- Gold markets have skyrocketed yet again during the trading session on Wednesday, as we continue to see a lot of bullish pressure in this market.

- All things being equal, this is just a continuation of everything that has been going on, which of course has been accelerated by the entirety of tariff talks and potential tariff wars.

- Jerome Powell gave a speech during the day they gave little confidence that the Federal Reserve is going to bail everybody out, so naturally, traders panicked.

Chasing is Dangerous

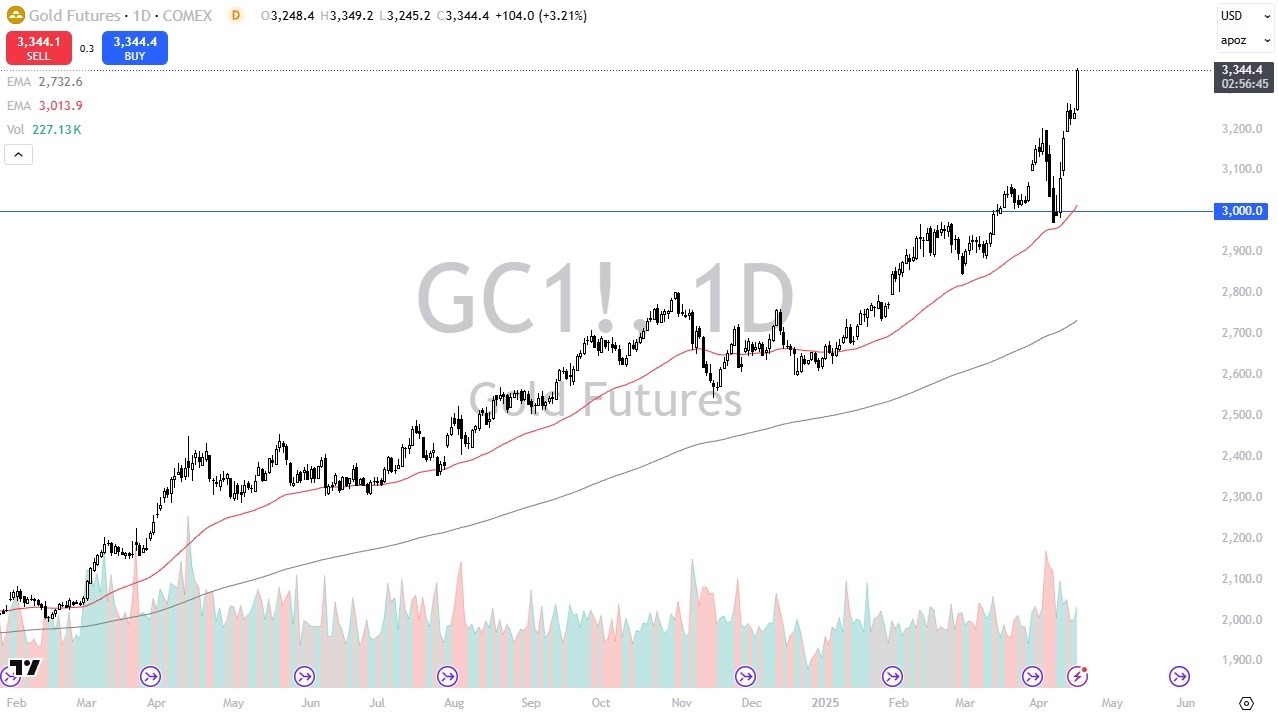

That being said, chasing the gold market right now is extraordinarily dangerous, due to the fact that it has accelerated to the upside for so long. It has risen about 10% in something like 6 trading sessions, which is not normal for the gold market. Obviously, you cannot be a seller of gold, because quite frankly it’s just too strong at this point. Over the longer term, I fully anticipate that the gold market should go looking to the $3500 level, but that doesn’t mean that you need to jump in it after this type of move. Sometimes as a trader, you must accept the idea that you may have missed the move.

That being said, if we get some type of pullback here, that could open up a potential buying opportunity. I think that’s true all the way down to the $3000 level, where the 50 Day EMA currently resides. This assumes that we can get anywhere near there, so some of the other levels that I would be watching include the $3200 level, the $3250 level, and possibly the $3300 level.

Speaking of $3300, that was the target from the previous bullish flag, which we smash through earlier during the trading session on Wednesday. You have to be very cautious here, but this is obviously a “one-way trade”, which shows absolutely no signs of slowing down anytime soon.

Ready to trade today’s Gold prediction? Here’s a list of some of the best XAU/USD brokers to check out.