- The crude Oil market has rallied a bit during the trading session on Thursday, as we continue to see a lot of volatility, but quite frankly I think we’ve got a situation where traders are looking for value in a market that has been far too oversold.

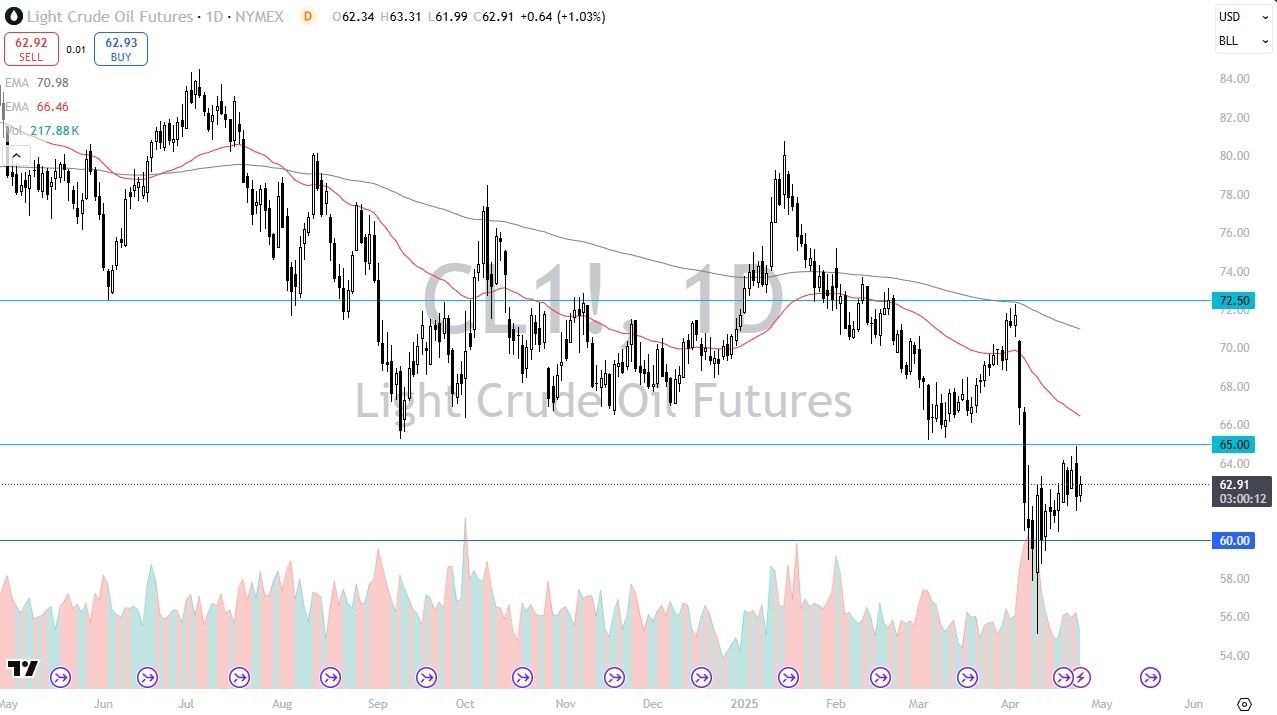

- That being said, there are a couple of levels that I will be paying close attention to, which I have marked on the chart and have been important more than once.

Important Levels

I think the most important level in this market at the moment right now is the $60 level, with the $65 level also being important. I think at this point in time, I think this is a situation where traders will try to play this range, but if we can break above the $65 level, it means that the Light Sweet Crude market is ready to continue going much higher, perhaps reaching toward the 50 Day EMA, perhaps even the $68 level above. Short-term pullbacks continue to be buying opportunities, with the $60 level being massive support. We have seen a significant bounce from that area, with significant volume, so I think you have got a situation where people are trying to turn this thing around.

With the tariff situation being so fluid, it does make a certain amount of sense that the market would start to turn around, as crude oil is a major component in global growth and transportation. If the economy takes off again, that means there will be a lot more demand for crude oil going forward. On the other hand, if things really start to fall apart, the crude oil markets will be one of the first places that you see selling.

I think short-term trading is probably what you need to focus on, as it has been the way to go over the last couple weeks, but I still believe that short-term pullbacks continue to get bought into rather quickly, we continue to see plenty of people either short covering, or trying to play the next move higher with economic growth.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.