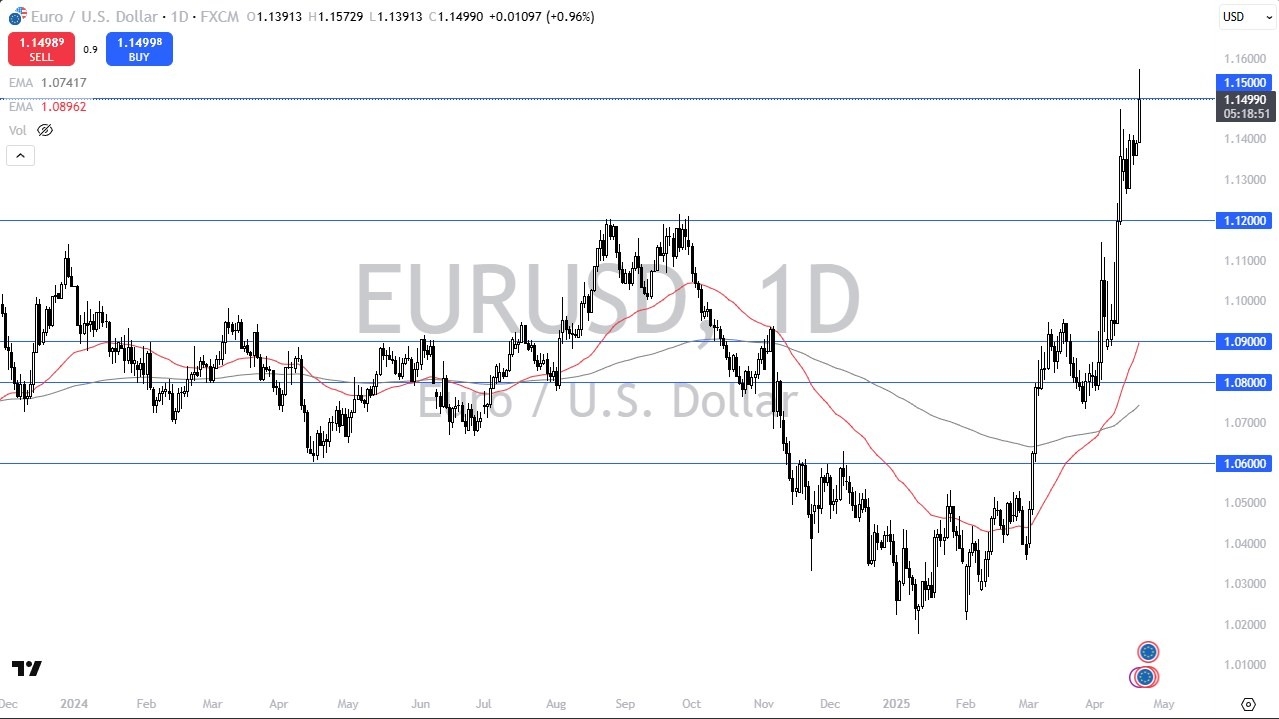

- The Euro reached above the 1.15 level in the early part of the session on Monday, but it does look like we are struggling a bit here.

- And I find that interesting because we are so overbought at this point that it does make a certain amount of sense.

When you zoom out, you can see that 1.15 was an area that was of major importance multiple times. So, I’m watching this closely. I'm not ready to jump in and start shorting, but for what it is worth, the US dollar being oversold against everything, and I'm starting to see signs of life in the Australian dollar, the Euro, and the Canadian dollar for the greenback later in the day. I'm watching this. We could get a pullback, and that would make a certain amount of sense anyways, after all, markets don't go in one direction forever, regardless.

A Pullback Coming?

Top Regulated Brokers

So, with that being said, I am watching this. A pullback to the 1.12 level probably doesn't change anything, but if we break down below there, that could really send this market racing to the bottom. A lot of this is going to come down to the trade situation. It looks like the United States and Europe, at least according to Donald Trump, might be a little closer to a deal. At least that was what he suggested during the session. He also suggested that he thought he could get a Ukraine peace treaty sometime in the next week or so, whether or not that's true, we'll have to wait and see, but I would think that would be good for risk appetite as well.

Ironically, that might make the dollar strengthen just simply because it will have foreigners buying into the U S stock market, all things being equal. This is a market that continues to be overdone. So, I think a pullback makes the most sense. Quite frankly, if we continue going straight up in the air here, that just means the pullback will be nastier.

Ready to trade our EUR/USD daily forecast? Here’s a list of some of the top forex brokers in Europe to check out.