Potential signal

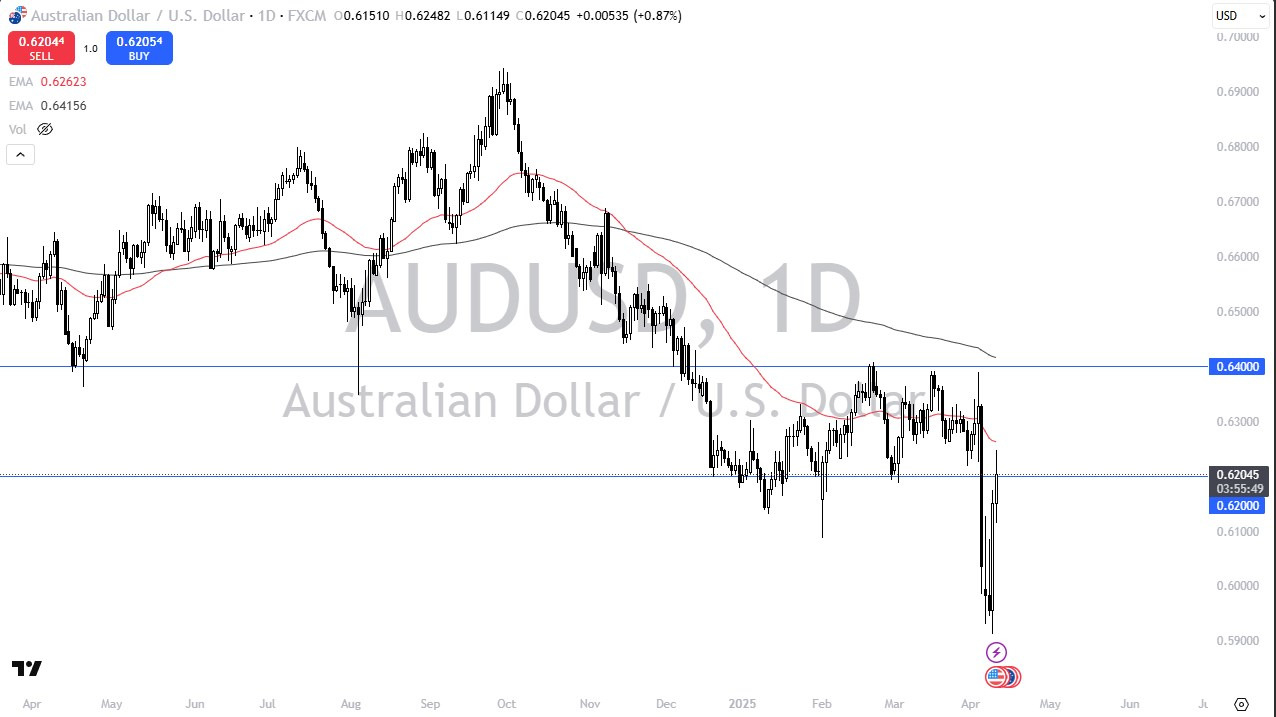

- I would be selling this pair at the moment, but I also recognize that if we break above the 0.6275 level, then things could get much worse for the US dollar.

- I would be aiming for a return to the 0.60 level.

The Australian dollar has been all over the place during trading on Thursday, slamming into a major resistance area, in the form of the 0.62 level. This is a market that is going to be very interesting to watch due to the fact that it is essentially the epicenter of all things China. After all, the Australian economy is based on the whims of the Chinese economy, as a huge amount of Australian exports to end up in that country in order to produce things for the rest the world.

With the United States and China in a massive tariff rift right now, it does make a certain amount of sense that Australia will take the brunt of the damage. After all, as commodities continue to get smoked, it makes sense that we would have the Australian dollar suffer as a result, due to the fact that there will be less demand. This will be especially true the longer that the US/China trade war goes on, as eventually it will have a major negative effect on how the Australian economy performs.

Top Regulated Brokers

Technical Analysis

The technical analysis is very interesting due to the fact that the 0.62 level had previously been massive support, and now it looks like it is going to be some type of resistance. By doing so, it looks to me like a market that is trying to break out to the upside, mainly due to a weak US dollar, but it has also seen a bit of exhaustion. I suspect we may know a lot more over the next couple of days, but right now it looks like we are probably going to have to wait to see who wins this argument.

A lot of the normal correlations have been smashed, as a lot of US dollar weakness is accompanied by a lot of safety asset hunting. Typically speaking, when things get scary and dangerous, it’s quite common for the US dollar to be a big winner in that environment. With that being said, the market is likely to continue to be very noisy, but I think you’d still be hard-pressed to be comfortable owning the Aussie dollar at the moment.

Ready to trade our daily Forex signals? Here’s a list of some of the best Forex platforms in Australia to check out