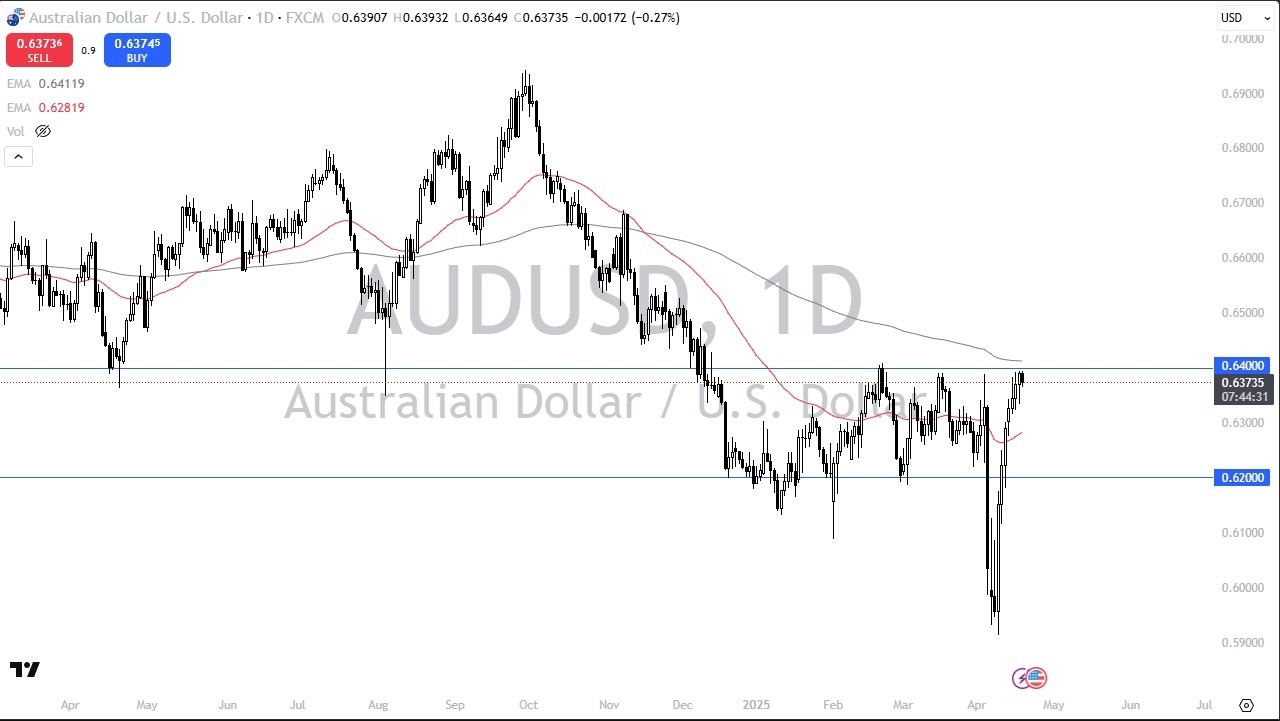

- During the trading session on Good Friday, we have seen the Australian dollar pulled back a bit, which makes a certain amount of sense considering that we are a major resistance barrier just waiting to happen.

- After all, the 0.64 level has been very resistant to buying pressure multiple times in the recent past, and I think you’ve got a situation where that could end up being the way things play out in the short term going forward.

Technical Analysis

Top Regulated Brokers

The technical analysis for this AUD/USD market is interesting at the moment, due to the fact that we plunged quite drastically a couple of weeks ago, only to turn around and see this market explode to the upside as the US dollar has been sold off against almost everything else. With that being said, the market also has to pay close attention to the 200 Day EMA above, which is a major indicator that a lot of people would be paying close attention to. Underneath, we have the 50 Day EMA near the 0.63 level, offering a certain amount of support potentially.

If we were to break down below the 0.63 level, then we could see the Australian dollar drop down to the 0.62 level. That is the bottom of the overall consolidation area that we have seen during the previous several months, and therefore I think it does make a certain amount of sense that it would probably hold as support. If we drop back down below that level, then we probably have something going on where people are running to the US dollar for safety again.

Australia is highly levered to China, so you need to keep that in mind as well. After all, the Australians provide the Chinese with most of the raw goods in order to make products to send around the world. As long as that correlation holds, then I think you have a situation where the Aussie dollar will be overly influenced by whatever is going on with the tariff spats.

Ready to trade our AUD/USD Forex forecast? Here’s a list of some of the best Australian forex brokers to check out.