Silver

Silver has been back and forth during the course of the trading week, testing the $33 level. This is an area that’s been important a couple of times in the past but at this point in time it looks like it is still going to be thought of as a target. If we can break above there, then the market is likely to continue to go higher, perhaps opening up a move to the $35.50 level. Short-term pullbacks should continue to be potential buying opportunities in this market, as it obviously has a lot of underlying upward pressure. I don’t think things change very quickly.

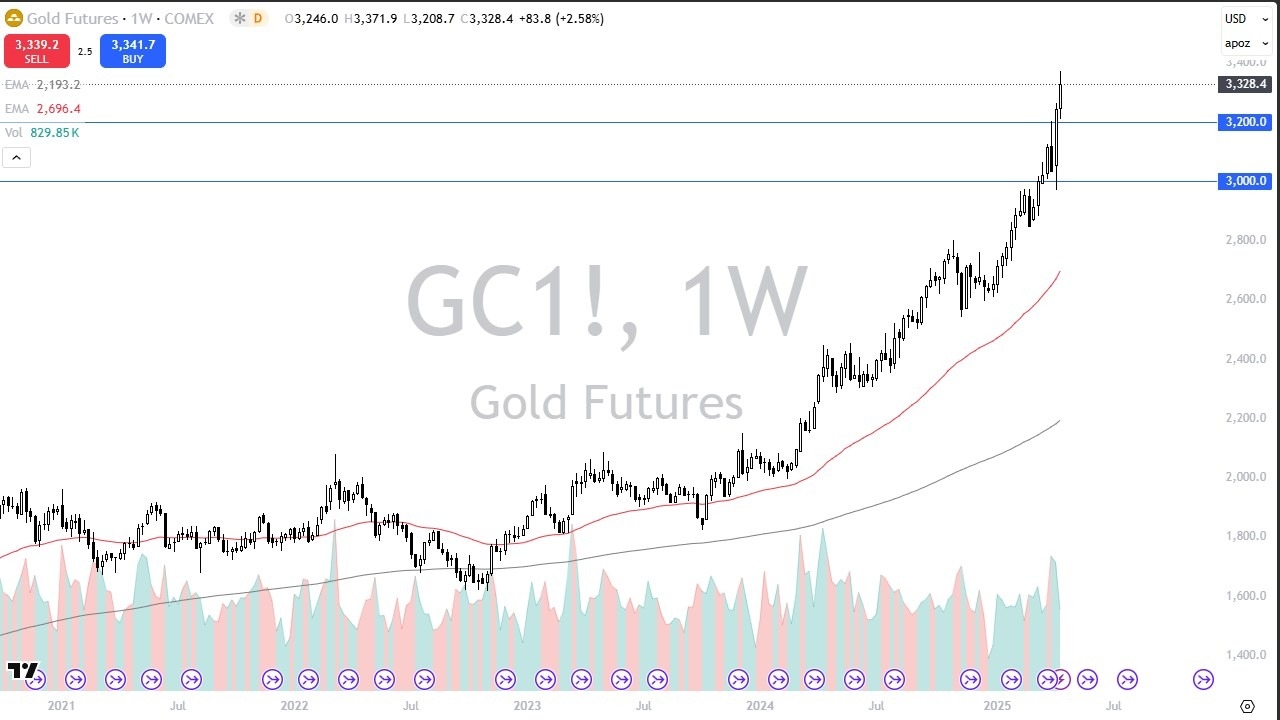

Gold

Gold markets continue to be very noisy, and it is worth noting that we did sell off during the day on Thursday, but quite frankly I think this is a market that any time we get some type of decent pullback, people will be willing to step in and pick up “cheap gold.” I believe that the $3200 level underneath is a significant support level, as it was significant previously, and then after that we have the $3000 level that could offer a bit of a short-term floor as well. After all, there is a large, round, psychologically significant aspect of that level.

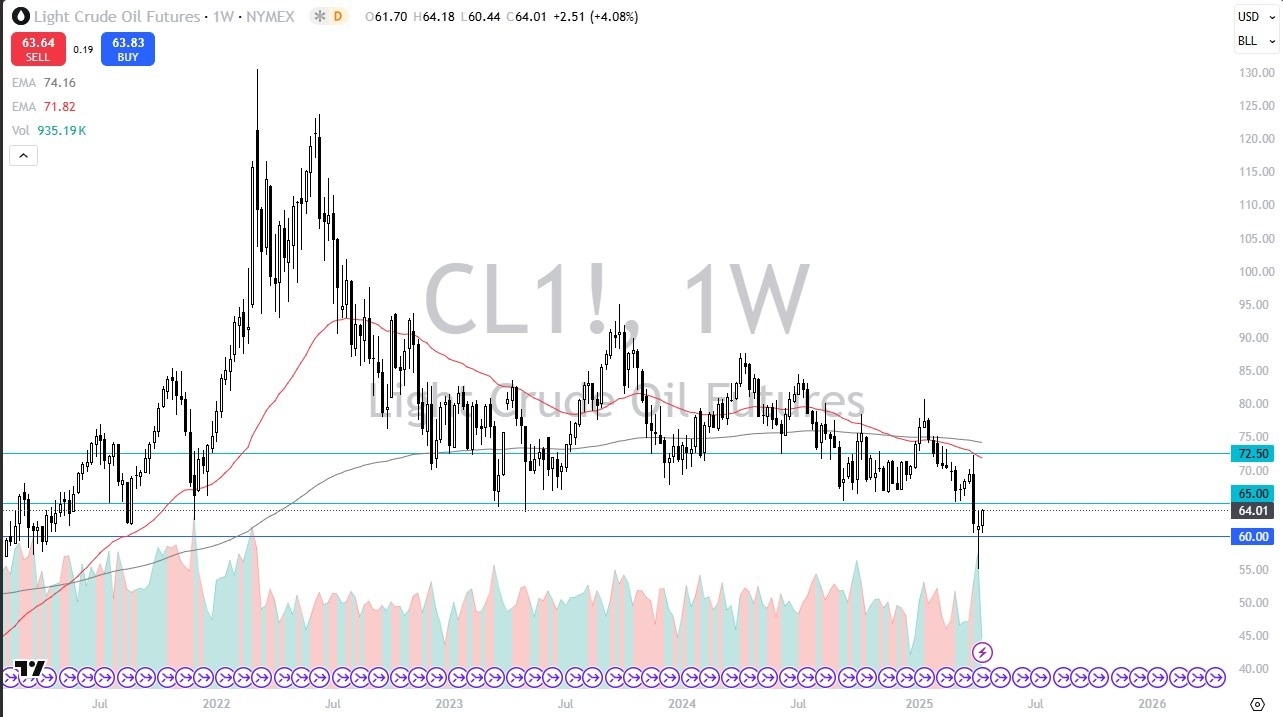

WTI Crude Oil

The West Texas Intermediate Crude Oil market has a definite air of positivity under it, with the $60 level offering support. The market looks as if it is going to try to get to the $65 level sooner rather than later, and if we can break above there, it’s very possible that the WTI Crude Oil market could break even higher than that, perhaps making a run toward the $70 level. All things being equal, this is a market that I think will remain very noisy, as people are trying to sort out whether or not they are going to see the man pick up in the near future, because quite frankly, we have bounce from a major support level.

Top Regulated Brokers

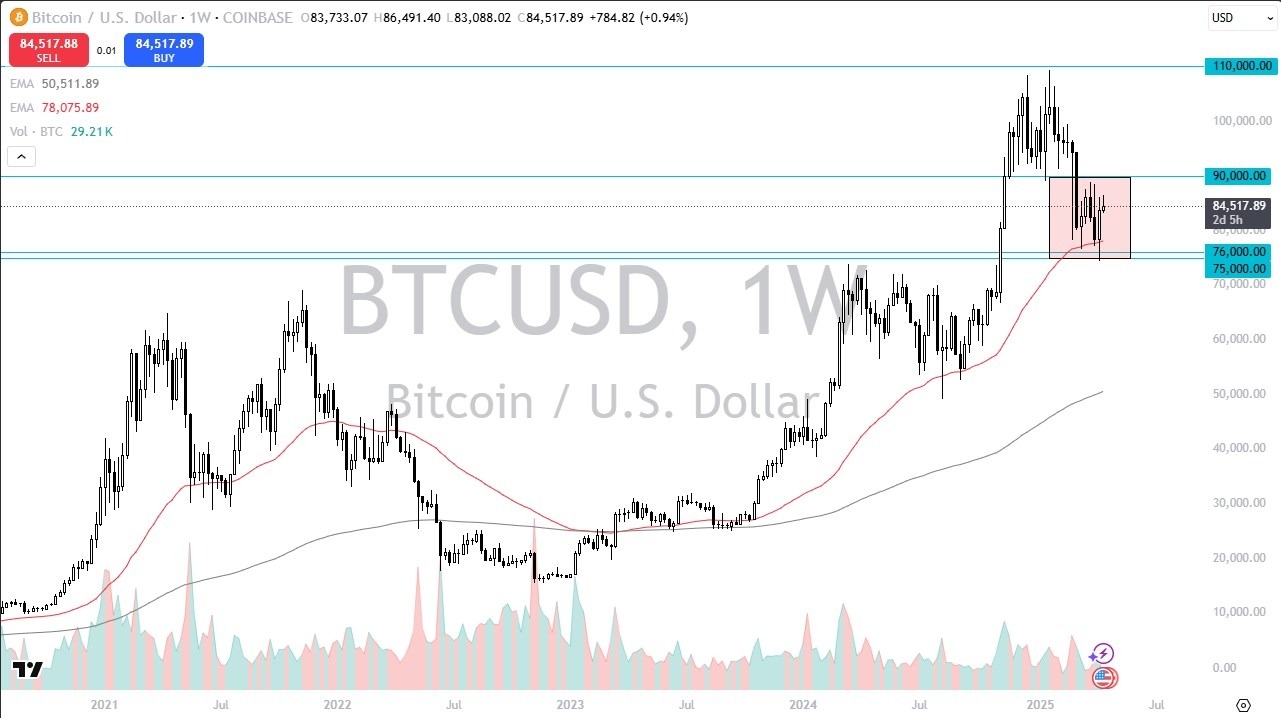

Bitcoin

Bitcoin has tried to rally during the week, but gave back a bit of the gains, as we continue to see this market go back and forth and try to sort out where we are going next. We have been in a range between the $75,000 level, and the $90,000 level above. Ultimately, this is a market that I think continues to be very noisy, but I do think that we are in a bit of an accumulation phase. The biggest thing that Bitcoin needs is some type of risk appetite returning to the market as it is such a risky asset for most investors.

DAX

The German index rally to bit during the trading week to reach toward the €22,200 level before pulling back a bit. Keep in mind the Friday of course was Good Friday (something that influenced all markets), and Germany of course would not have been any different. Ultimately, this is a market that looks as if it is trying to support itself, and bounce as the €20,000 level has been important, and it also has the 50 Week EMA hanging around that region. I don’t have any interest in shorting, but I do anticipate that we may get the occasional pullback that has people looking to take advantage of “cheap contracts.”

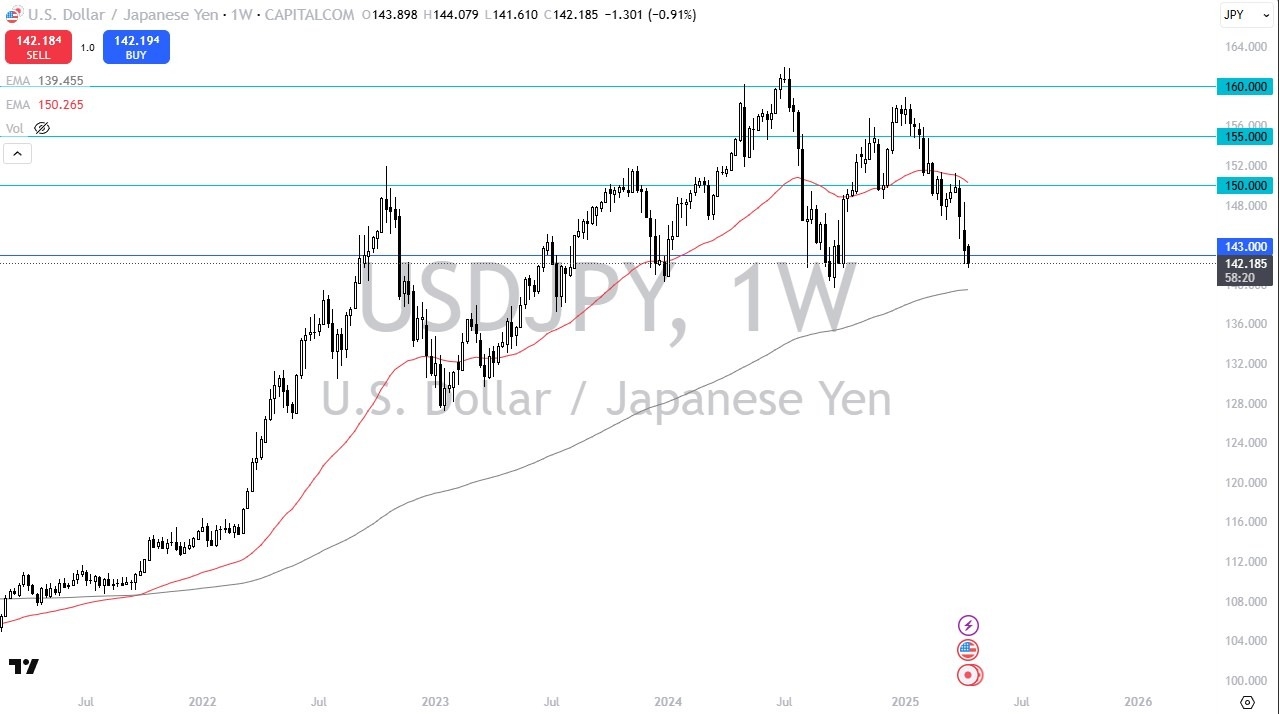

USD/JPY

The US dollar has fallen during most of the week to break down toward the ¥142 level. This is an area that’s been with minor support, but I think given enough time, we could very well continue to drop from here and go looking to the 140 and level, an area that I think is even more important in general. With that being the case, I think you need to be aware of the fact that the market is going to continue to see a lot of volatility, but it’s also worth noting that the 200 Week EMA is near that 148 level as well.

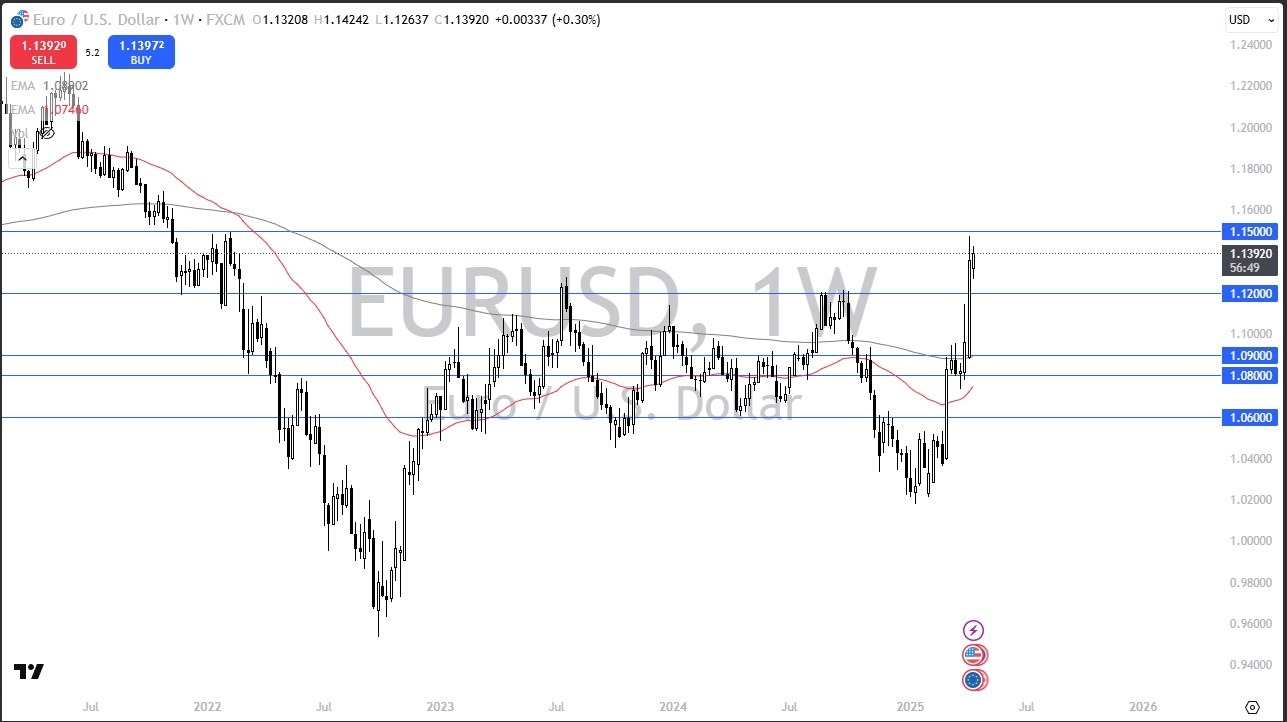

EUR/USD

The euro has initially pulled back a bit during the week only to turn around and show signs of life again. At this point in time, I think the 1.15 level is going to continue to be a major resistance barrier, see you do need to pay close attention to that. However, I also recognize that you need to understand that the market is likely to continue to see a lot of noise here, but I think that if we were to break above the 1.15 level, it’s likely that the market could continue much higher, perhaps breaking to the 1.23 level. Underneath, we have the 1.12 level as a massive support barrier. So having said that, we may be entering a consolidation phase as well, trying to work off some of that excess froth.

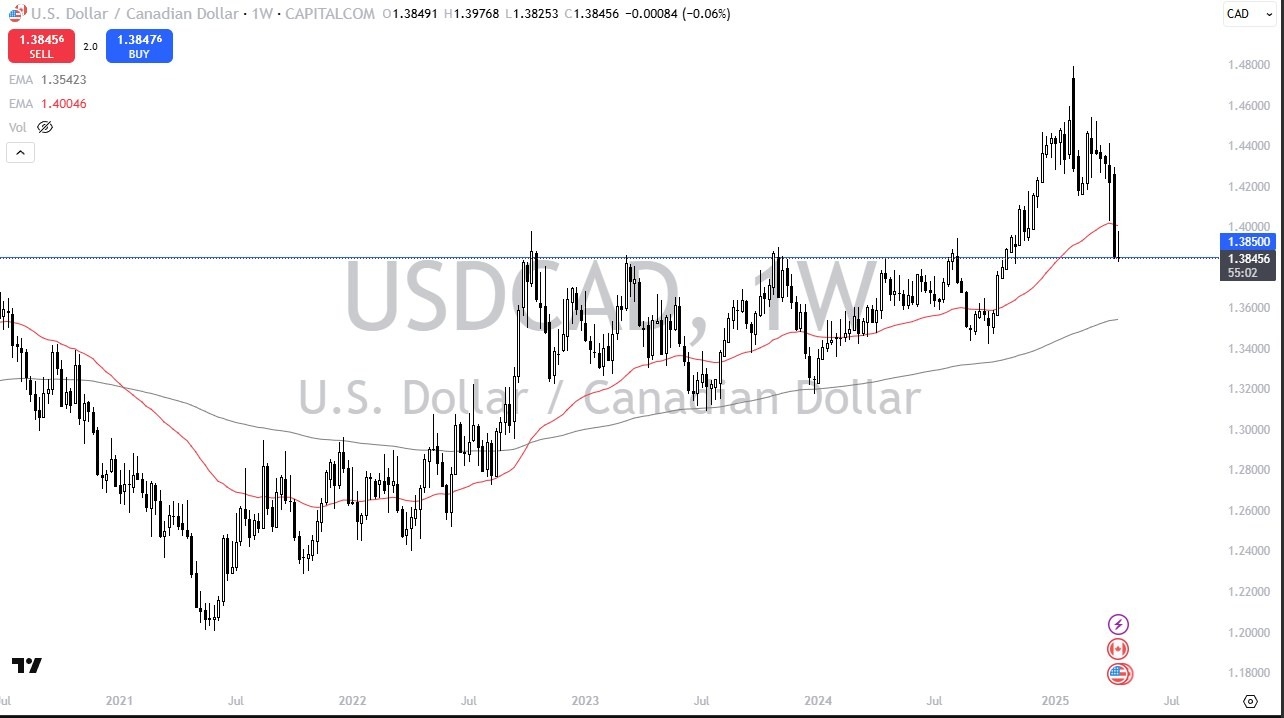

USD/CAD

The US dollar initially rallied against the Canadian dollar for the week, but found quite a bit of resistance, and turned around to show signs of weakness. At this point in time, we are hanging around the 1.350 level, an area that has been important multiple times in the past. With that being said, I think you got a situation where we may continue to see a significant amount of resistance above, but if we do break down below here, then the market probably goes looking to the 1.36 level, where the 200 Week EMA currently sits. If the market turns around and breaks above the 1.40 level, then we could see the market running to the 1.42 level after that.

Ready to trade our Forex weekly forecast? We’ve shortlisted the best forex trading accounts to choose from.