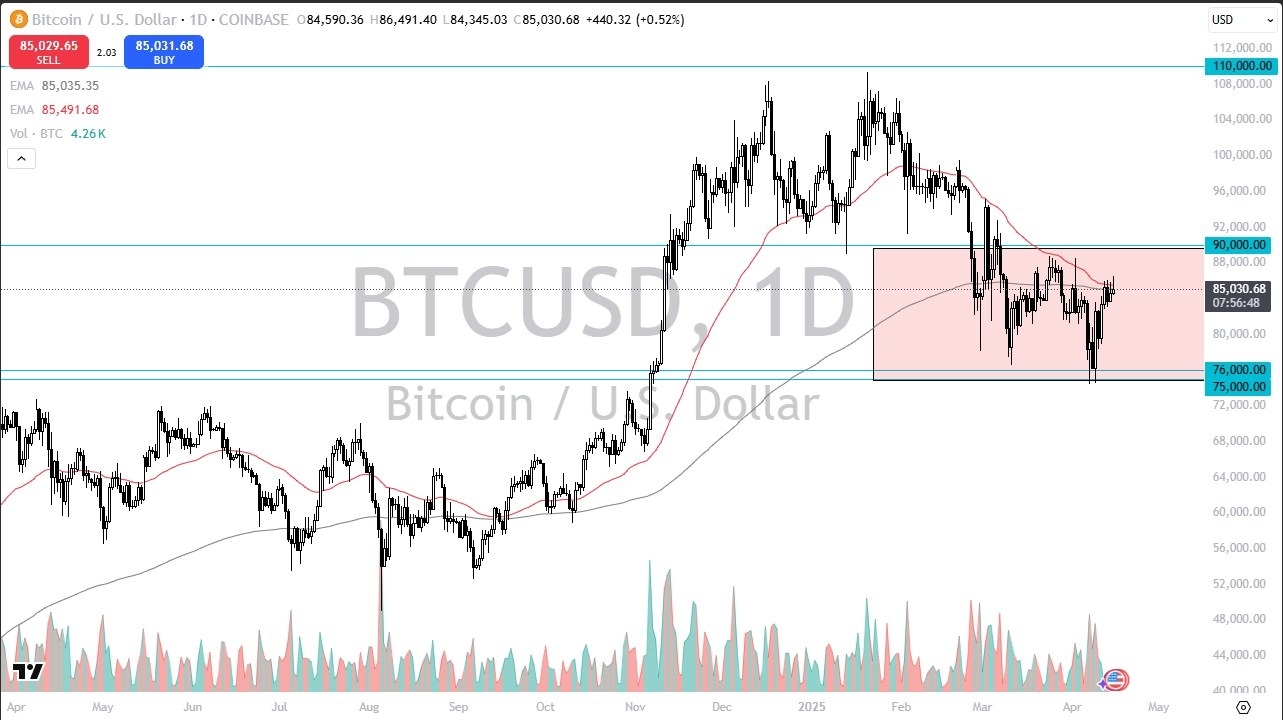

- The Bitcoin market has rallied a bit during the early hours on Tuesday, but we have given back a little bit of the gains as we jumped over the 50 day EMA.

- That being said, the market is likely to continue to be somewhat choppy. It is no reason to suspect that suddenly Bitcoin is going to take off, at least not without some type of help.

- We're having enough trouble in the stock market getting things going.

In an environment like that, it's very difficult to get overly aggressive in the Bitcoin market. The 50 day EMA and the 200 day EMA both sit in this area. And with that being said, it does make a certain amount of sense that we would continue to see a little bit of hesitation if we can break above the $86,000 level, then we go looking at the $90,000 area. This is an area that will continue to be massive in its implications.

Underneath Current Levels

Underneath, if we were to break down the $75,000 region is an area of pretty significant support. I think Bitcoin remains very noisy over the next several weeks. But if we can finally clear that $90,000 level, that will be the sign that traders are willing to step in and start picking things up again. In that environment, breaking the $90,000 level, I think opens up $100,000, which of course is a large, round psychologically significant figure.

Top Regulated Brokers

After that, you have the $110,000 level, which had been a bit of a problem area for buyers, but that would obviously be the target. If we were to break down here, then somewhere around $65,000, you'll have a pretty significant supply. This is an area that has been important for some time, and I think this continues to be a region you will have to pay close attention to.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.