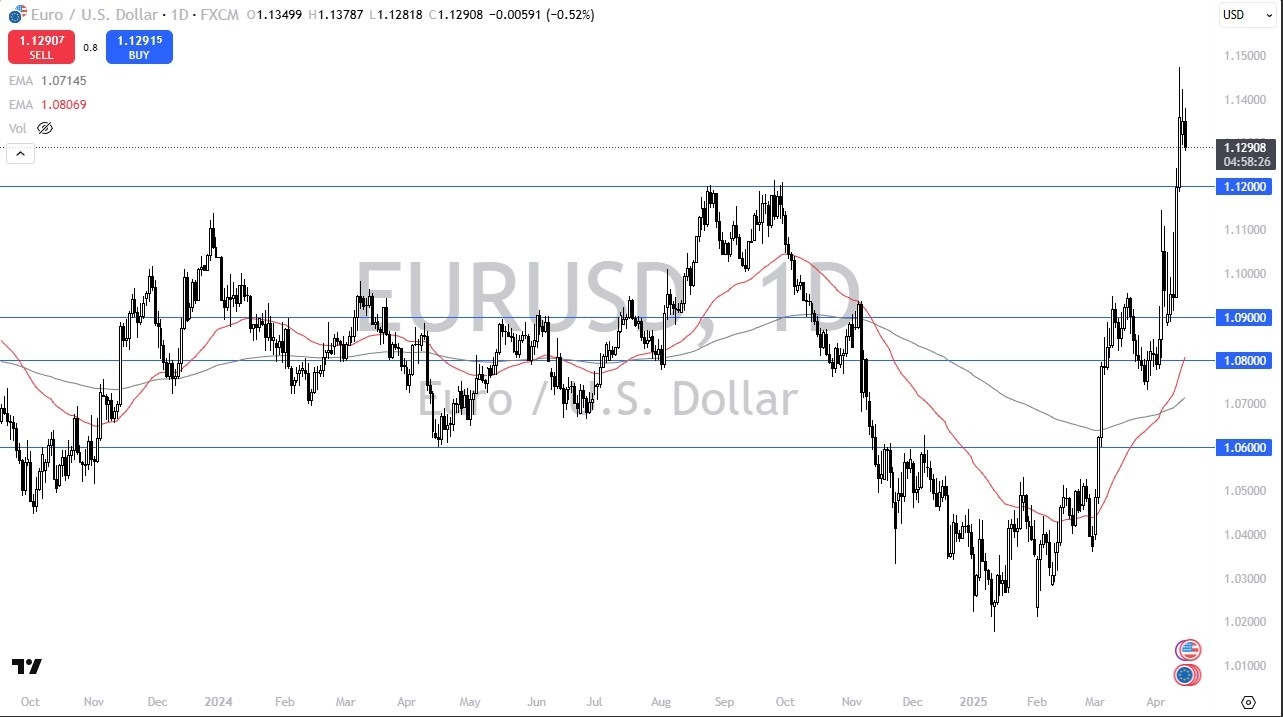

- The euro Initially tried to rally against the US dollar during the trading session on Tuesday, but it looks like we are seeing resistance yet again near the 1.14 level.

- What I find interesting also is that we've had some somewhat disappointing headlines about trade negotiations between the United States and the European Union, so maybe we're starting to see a little bit of a run to safety.

- It's still early and you can also make the argument from a technical analysis perspective that we're just simply far too overbought.

If that is the case, then I don't really know how far we drop, but I would anticipate that the 1.12 level would be of interest. It was previous resistance, and it should now be support if we were to break down below there, then we open up the possibility of going much lower, maybe down to the 1.09 level, if this level doesn't hold. On the other hand, if we bounce, then I anticipate that we probably go looking at the 1.14 level.

Top Regulated Brokers

1.14 Continues to Be Important

Anything above there then brings in the 1.15, which is obviously a large round psychologically important figure. I do expect a lot of choppiness. I do expect maybe to drop towards the 1.12 level as the ECB meeting comes into focus on Thursday.

Most of what we see next probably is a reaction to either tariffs or negotiations between the United States and possibly the statement coming out of the ECB. So, I think there's a high probability of volatility here, but regardless, the US dollar is oversold, so it does make a certain amount of sense that we pull back in the short term. The next couple of days should tell the story as to whether this massive momentum in the EUR/USD can keep going, or if we need gravity to return.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.