- Bitcoin has rallied slightly during the trading session on Wednesday as we continue to bounce around the same area.

- That being said, the market is likely to continue to be very noisy, but I also recognize that it is likely to be very flat.

- This is because there is no real risk appetite out there, which is something that Bitcoin desperately needs. If there's no risk appetite, generally speaking, Bitcoin plummets. So, what's interesting is that we've already seen the selloff in Bitcoin and now it's somewhat stable. And this could be something worth paying attention to due to the fact that Wall Street now has a Bitcoin ETF. And maybe this is the new behavior of Bitcoin. Maybe not so much panic, but just nothing when there's no risk appetite.

- It's very interesting to watch this because with everything that's going on, a 50 % drop in Bitcoin four years ago would have been a given. So here we are.

Consolidation

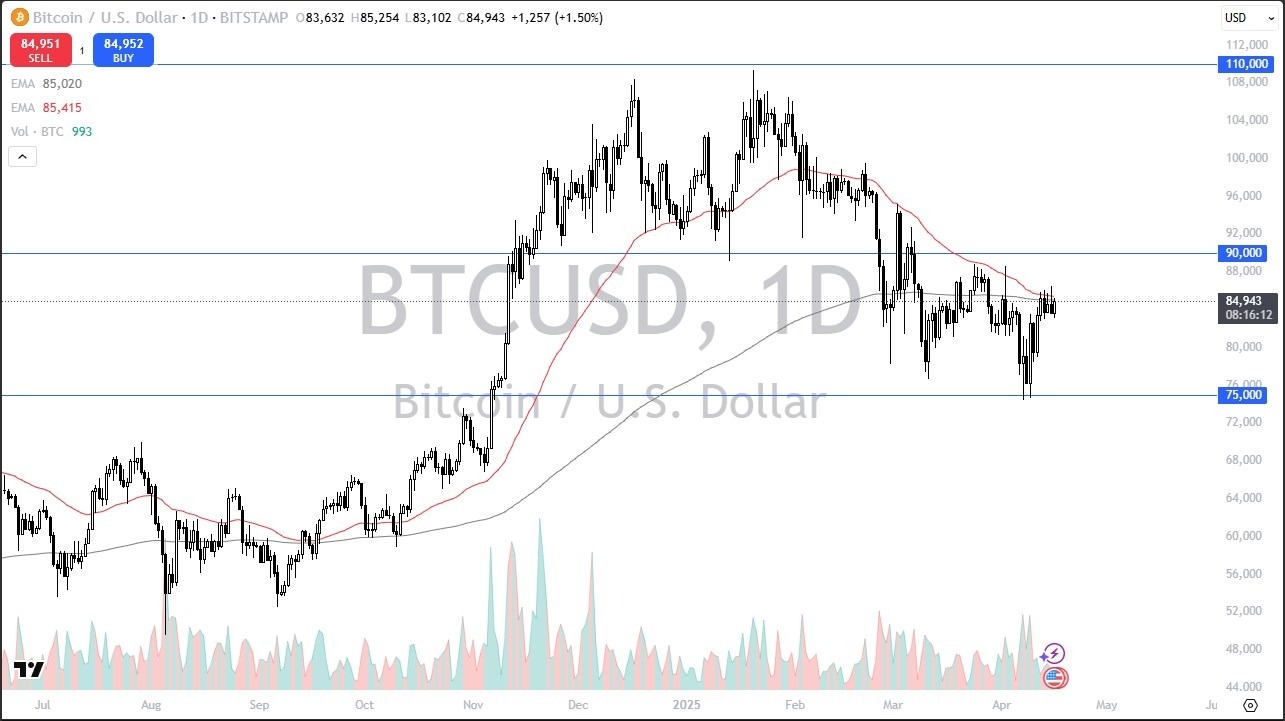

And now I think we're in the midst of trying to form some type of consolidation area with the $75,000 level underneath offering support and the $90,000 level above offering resistance. We are basically going sideways right around the middle of this area, maybe just a little higher, but we're also dancing with the 200 day EMA and the 50 day EMA indicators. So, in other words, I think you have a situation where markets are probably settling into this range. I've been dollar cost averaging in Bitcoin for some time and this latest bounce is somewhat interesting and impressive due to the fact that volume picked up, but it's not enough to really get the market screaming to the upside. Someday we'll get a resolution to all of this tariff talk and I suspect that everything will rally, and Bitcoin will probably be right there with it. If we can break above the $90,000 level on a high volume long candle, then I think that's your sign. Bitcoin goes racing to $100,000 followed by $110,000. If we break down below $75,000, then a return to $68,000 is very possible.

Ready to trade Bitcoin forecasts & predictions? We’ve shortlisted the best MT4 crypto brokers in the industry for you.