- During the session on Wednesday, the Australian dollar has been all over the place, as we continue to see the market try to focus on the idea of tariffs and what they may end up doing for or against the markets overall.

- After all, the Australian dollar is particularly interesting, due to the fact that it is a currency that represents an economy that is highly levered to Chinese interests, which is in the crosshairs of Donald Trump.

Over the last several days, we have seen tariffs being levied against the Chinese, as well as reciprocal tariffs being levied against the Americans from China. Because of this, it will have a major negative influence on the Australian dollar due to the fact that the Australians are major exporters of commodities to China, which of course will then use those commodities to build infrastructure as well as products for the rest of the world. If we are entering a tariff war, the Australian dollar will almost certainly end up being a major victim.

Top Regulated Brokers

Technical Analysis

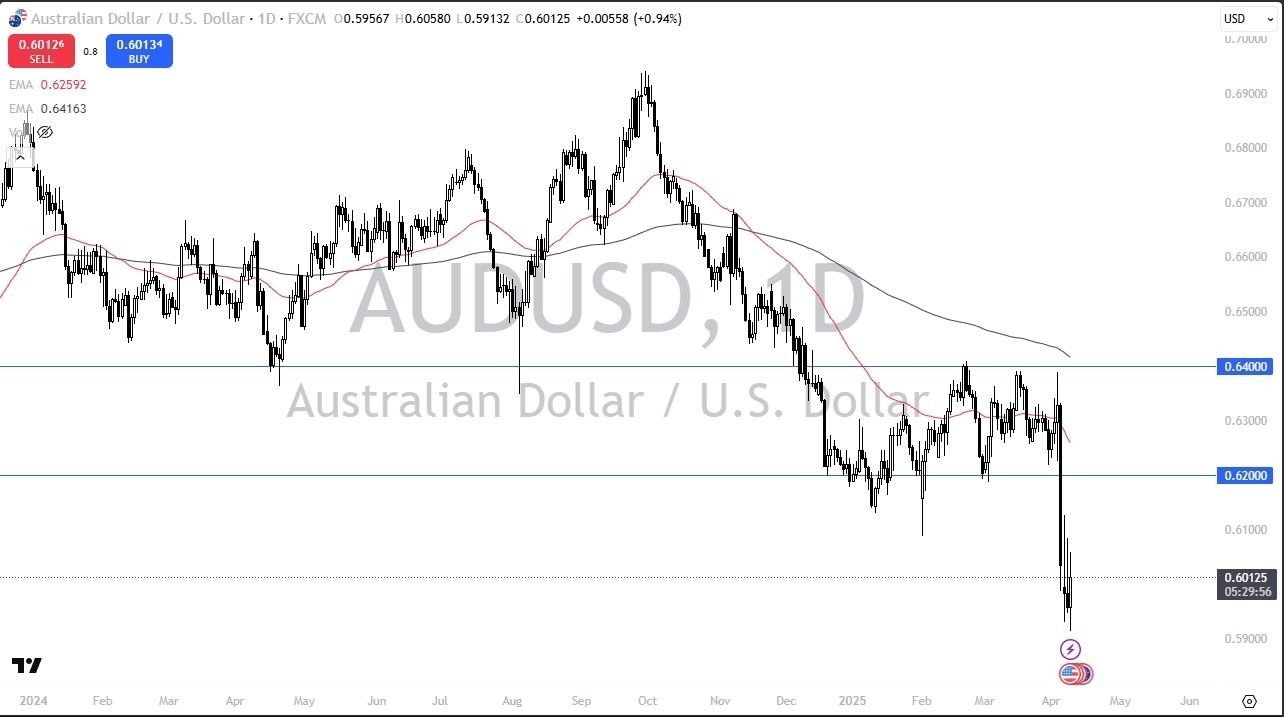

The technical analysis for the Australian dollar is obviously very negative, and it’s worth noting that the last 3 days have seen the Australian dollar try to rally, only to give up gains near the highs. In fact, the previous 2 candlesticks on the daily chart were both inverted hammers, so this tells you just how much pressure there is against the Aussie at the moment. The 0.59 level seems to be a bit of a support level, but quite frankly it’s just a situation where a large, round, psychologically significant figure comes into the picture and keep in the market somewhat afloat.

If we break down below the 0.59 level, then it’s likely that we will continue much lower, perhaps down to the 0.57 level. On the other hand, if we can turn around and break above the 0.61 level, a move to the 0.62 level which was previous support would be anticipated. That being said, if we get a tweet or announcement about the tariff tensions cooling off, that will be a major boon for the Aussie dollar.

Ready to trade our AUD/USD Forex analysis and forecast? Here’s some of the top forex online trading Australia to check out.