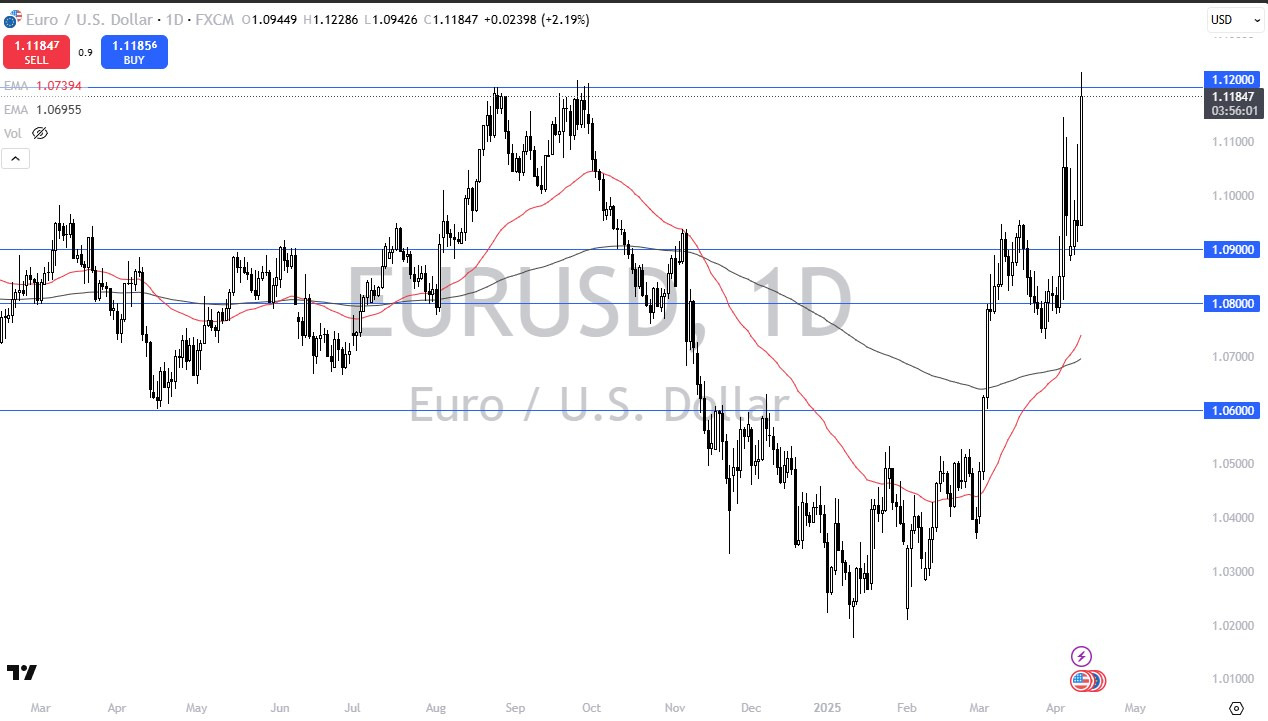

- The Euro rallied rather significantly during the trading session on Thursday, touching the 1.12 level, and even breaking above it at one point during the day.

- That being said, the euro is getting a bit overextended, and it will be interesting to see how much longer this can continue.

- While it is possible that the euro continues to scream higher against the US dollar, and it’s also possible that the trump administration would be perfectly fine with that, the reality is that eventually momentum becomes a problem yet again.

Recessionary Fears

While Germany is exiting a recession, it looks like the United States might be heading toward one. Whether or not it is a long-term recession remains to be seen, but it’s worth noting that the CPI numbers were lower than anticipated during the trading session on Thursday, and of course traders are already starting to perhaps get in the back of their mind that the Federal Reserve may have to come in and start cutting rates. If they actually do that, then it makes a lot of sense that we would see the US dollar weaken.

Top Regulated Brokers

What’s interesting to me is that this is a market that could turn around just as quickly as it rallied, because quite frankly, if the global economy slows down, Europe is not going to be immune from it. Ironically, yields in America are rallying while the dollar is falling, suggesting that perhaps there is still a major influence on the air due to U.S. Treasury selling. Eventually, if countries wish to do cross-border transactions, they will need those US dollars. It is because of this and the structure of the Euro dollar system that I think the upside will eventually slow down.

That being said, we could go to the 1.15 level, but we could just as easily see some type of shock to the system that sends everybody back down to the 1.10 level. Ultimately, the market is certainly trying to break out, but it still got some work to do see if it has any real follow-through at this point.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.