- The British Pound has been relatively quiet against the Swiss Franc during trading on Friday, which being Good Friday, it's not a huge surprise to see that it's been a pretty quiet candlestick and session.

- But what I do find interesting is that despite the fact that there aren't massive players in the market, we haven't fallen apart either, not due to a lack of liquidity or not due to some headlines.

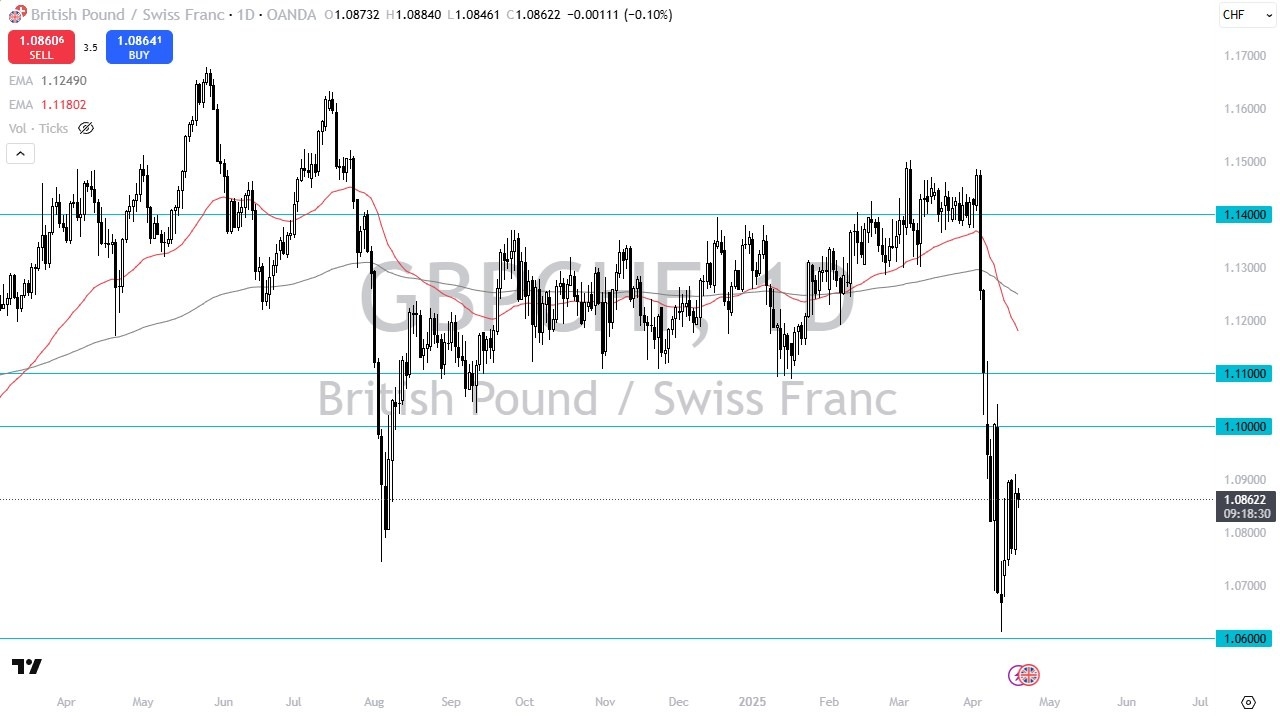

- When you look at the last couple of sessions, it does seem as if we are trying to stabilize against the Swiss franc in not only the British pound, but even the US dollar.

So, the Swiss franc might be a little overbought. And certainly, one of the things that people will try to keep in the back of their mind is that the Swiss National Bank as a history of intervening when the Swiss franc gets to be a little too strong. Now, specifically, I think they probably follow the euro against the Swiss franc more than anything else due to the fact that 85-ish percent of the exports from Switzerland end up in the EU, but these Swiss franc denominated pairs tend to move in the same direction.

So, if they intervene over there, you'll see it here and in the dollar against the Swiss franc, for example. Now, I don't necessarily know that they are that close to doing it, but it is something that when you see a pretty significant plunge, you always have to ask that question.

Top Regulated Brokers

This Area is Important

When you zoom out on the chart, you can see going all the way back to October of 2022, that the area that we had just bounced from has been significant support. So, unless we get some type of Armageddon-like disaster in the financial markets, I suspect that bigger players are looking at this as a potential buying opportunity. That doesn't mean it'll be easy, but I think over the longer term, we will probably try to make our way higher.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.