- The crude oil market has been back and forth during the trading session on Monday, as we continue to ask questions of where the tariff war is going, and whether or not things are going to accelerate, or if cooler heads will prevail.

- Which been interesting to watch is the fact that crude oil is dropping and at the same time OPEC is expanding production.

- In an environment where inflation is feared, this actually will help drag crude down quite drastically.

Technical Analysis

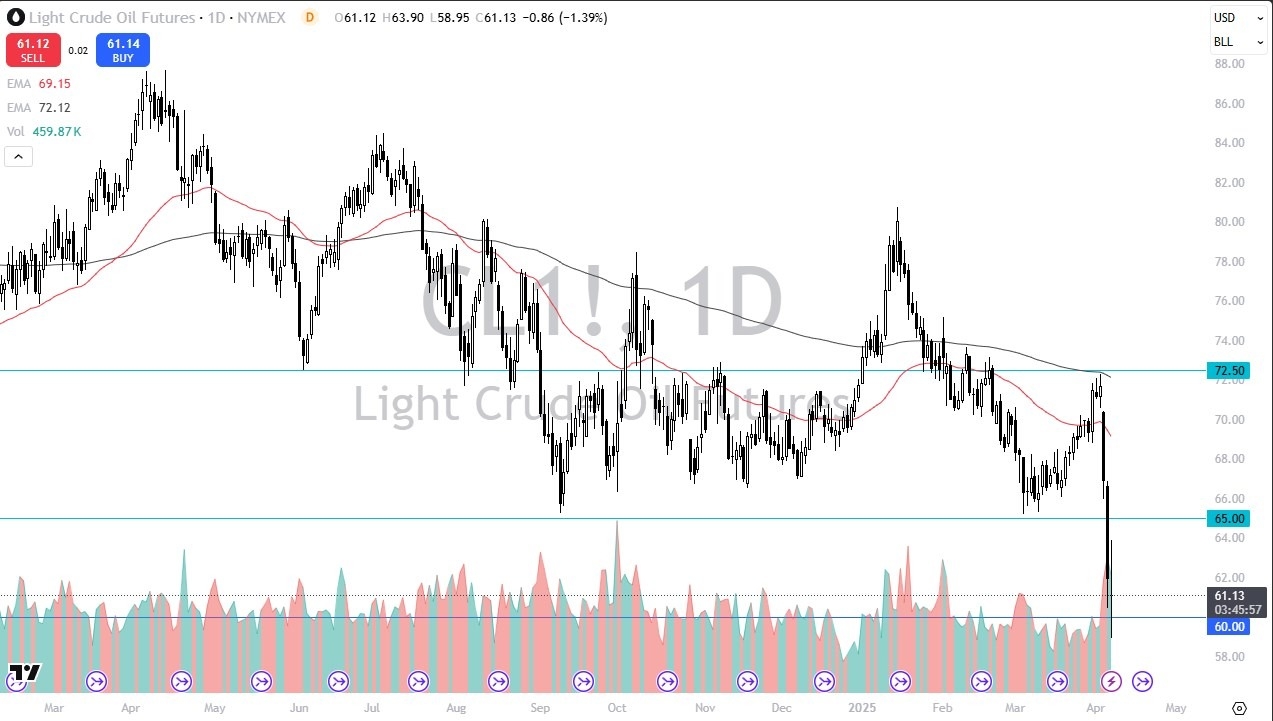

We have recently broken through a major support level in the form of the $65 level, which goes back 3 years in its importance. Now that we have broken down below there, we have seen the Monday session test the crucial $60 level, which is a large, round, psychologically significant figure, and an area that has been important more than once. We broke down it but then turned around to show signs of life again. We did see a lot of volume, so while it’s early, you could make an argument that perhaps the $60 level will offer at least a short-term floor.

Top Regulated Brokers

The 50 Day EMA is close to the $69 level and is dropping. This is an area that I think could be targeted if we get some type of bullish run, but between here and there we have to pay close attention to the $65 level, as “market memory” could come into the picture and caused a bit of selling pressure. Furthermore, you have to keep in mind that if we were to break down below the candlestick for the trading session on Monday, then we will start to enter a new leg lower, and at that point it’s not entirely clear where we could end up, but I would suspect that it’s going to be closer to the $50 level at that point.

A lot of concerns out there remain as far as demand for crude oil is concerned, and this is something that traders will continue to gauge for going back and forth. Ultimately, this is a market that is looking for a bottom, and the question now is whether or not it will be found?

Ready to trade daily crude oil price analysis? We’ve shortlisted the best Forex Oil trading brokers in the industry for you.