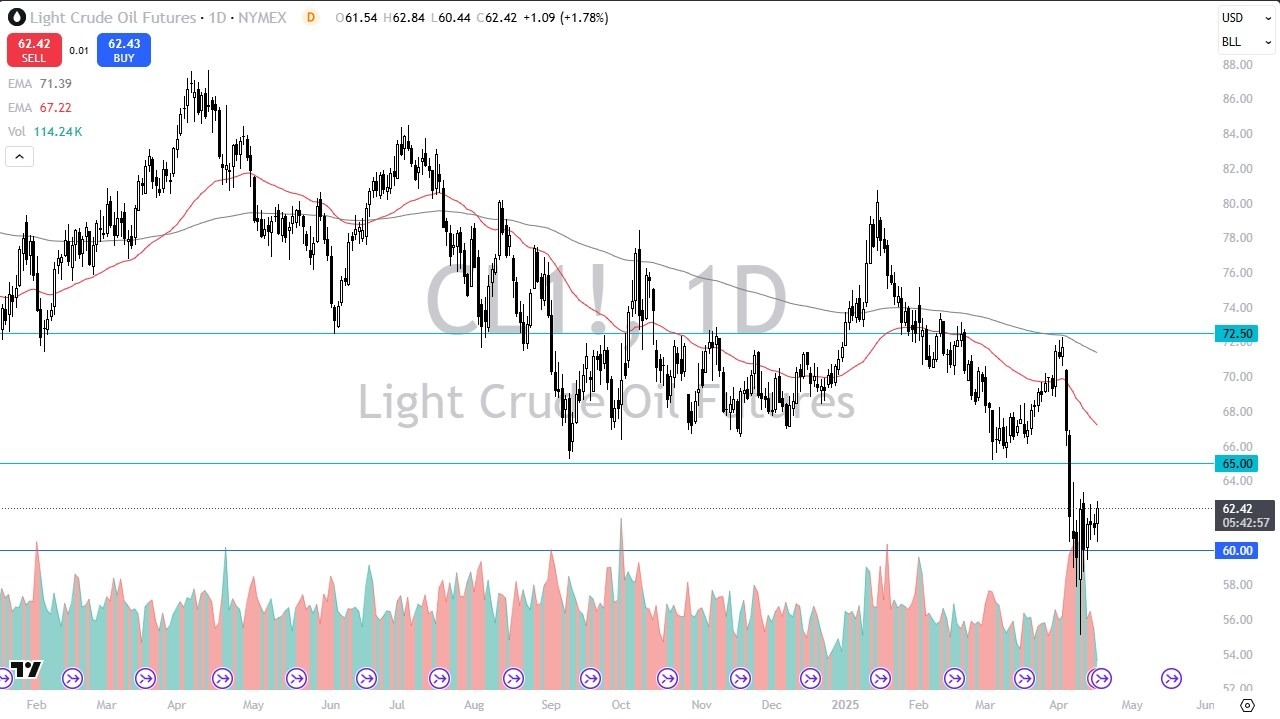

- As you can see, we pulled back just a bit in the early part of the session here on Wednesday only to turn around and show signs of life again

- This does look a lot like a market that is trying to form some type of bottom, but it just hasn't been able to find follow through momentum.

- So really at this point in time, the question is probably going to be more of a catch of whether or not we can find buyers to jump in and truly get things moving or if we are going to continue to just grind back and forth. Either way, I do think that for the most part, the selling or at least the major selling pressure is probably a little bit overdone and is probably going to go away for a while.

- That being said, I don't necessarily think that oil is going to explode to the upside.

Top Regulated Brokers

Tariff Wars and Agreements

But if there is some type of an agreement with trade, especially between the United States and China, it wouldn't surprise me at all to see oil go limit up that day. With this, we are in a cyclically positive time of year. And ultimately, I think you have a situation where the $65 level above is an area that could be a bit of a target. If we can break above there, then we can go looking to the 50 day EMA. If we break down below the $60 level, then maybe we test this excess here, but looking at the future chart, there was a lot of you would call it a failed auction. So, I don't think there's any real demand to short underneath 60 unless something changes. As things stand right now, we are forming a sideways market. That is the first thing that you need to do in order to find a sustainable rally. Now all we need is positive news.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.