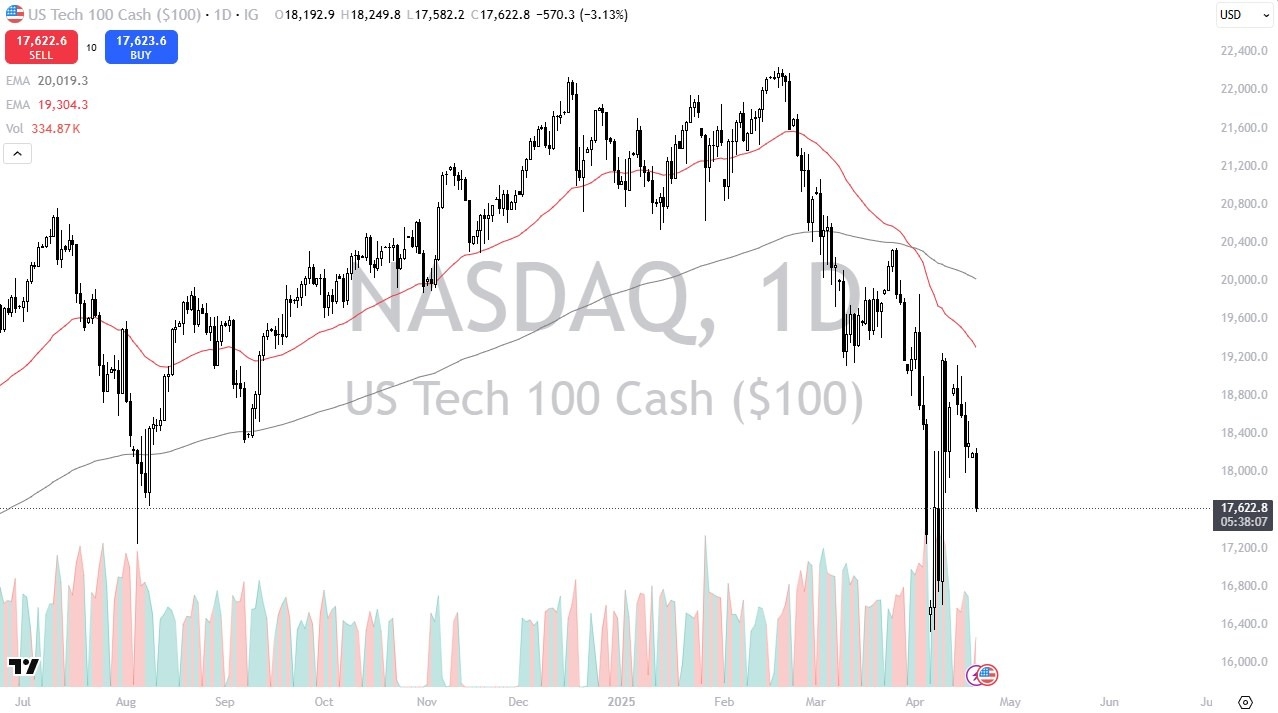

- If there were any questions as to whether or not the panic was going to continue, that was answered with an emphatic “yes” at the open on Monday.

- The market has dropped yet another 3% or so during the day, as we just continue to sell anything we can going forward.

- The downtrend probably has further to go at this point in time, but I can also make an argument that sooner or later this selling has to stop.

Unfortunately, it’s not necessarily a typical sell off, because most of this hinges on one man, which of course is Donald Trump. He could simply change his attitude in his idea of tariffs, in the market would probably gained 20% in a session or 2. Furthermore, other leaders may come to some type of agreement with him, and that would accomplish the same thing. However, sometime during the session we got wind of the Japanese contingent complaining that the negotiation was a bit of a “moving target”, which would have people panic yet again. After all, the idea of the Japanese being difficult to deal with means that the European and the Chinese negotiations are going to be even worse.

Top Regulated Brokers

Technical Analysis

There’s nothing on this chart that suggests bullish behavior under any circumstance. The size of the candlestick is terrific, but these days the candlesticks are all huge anyway. Losing 3% is nothing new at this point, and quite frankly I think you might as well get used to this. You will have to be very cautious with your position size but recognize that it is simply a market that doesn’t have a lot of clarity to it, and unfortunately, all it takes is a quick Tweet or announcement to turn things around massively. I have talked to several professional traders that simply think that the NASDAQ 100 is “untradable” at the moment.

Unfortunately, I also get a lot of communication with retail traders that are trying to figure out how to get rich overnight. This is a very dangerous market and you have to have one eye on the chart, and the other one on Twitter or newswires. As things stand right now, we may be in a 3000 point range.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.