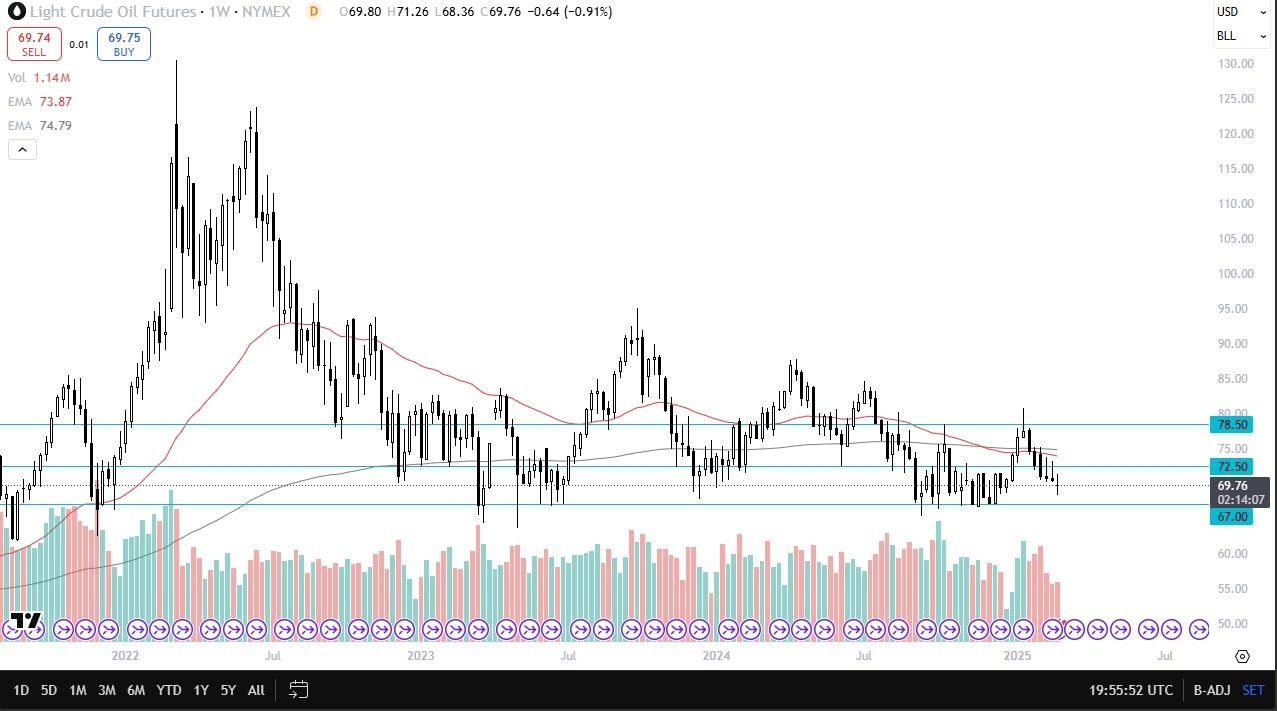

- During the month of February, we have seen the crude oil market try to rally a bit, but it failed a little bit overall, and at this point in time it looks like the West Texas Intermediate/Light Sweet Crude market will continue to see a lot of noisy consolidation.

- All things being equal, consolidation is a feature of this market going forward, and I do think that we have a very well-defined range from which to trade.

- Ultimately, this is a market that’s paying close attention to the attitude of global markets, and we are starting to look at the possibility of a global slowdown, but we also are reaching a time of year that typically has quite a bit more in the way of demand, and that demand should translate into higher prices.

- Nonetheless, I don’t necessarily think we have the ability to break out of the range anytime soon, therefore I think you have to assume that we will get more of the same going forward.

In other words, I think we will be stuck between the $67 level at the bottom and the $70.50 level at the top. Even if we can break above the top, then the next major resistance barrier is closer to the $85 level, which has been important about a year ago. All things being equal, this is a market that I think will be noisy, but if you wait until we get on the outer edges of the market, then you can play the overall range and by the market when it’s oversold, and of course short the market one is overbought.

Top Regulated Brokers

I don’t necessarily see the catalyst for this market to break out, but if and when it does, it will be obvious as to which direction you should be trading.

It is because of this that I think we have a situation where this might be one of the better trading environments if you simply take your time and perhaps pay attention. The market will continue to look for some type of momentum, but right now we just don’t have it.

Ready to trade monthly forecast? Here are the best Oil trading brokers to choose from.