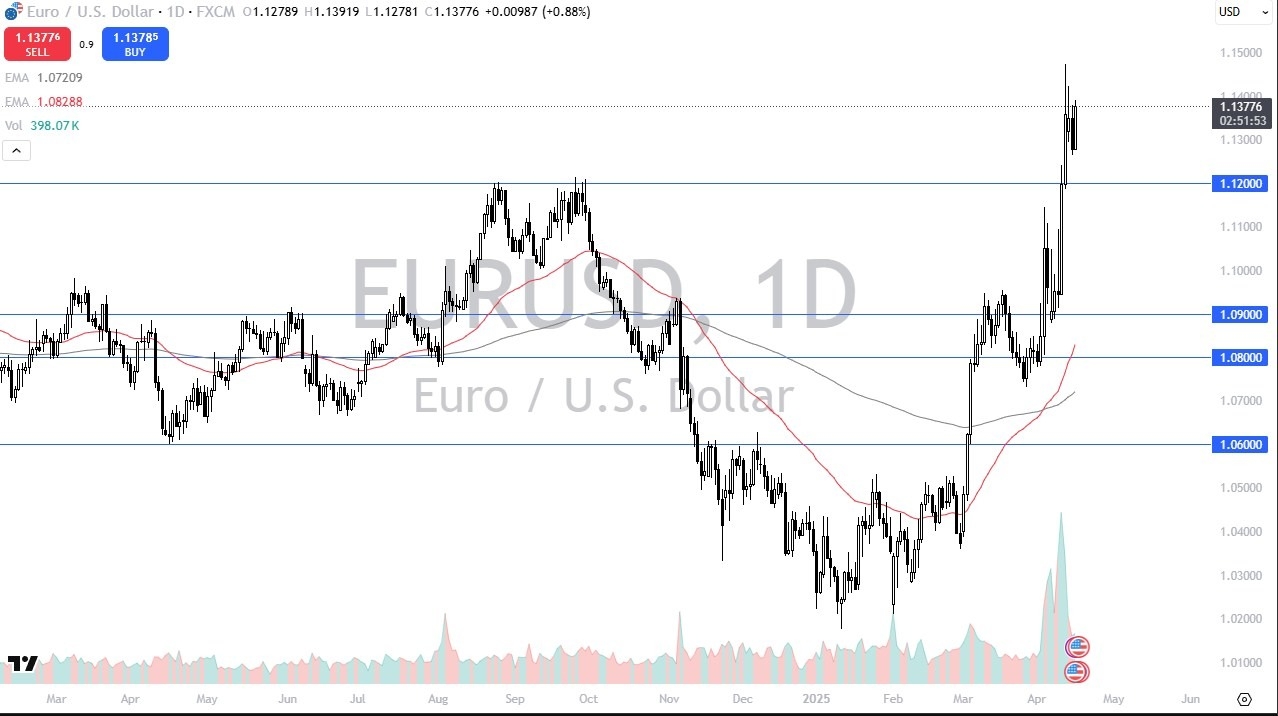

- The euro continues to Rally during the trading session on Wednesday, but it looks as if we still see a lot of resistance near the 1.14 level.

- The 1.14 level is an area that has been very resistant over the course of the last 4 days or so, and now we have to start to ask questions as to what exactly it is we are seeing at these elevated levels.

- After all, we have seen the market gets to this area very quickly, but every time we pull back it’s also very persistent. Because of this, I think you have got a situation where traders are doing everything they can to break to the upside, but there’s obviously a lot of supply up in this area.

Forming a New Range?

Top Regulated Brokers

The question now at this point in time is whether or not we are trying to form a new range? After all, the 1.14 level is an area that has been important a couple of times in the past as well, and it’s obvious that it is causing a lot of trouble at the moment. The fact that we cannot hang on to gains above the 1.14 level does suggest that there is a lot of supply there, so would not be surprising to see this pair drop again. That being said, the 1.12 level has a lot of “market memory” attached to it as well, so that could be the bottom of your overall range. If that ends up being the case, then you see the euro bounce back and forth in a 200 point range, which is pretty typical behavior to be honest. Anything below the 1.12 level would be a bit surprising at this point.

Alternatively, if we were to break above the 1.14 level on a daily close, then I think we go looking at the 1.15 level. The 1.15 level of course is a large, round, psychologically significant figure, and would be an area where I would anticipate seeing a lot of selling pressure as well. Anything above there then kicks off an even longer uptrend, but right now it appears that the market is simply moving on the latest headline involving trade, meaning that it is very erratic and unstable.

Ready to trade our daily Forex forecast? Here’s a list of some of the best regulated forex brokers to check out