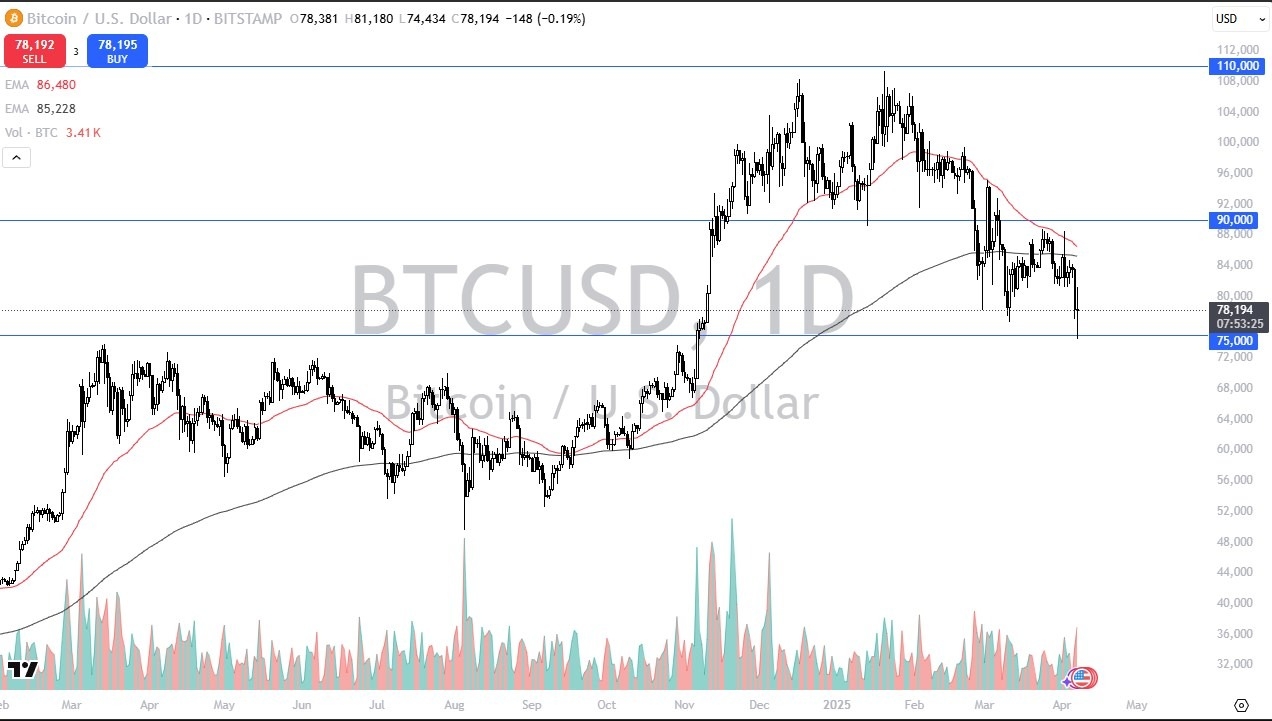

- Bitcoin has been all over the place during the trading session on Monday, testing the crucial $75,000 level before bouncing significantly to show signs of recovery and massive support in the $75,000 level.

- This being a market that of course is highly sensitive to risk appetite, you have to pay attention to the other markets.

- The $75,000 level has been important multiple times in the past, so therefore I would anticipate that we will continue to see a lot of market memory in this area, and the neutral candlestick for the day is a good sign.

While I don't necessarily expect Bitcoin to get suddenly bullish, I do expect that maybe, just maybe, we have enough momentum in this area at this day in this consolidation area. All things being equal, breaking above the top of the range for the day does open up the possibility of a move to the 200 day EMA, maybe even the 50 day EMA.

On a Break Down

If we were to break down below $74,000, then maybe we drop down to $60,000. And with the way risk appetite is going, that's a very real possibility. However, the way we have behaved over the last couple of days shows that Bitcoin is at least holding up better than a lot of other assets. Ironically, maybe it's just because we've sold off previously.

Top Regulated Brokers

I do think that there's a lot of dollar cost averaging going on right there. And I think that we will continue to see traders get involved, but in small positions, building up a bigger position for a longer term move. We could go into crypto winter, but really, at this point in time, it doesn't look like that's the case. That being said, you have to be very cautious getting too big in this market, or any other at the moment.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.