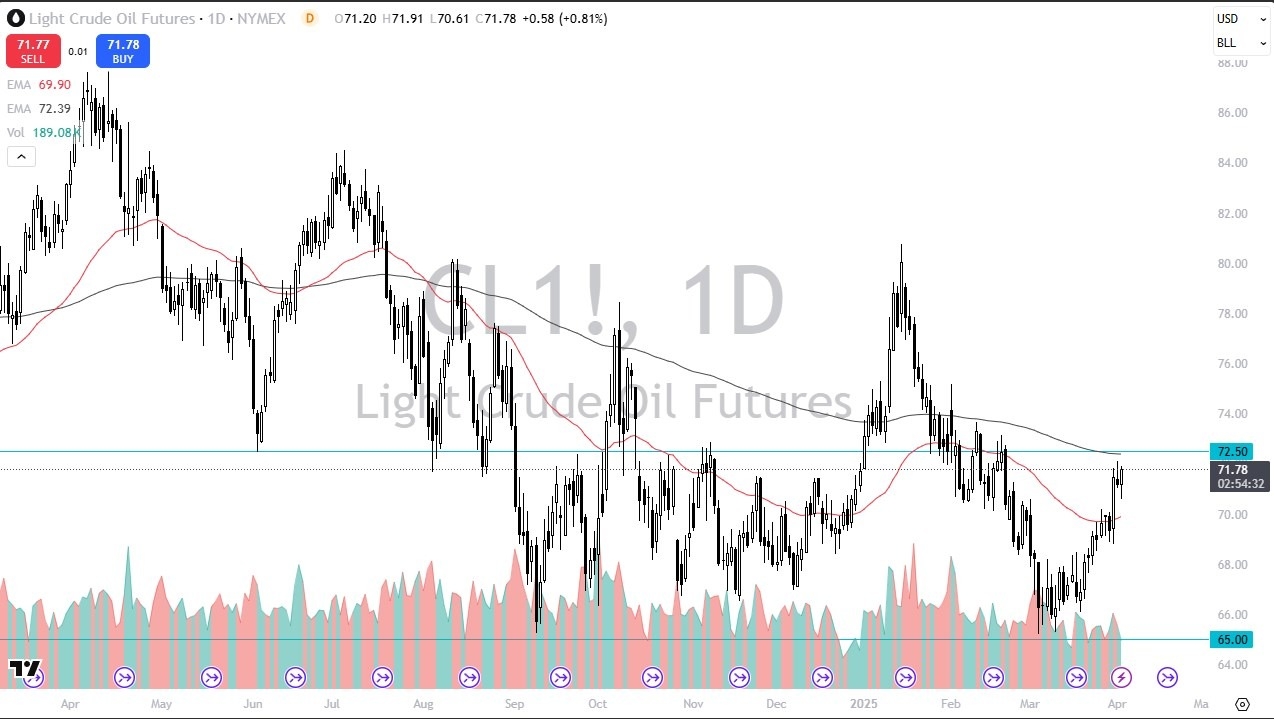

- The light sweet crude oil market has pulled back quite a bit during the early hours on Wednesday as we wait for the Trump tariffs.

- We are starting to see several countries acquiesce to Donald Trump's demands.

- We are now starting to see even Canada talk about how tariffs are a bad thing all the way around and there should be no tariffs whatsoever.

In this fight, we've seen a lot of concern, but the United States held all the cards to begin with. So, with that being the case, it'll be interesting to see what happens with the oil, because if traders start to celebrate the idea that we are going to avoid some type of economic disaster, then this time of year is typically good for oil anyway, especially the light sweet crude market, as it's used primarily in the United States for lighter machinery, think automobiles.

A Breakout Coming?

Top Regulated Brokers

So, if that's going to be the case, then I think you've got a situation where we could break out, but the 200 day EMA sitting right at the $72.50 level must be paid close attention to. If we can break above that level, then it's possible that we could go look into the $75 level and then longer term, $80, which I expect to see sometime this summer.

The market has been rallying quite nicely from the bottom, which is closer to the $65 level. And the $65 level is an area that's been important for at least three years as support. So, I definitely think we are in the midst of trying to bottom out and maintain the range that we have been in for several years. And $80, of course, is an area that a lot of people have been comfortable with previously.

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.