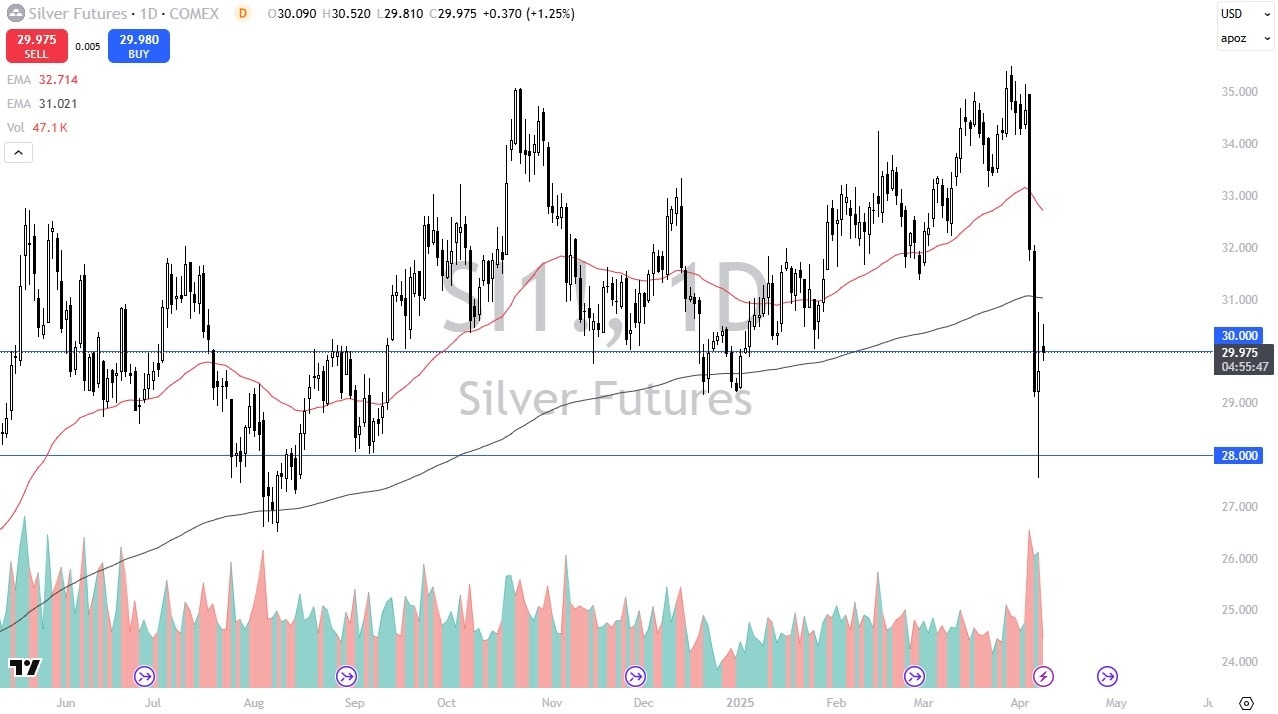

Potential signal:

- A small long could be had on a daily close above $31.

- I would have to have a stop at $30.60, and a target of $32.

Silver gapped higher to kick off the trading session, but I don't think it looks that good. And it's likely that we will see silver perhaps hang around in this general vicinity. The $30 level, of course, will attract a certain amount of attention. And I think you need to keep that in the back of your mind. But if we were to break down below here, we could find ourselves retesting the $28 level, an area that has been important for some time. If we were to break down below $28, then the bottom falls out. To the upside, we have the $31 level and perhaps more importantly, the 200-day EMA. Something that I think a lot of traders will be looking at.

Noise Will Continue

Ultimately, this is a market that is going to be very noisy to say the least, mainly due to the fact that we still have a lot of tariff headaches. What most retail traders forget is that silver is not a precious metal only, it's also an industrial metal, and that is something worth paying attention to. After all, if trade starts to slow down, then you have a situation where traders will be looking at the idea of whether or not there will be any demand.

Top Regulated Brokers

That could be a major problem. Ultimately, I think you have a situation where traders will be looking at the headlines and trying to decide whether or not Trump is going to get his way or if it is going to be a situation where there is going to be a continued conflict. If there is continued conflict, then I think you have to assume that this is a market that will get hammered. Now there will be that little bit of precious metals hope to it. But if you're looking for precious metals to protect your portfolio, you need to see the gold market in your portfolio because gold is much more safety focused than silver. If we get a breakdown in global trade, silver will get absolutely pummeled. So please keep that in mind.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.