- The Australian dollar has initially tried to rally during the trading session but has given back those gains to show hesitation.

- Because of this, we ended up forming a bit of an inverted hammer for the trading session, and it looks very much like a market that is going to continue to be parish given enough time, as tariffs almost certainly will continue to be a major issue.

- All things being equal, this is a market that I think you need to watch, because it is firmly at the epicenter of everything between the United States and China.

Let us not forget, the tariff war between the Americans and the Chinese look like it’s going to heat up, and that of course will have a major influence on Australia itself as it exports so many of its commodities to China.

Top Regulated Brokers

Technical Analysis

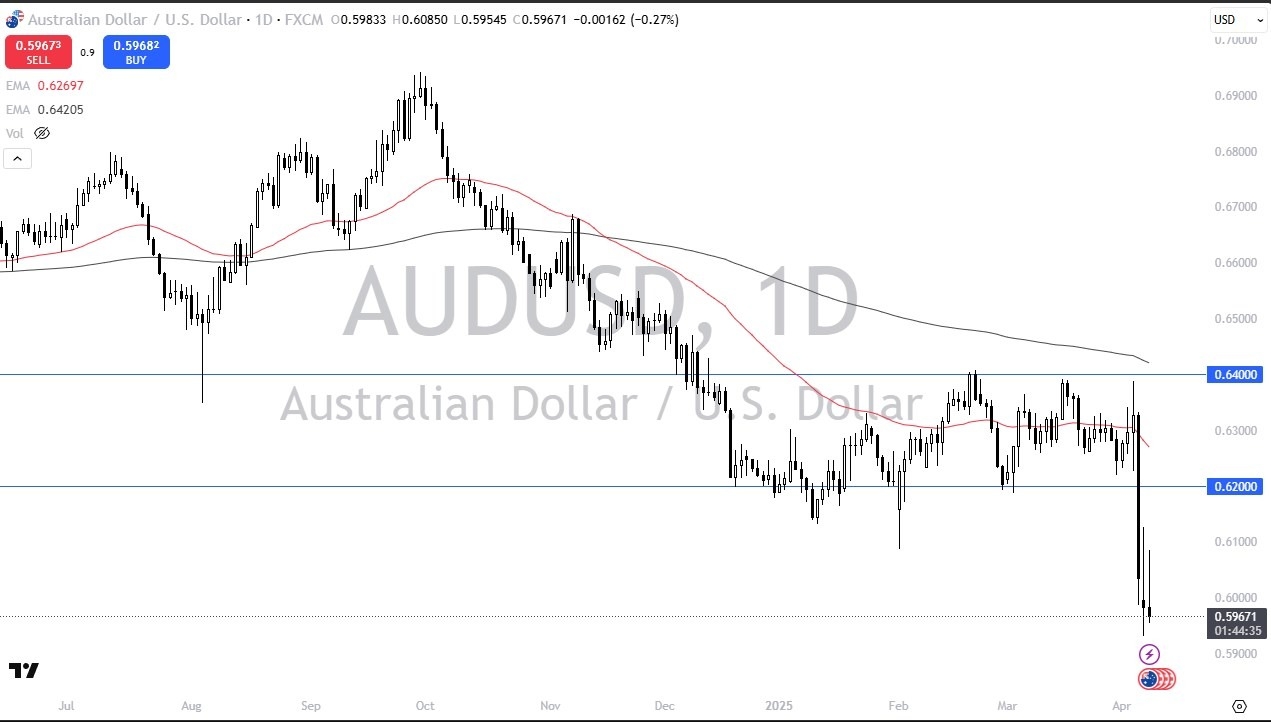

The technical analysis for this AUD/USD pair is terrific, and the fact that we ended up forming to inverted hammers in a row suggest that the Australian dollar is actually going to fall further. At this point, we could be looking at a move down to the 0.55 level, but that doesn’t necessarily mean that we get there easily. On the other hand, if we turn around and take out the top of the last 2 candlesticks, it’s possible that the Aussie dollar could go looking to the 0.62 level. This is an area that has been very noisy in the past, as it was a massive support. The support of course then brings in the idea of “market memory”, meaning that we could see those who were originally long sell their positions as they can finally escape with a breakeven trade, or at least a small loss.

The Australian dollar of course is going to remain very noisy in general, but I also recognize that we have a situation where the US dollar might get more attractive to traders as they try to protect their wealth. Remember, the Australian economy is highly levered to growth, both from a Chinese and international standpoint, and if the tariff situation only get worse, Australia will get ran over.

Ready to trade our daily AUD/USD Forex analysis? Check out the best forex trading platform for beginners Australia worth using.