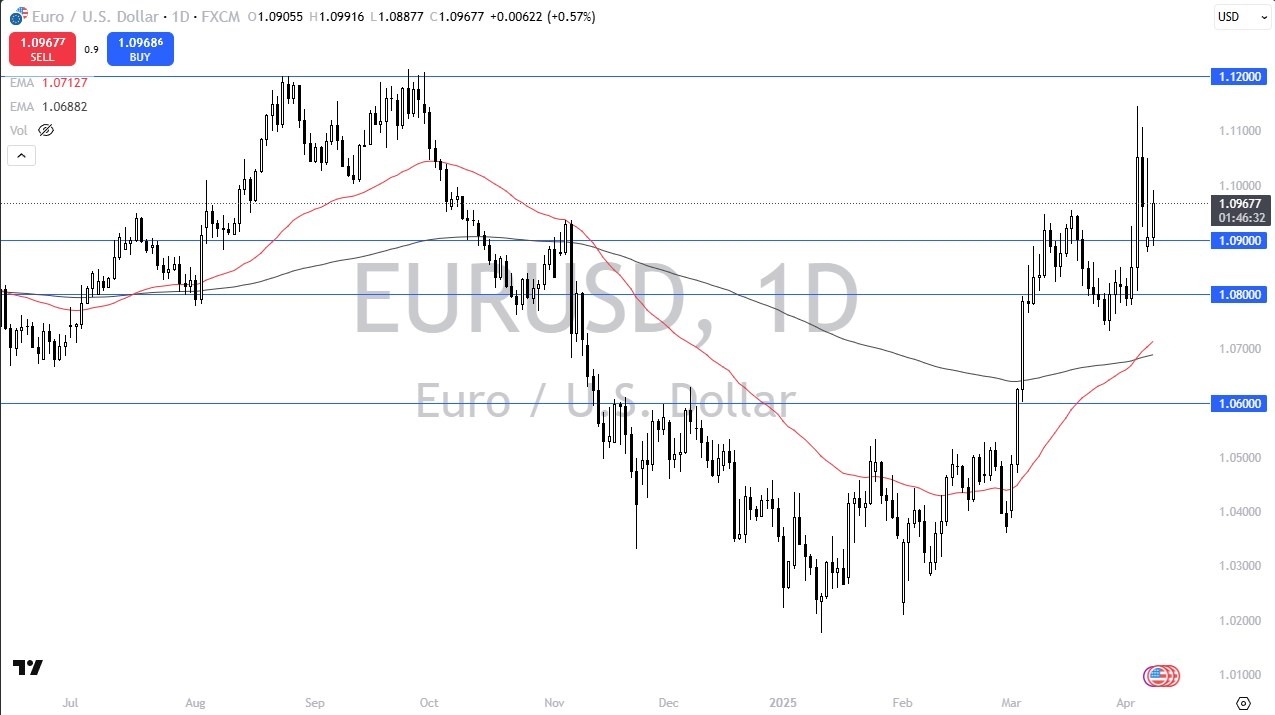

- During the trading session on Tuesday, we saw the euro rally a bit, using the 1.09 level as a bit of a springboard, but it’s also worth noting that the market has seen quite a few shocks recently, as assets around the world continue to look very volatile.

- The euro won’t be any different, but I do think at this point in time you should probably keep an eye on the fact that Germany is at least in the beginning of pulling out of a recession, and that helps things when compared to the United States that is now going to be in a tariff war with multiple countries, including the ones in Europe.

Expect Wild Range

I expect to see a wild range in this market, despite the fact that typically this EUR/USD pair is somewhat boring and quiet. That being said, we are not in a situation where anything is going to be boring and quiet, so you need to keep an eye on the latest headlines. There is a certain amount of sense with the idea of running to the US dollar for safety, but at this point in time we don’t really see anything along the lines of clarity. While the euro looks rather bullish, the reality is that we will turn on a dime at the first headline that crosses the wire about tariffs.

Top Regulated Brokers

At this point, I anticipate that the 1.12 level above is the top of the range, with the 1.08 level being the bottom. If and when we can finally break out of this 400 point range, then we might have a little bit of a trend, but with that being said, between now and then we are going to see a lot of head fakes, and therefore a lot of ugly trading and probably losses if you are not careful with your position sizing. Unfortunately, I know that most retail traders like this pair because of the spread, intend to leverage their positions rather wildly, hoping for a 10 or 12 pip move. This is not the environment to play that game.

Ready to trade our daily Forex analysis? We’ve made a list of the best online forex trading platform worth trading with.