- The light sweet crude oil futures market has been absolutely crushed during trading on Thursday as the tariffs were announced by the United States.

- This is a situation where traders are worried about global growth and more importantly, the global transportation sector.

- After all, a global economy needs a lot of transportation, and that transportation demands fuel. That's exactly what's happened here.

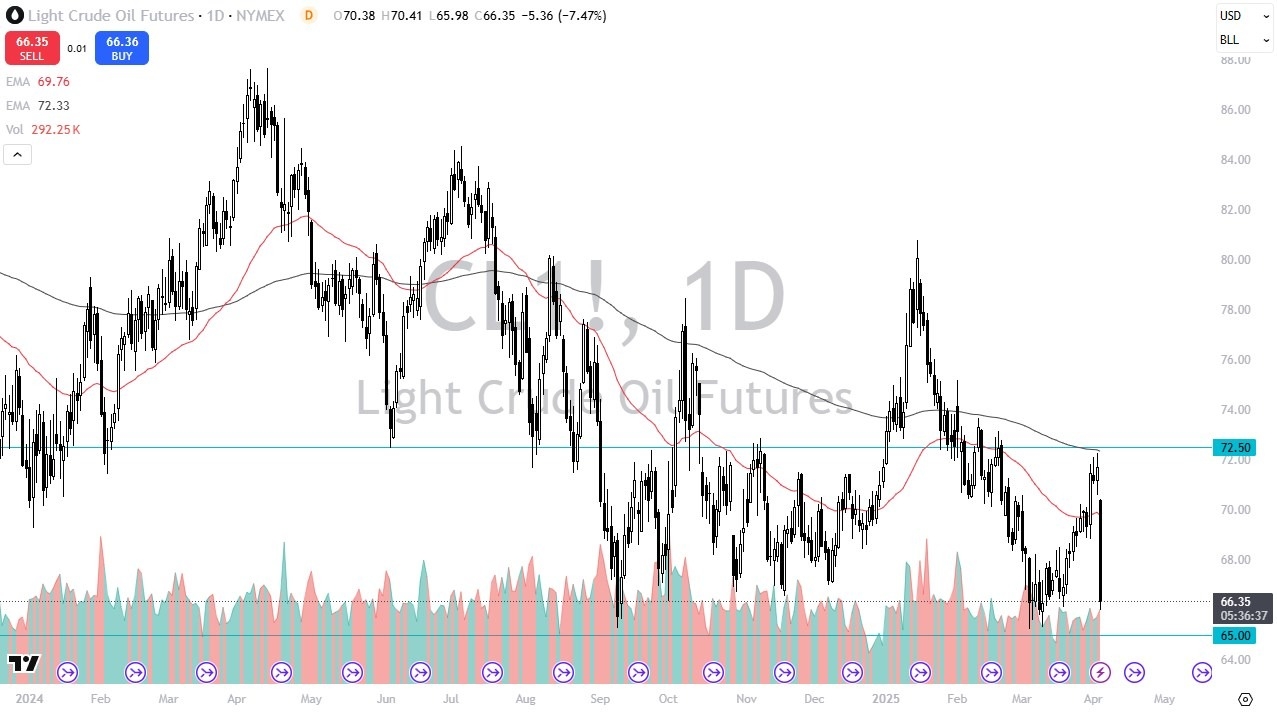

People panicked and they sold oil as quickly as they could. In fact, as I record this, the CL contract in the futures market is down seven and a half percent. However, what I would also point out is that we are very close to a major support level that has been important multiple times. This of course is the $65 level, a large round figure that has been important for three years or so.

Top Regulated Brokers

Watching this Market Closely Over the Next Day or Two

Because of this, I will be watching this market very closely, but keep in mind Friday also happens to be the jobs report coming out of the United States, and that is something that must be paid close attention to. After all, the idea of whether the economy is adding or subtracting jobs in the United States can have a major influence on the perceived demand for crude oil in that country as well.

With that being said, if we were to break down below the $65,000 or $65 level, then I think that opens up the floodgates. However, what I'm looking for is an attempt to break down below there and abouts, because if we get that, there's a real shot that we stay in the same trading range that we have been in for several months now. This could be a great trade setting up, mainly because the potential “floor in the market” is so obvious at this point in time.

Ready to trade the daily crude oil Forex forecast? Here’s a list of some of the best Oil trading platforms to check out.