- The light sweet crude oil market or West Texas Intermediate has been somewhat stable during the trading session on Tuesday.

- That is a bit of a victory considering just how ugly things have gotten.

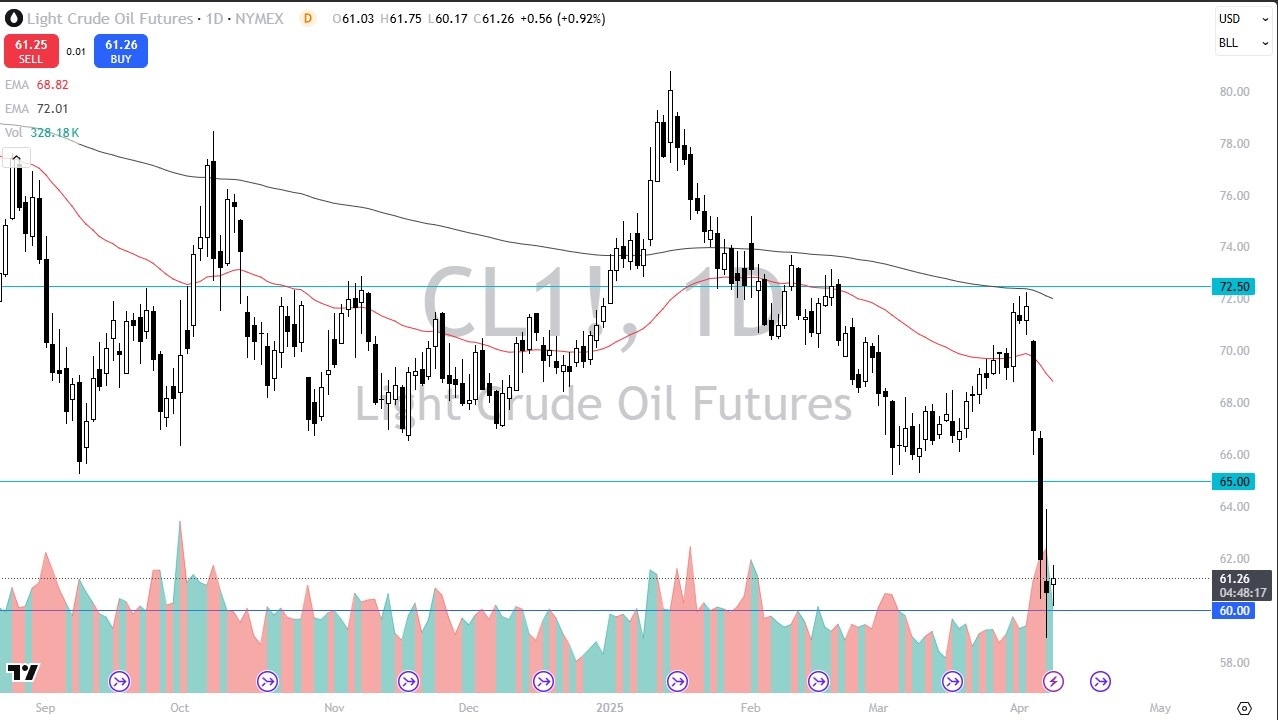

- Nonetheless, we have to look at the $60 level as a major area of importance.

The $60 level has a lot of psychology attached to it, but it also is an area that in the past has been very important. If we can hold the $60 level, then I think we may be getting ready to see a bit of a bounce, and that would make a certain amount of sense considering how ugly things had gotten. They had clearly gotten out of control, but at this point, I think you have to accept the fact that any rally that you run into at this point in time probably gets sold off. I don't have any interest in trying to get too cute here. I think you've got a scenario where what you're looking for is a little bit of a bump higher, some signs of exhaustion, and then maybe shorting it.

The Importance of $65

Top Regulated Brokers

If we could recapture the $65 level, then that would be a completely different scenario. In that environment, I think you could probably start to think about the upside, but right now, this is a market that probably is going to get a little bit of a bear market bounce like we've seen in some of the US indices. But at the end of the day, this is a market that I think is just trying to take a little bit of a breather after what has been an absolutely brutal couple of days. And keep in mind that there are a lot of concerns about the global trade situation, which of course has a direct influence on demand, but at the same time, OPEC has decided to produce 400,000 more barrels a day. So, supply is definitely overwhelming demand.

Ready to trade Oil daily analysis and predictions? Here are the best Oil trading brokers to choose from.