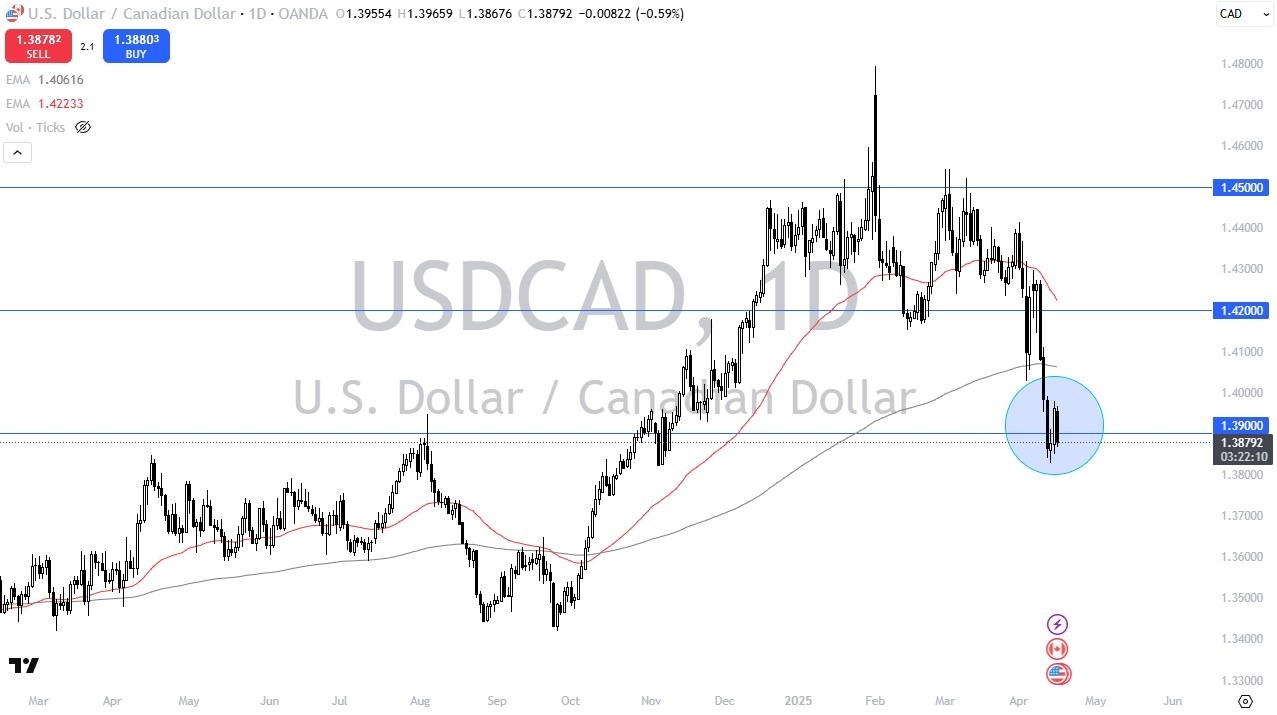

- During the trading session on Wednesday, we have seen the US dollar dropped to the 1.39 region against the Canadian dollar, an area that’s been interesting multiple times in the past,

- and I do think that we are in the midst of trying to sort out whether or not the US dollar can find technical support here, or whether or not it continues to break down against the Loonie.

Technical Analysis

The technical analysis suggests that we should have a certain amount of support in this area, as it was previous resistance. So-called “market memory” could come into the picture, and therefore you need to watch this area very closely, because we could get a nice buying opportunity, or it could be a sign that the US dollar is going to plunge even further.

Top Regulated Brokers

The tariff spat between the United States and Canada continues, but it is worth noting that PM Carney decided against the retaliatory tariffs against the United States and the automotive sector, because quite frankly, he had no choice. With that in mind, it does make quite a bit of sense that perhaps there was a little bit of relief for the Canadian dollar. Because of all of this, I do think that we are about to see some type of decision made sooner or later, and I do think that it is setting up a bigger trade for those who are patient enough to wait for some type of larger impulsive candlestick.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.