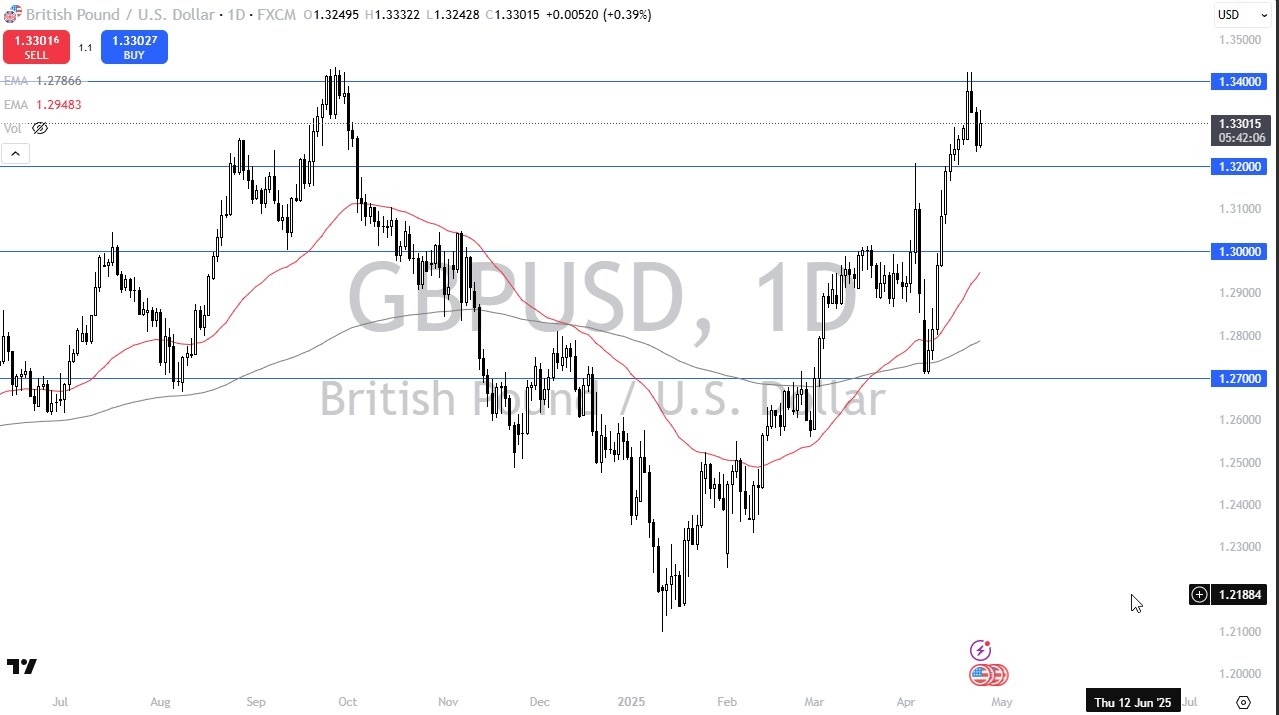

- The British Pound has rallied rather significantly during the session here on Thursday as we continue to bounce back and forth trying to sort out where we are going to go over the longer term.

- That being said, this is a scenario that I think a lot of people will be watching as to whether or not we can break out above the 1.34 level on a sustainable path.

- The 1.34 level is an area that has been important a couple of times in the past.

Therefore, I think it makes quite a bit of sense. Then maybe, just maybe, we have the potential to see a little bit of a consolidation area here between 1.34 and 1.32. Ultimately, I think you have a scenario where trader sentiment will have a lot to say about this.

Working Off Excess Gains

Right now, I think we're just trying to work off some of this excess gains that we have seen so rapidly. The death of the US dollar is probably prematurely anticipated, so therefore, I also think that you have to be aware of the fact that traders are perhaps trying to sort out whether or not there is going to be more dollar weakness or are we finally going to see a little bit of stability.

If we break down below the 1.32 level, then it's very likely that we could see a drop from here, sending the market down to the 1.30 level. The market is of course going to continue to be one that is very erratic and will probably move on to the latest headlines coming about the trade tariffs. But in the short term, I would anticipate that this 200 pip range probably holds with more of an upward bias at this juncture.

Ready to trade our daily Forex GBP/USD analysis? We’ve made this UK forex brokers list for you to check out.