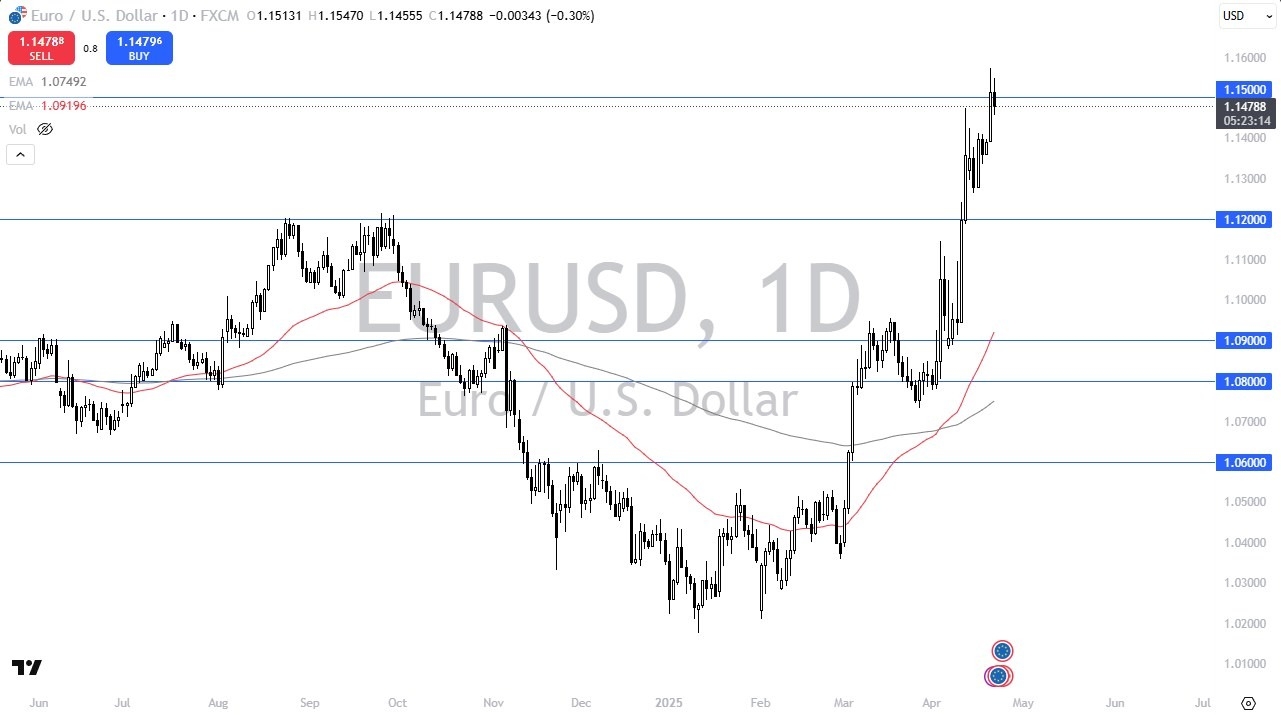

- The euro initially rallied during the trading session on Tuesday, but we are extraordinarily overbought at this point and wrestling with a major area of importance, going back multiple years in the form of the large, round, psychologically important 1.15 level.

- All things being equal, I think this is a situation where we are going to continue to see this area offer a little bit of a ceiling.

- And it'll be interesting to see whether or not we can continue to the upside.

- I think at this point the overbought condition is really a major issue for a lot of traders. And with that being said, a little bit of a pullback does make a certain amount of sense.

On a Pullback

A pullback at this point in time could drop all the way to the 1.12 level, which of course is an area that was previous resistance. We'll just have to see how this plays out. I don't necessarily think that shorting this EUR/USD pair is the way to go, but I do recognize that this is a market that needs to take a bit of a break. And if that's going to be the case, then I think you have to look at this through the prism of whether or not there are going to be buyers looking for a little bit of value here. That being said, I also recognize that we have a lot of questions to be asked about whether or not the balance of payments and other “the sky is falling” type of statements truly come to be real.

Top Regulated Brokers

The trade tariffs and the like continue to be a major driver, but we are starting to hear some overtures between the Americans and the Europeans that maybe things aren't as bad as they appear on the surface. Regardless, this is an overbought market. I think a pullback is probably welcomed by not only the bears, obviously, but also those who are bullish. The real decision is probably a 1.12. If we do break to the upside, the 1.16 level is the top of this little range of resistance. Anything above could open up a move to the 1.20 level, but that's not really what I'm looking for at the moment. I think a pullback makes quite a bit of sense, or at the very least, some sideways trading.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.