- Natural gas continues to see a little bit of trouble, which makes a certain amount of sense considering that the time of year typically means less demand as temperatures rise in the United States and, for that matter, the European Union.

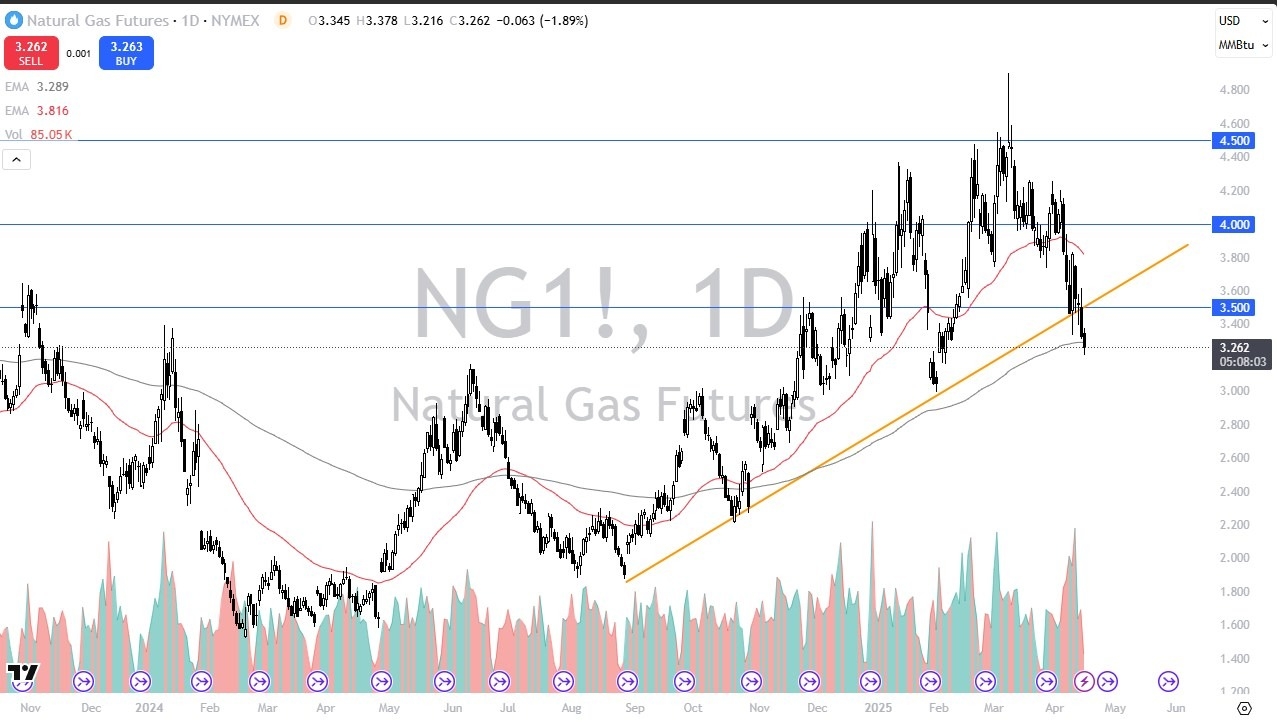

- That being said, there are concerns about inflation, so that has kept Natural Gas a little inflated this time of year, but as we hang around the 200 day EMA, I think you've got a situation where we're just waiting to see whether or not the market will bounce towards the $3.50 level.

- The $3.50 level of course is a large, round psychologically significant figure and an area where you would expect to see a lot of resistance.

Warmer Temperatures Matter

Top Regulated Brokers

This is especially true given the fact that the market is starting to see warmer temperatures in the U.S. But there's also questions asked about whether or not the Europeans will have to import from the U.S. Because the alternative, of course, is Russia. If we break down below the bottom of the candlestick for the day, then I think we could open up the possibility of a move down to the $3 level. Anything below $3 of course would be rather ugly. All things being equal, even if we break above the $3.50 level, I'm looking for signs of exhaustion that I could sell into, especially near the 50-day EMA, and this time of year, it's just really tough to get long of natural gas because the demand should fall.

There’s also the added concern this time that global markets and economies could slow down. And if that's the case, then maybe electricity demand will dive and that of course will drive down that gas pricing as well.

Ready to trade our stock market analysis? Here’s a list of some of the best CFD trading brokers to check out.