the case, I think you have a scenario where there are plenty of buyers looking to get involved, and I think it’s probably only a matter of time before we break above the crucial 1.15 level above. The 1.15 levels course is a large, round, psychologically significant figure, and an area where we’ve seen a lot of resistance previously. With that being said, the market is likely to continue to see a lot of buying opportunities every time we get, but if we were to break above the 1.15 level, it’s likely that the market will go much higher and kick off a bit of a short covering rally.

Top Regulated Brokers

Longer-term investment

I think at this point in time we are trying to break out for a bigger move, and if we can break above the 1.15 level then it’s likely that this becomes a longer-term investment, and I think the GBP/CHF pair could very well go to the 1.18 level initially, followed by a much bigger move as the Swiss will almost certainly continue to be loose with monetary policy, and of course they don’t like the idea of an extraordinarily strong Swiss franc anyway.

For additional & up-to-date info on brokers please see our Forex brokers list.