- Bitcoin initially pulled back just a bit during the trading session on Wednesday, as the world waits to see what’s going to happen with the tariff announcement.

- After all, the “liberation day” that Donald Trump promised is coming, and that will have a major influence on risk appetite around the world.

- Remember, Bitcoin cannot function in a world that is based on fear and massive risk aversion.

There had been conversations about Bitcoin being “digital gold”, but it is clearly not gold. It doesn’t behave the same way, and it has been left wanting as markets have melted down. In fact, it’s almost like a proxy for the NASDAQ 100 if you look at the charts over the longer term, although I’m the first to admit that Bitcoin is much more volatile and when things are good, it outperforms the NASDAQ 100 most days. That being said, it’s clear that we’ve had a lot of fear out there, and I think you have a situation where traders need to recognize that Bitcoin is about pure speculation at this point, a hope that sooner or later we will see more adoption.

Top Regulated Brokers

Technical Analysis

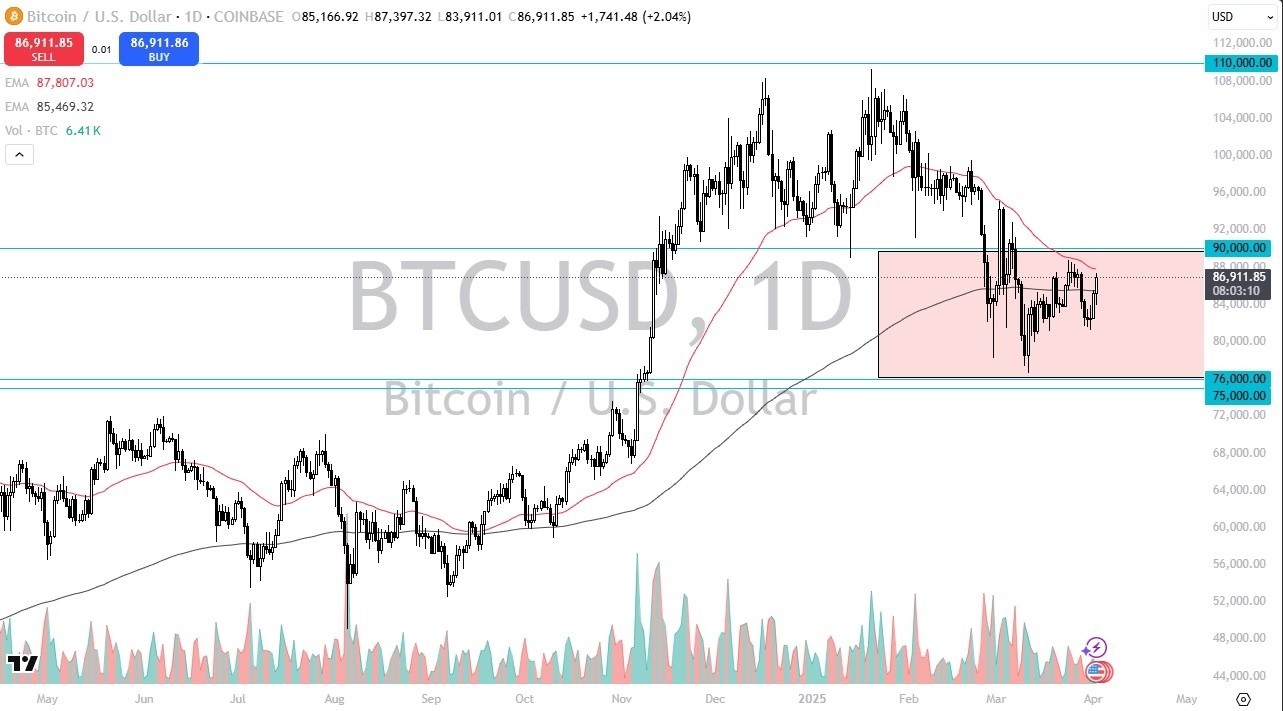

The technical analysis for Bitcoin is somewhat neutral at the moment but depending on the timeframe that you are looking at, things may not be as clear. After all, shorter-term traders are probably looking at Bitcoin through the prism of a flat in neutral market with nowhere to be. Longer-term traders obviously see it as extraordinarily bullish, especially over the last 10 years or so, and intermediate traders look at Bitcoin as falling apart as we have dropped all the way from the $110,000 region.

That being said, in the short term I think we will continue to see a lot of questions asked of the ability for Bitcoin to continue to strengthen, but we need to get past the $90,000 level to get excited. That were to happen, then I think you have a situation where you probably see traders start to pile into the market due to “FOMO.” With this being the case, I think that’s the key for bullish traders going forward. If we don’t get that, then we probably continue to go back and forth as there’s no real catalyst to getting overly bullish.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.