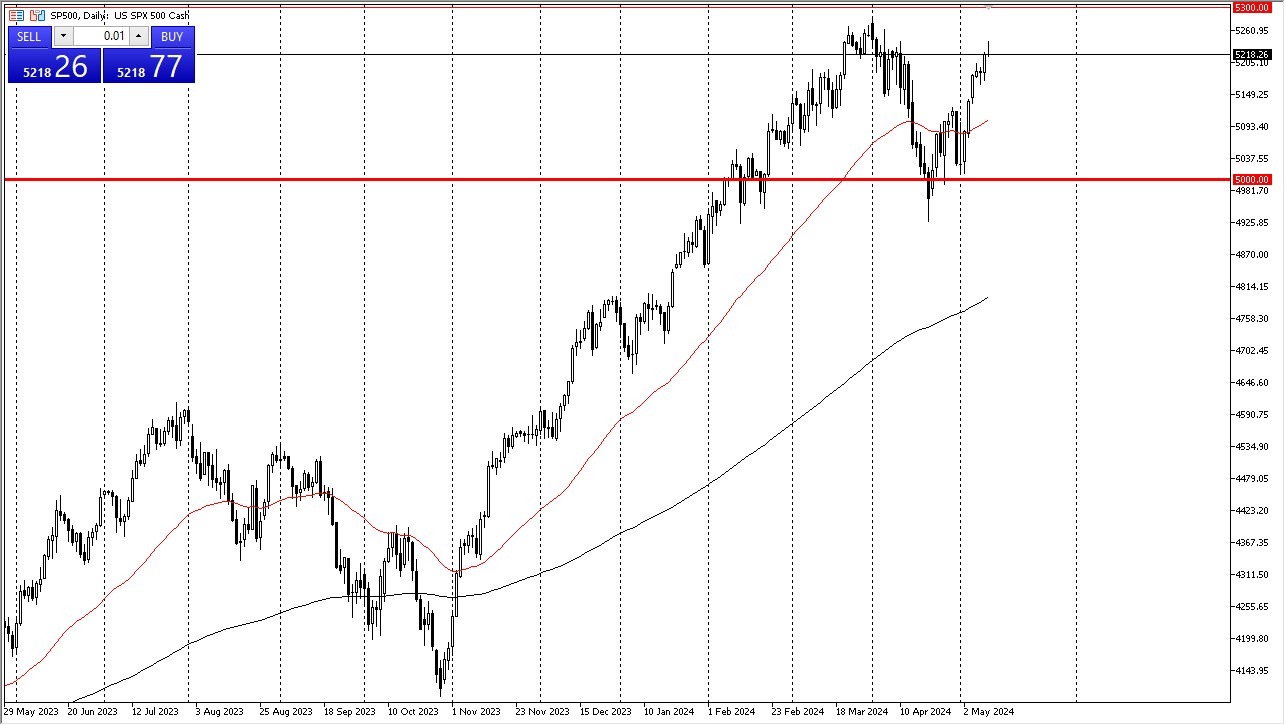

- The S&P 500 initially rallied a bit during the early hours on Friday, but then turned around quite drastically.

- Part of this may be due to the University of Michigan consumer sentiment numbers coming out so poorly.

- With that being the case, it's a situation where we may get a little bit of a pullback, but I think that's a pullback that a lot of people will be paying close attention to. It could end up being a buying opportunity.

We Got Ahead of Ourselves

After all, S&P is a market that got ahead of itself, and if we do see a recession come to the United States, it's possible that traders will come in and try to pick up value based on the idea of liquidity coming back into the market. In general, I think this is a situation where you just look for value underneath, especially near the 5100 level, assuming we pull back that far.

Top Regulated Brokers

It's also worth noting that there is a major high above, which was the all-time high sitting just below the 5300 level. In general, this is a market that I think given enough time will not only reach there, but probably break much higher. With this, I'm looking for an opportunity to get long again, but we probably don't have it quite yet. And there's nothing wrong with being a little bit patient here.

As the market has been so far overstretched for so long, then I think it's a situation where you don't want to pay up. You will get volatility that will allow you to get long again. A simple bit of value trading is probably what you will be finding is most profitable, as the market is obviously stretched in general so therefore you will have to let the “weak hands” get flushed out of the market, and then take advantage of what has been an obvious uptrend for several months now. Because of this, a little bit of patience will probably make a huge difference in your results going forward here.

Ready to trade our S&P 500 analysis? Here’s a list of some of the best CFD trading brokers to check out.