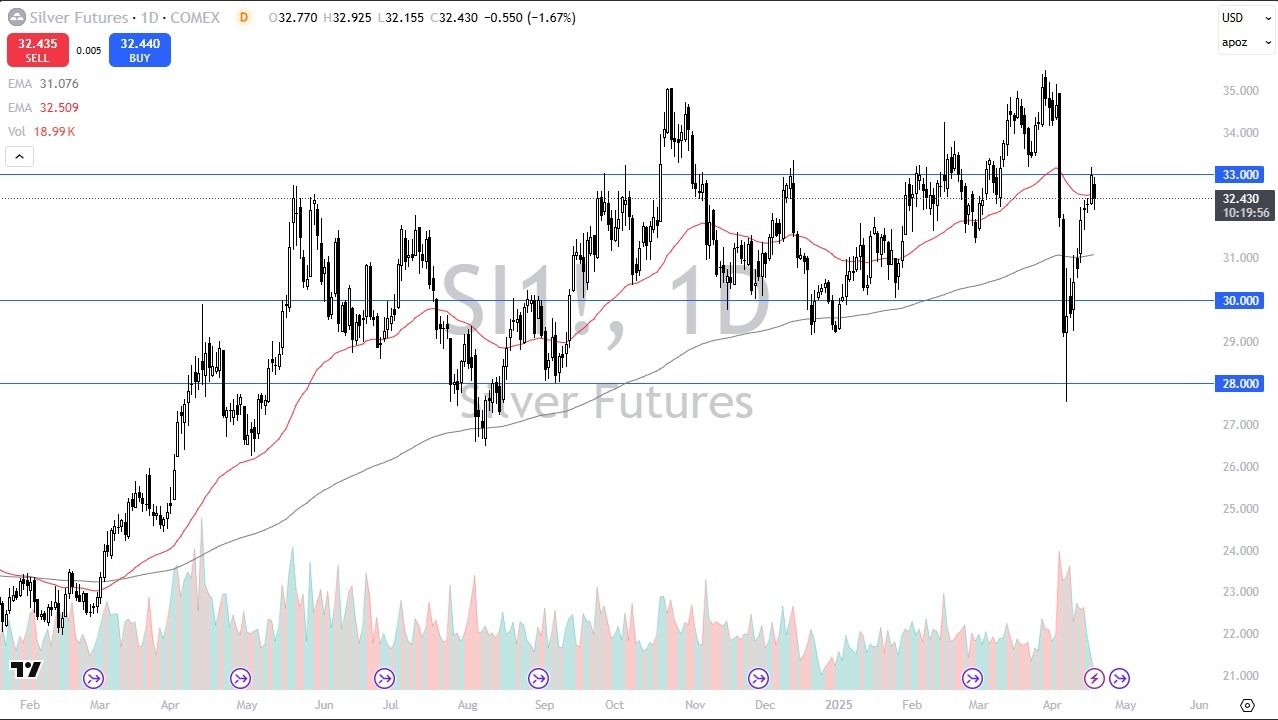

- Silver has pulled back a bit during the early hours here on Thursday, as it looks like the $33 level is going to continue to cause a little bit of a headache.

- Ultimately, this is a market that is moving pretty significantly to the upside over the last week or so after plunging due to forced liquidation.

- In other words, it's a very volatile place to be right now.

The $33 level has been important multiple times in the past, so this is not a huge surprise. Ultimately, I do think that this market does have plenty of buyers out there that will continue to be interested in this market, perhaps trying to drive it back to the $35 level.

That doesn't mean we get there overnight, nor does it mean that it's going to be easy to get there in general. But I look at this through the prism of a market that is going to remain jittery due to the tariff situation and the tensions geopolitically. The market pulling back at this point in time should, at least in theory, offer a bit of a buying opportunity for those who are more value-minded and who are more than willing to be patient enough to find cheap silver.

Top Regulated Brokers

The Trend Should Remain

I don't see the trend changing anytime soon, at least not until the US dollar changes its overall behavior, which of course silver does tend to move in the opposite direction of. With this being said, I think you have to look at this market as one that will continue to be very noisy and choppy, but given enough time, I do think that it resolves to the upside. I like the idea of coming into the market and taking advantage of any time it dips. And it's really not until we break down below the $30 level that I'd be worried about the overall uptrend.

Ready to trade our daily forex forecast? Here are the best online Silver trading brokers to choose from.