- The NASDAQ 100 initially gapped higher to kick off the trading session on Monday, in reaction to Donald Trump walking back some of the tariffs against Chinese electronics.

- This obviously had a major influence on Apple, which is a major part of this index.

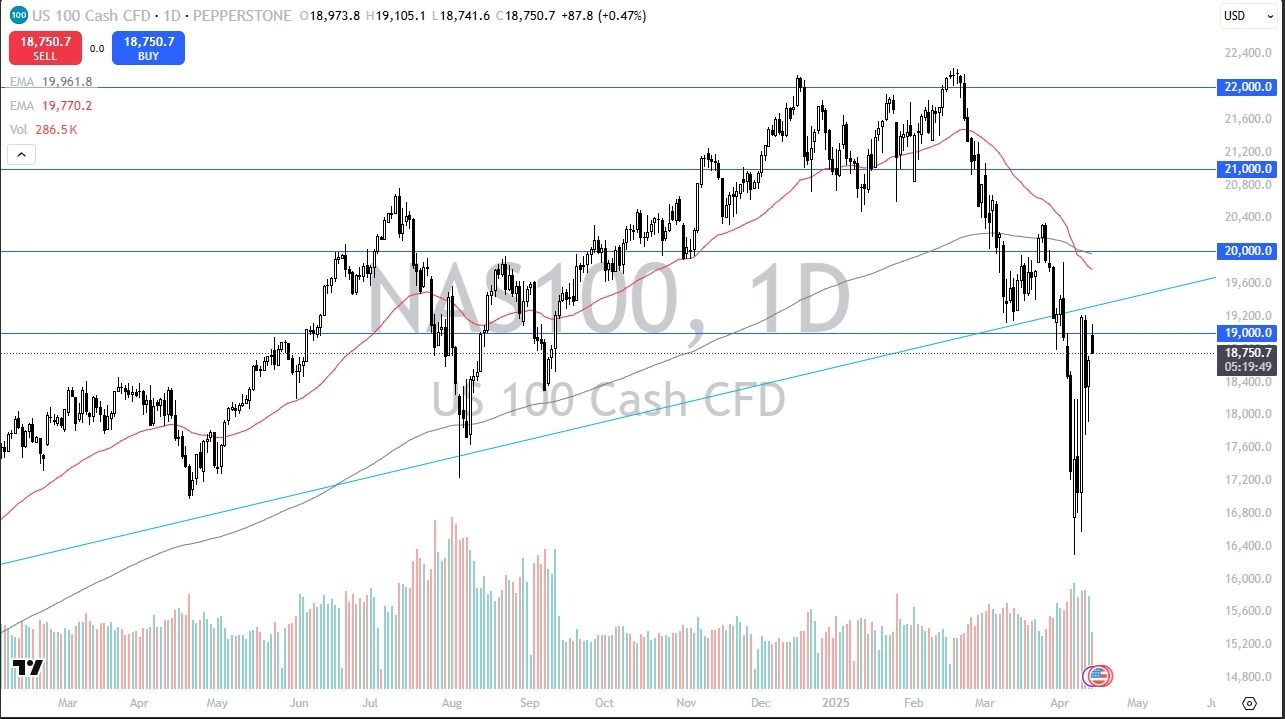

- However, we have seen a lot of trouble around the 19,000 level, so it’ll be interesting to see if we can find any momentum.

This is a market that needs to calm down before he gets overly bullish, so while I see this as an interesting set up, the reality is that you have to be very cautious here, because the volatility will probably only get worse from here, not better.

Top Regulated Brokers

Having said that, if we do see some stabilization for a couple of days, that probably goes a long way to settling the overall attitude of markets. With this being said, I think we have a situation where it probably becomes very range bound if we get good news. Yes, this is a market that has been sold off quite violently, but when you are trying to stabilize and turn things around, it is not an instant thing to happen. It takes time, and it takes a lot of work, so make sure that you are patient enough to take this set up as it comes.

We need a range

At this point in time, we need to form some type of range, which is going to help everybody calm down. All things being equal, the market is going to continue to be noisy, but I do think that we get a point where sooner or later everybody starts to ignore Donald Trump, because he is starting to lose some credibility with the market, going back and forth with the idea of what tariffs are going to be levied win. Because of this, it will probably be a lot like his first presidency, where Wall Street eventually learns to ignore all of the noise. I think we are still very much in that process.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.