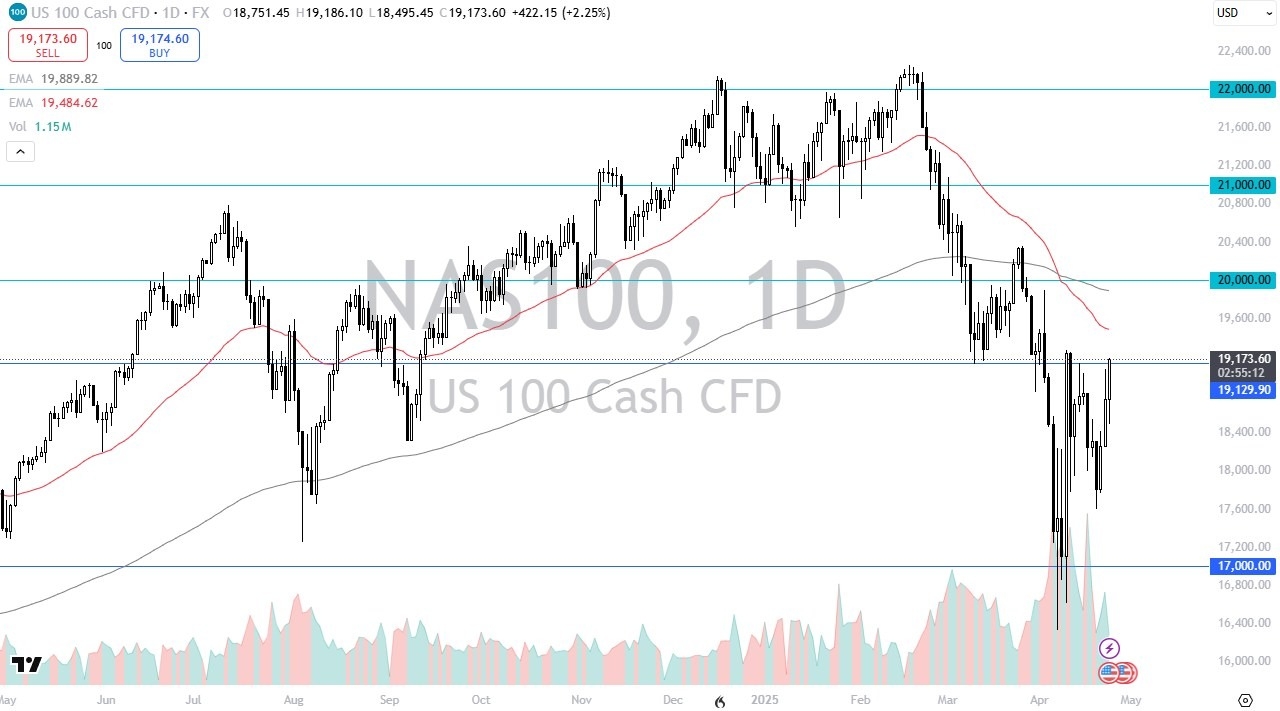

- During the trading session on Thursday, we saw the NASDAQ 100 pulled back just a bit, only to turn around and show strength yet again.

- With this being the case, it looks like we are threatening a major break out, and I think a lot of traders have finally reached the point where they are suspecting that the market has more upside than down, as perhaps the risk aversion has been a little overdone.

- I think ultimately we have to look at this through the prism of a market that has quite a bit of distance to the upside to recover.

Underneath, there are plenty of areas that I might be looking to buy into, with the 18,400 level being a prime entry point. That doesn’t mean that we get down there, and quite frankly, as I look at this chart, it looks a lot like a bottoming pattern as volume has also picked up quite nicely. Volume begets more volume, and now it looks like we are reaching the top of what would have been the potential consolidation area.

Technical Analysis

The technical analysis for this market was becoming more and more bullish, but we have plenty of resistance above that continues to see Marcus paying attention to it in the form of moving averages. The 50 Day EMA sits right around the 19,500 level, but if we were to break above there, then we need to look at the 200 Day EMA, currently sitting just below the 20,000 region.

I would anticipate the occasional pullback, but if we get any type of trade deal anytime soon, it certainly will continue to have money running into this market in trying to take advantage of the fact that markets had sold off quite aggressively, so at this point in time a lot of things are becoming “cheap” for investors to be involved in. Longer-term value investors are most certainly excited at this point.

Ready to trade our stock market forecast and analysis? Here are the best CFD stocks brokers to choose from.