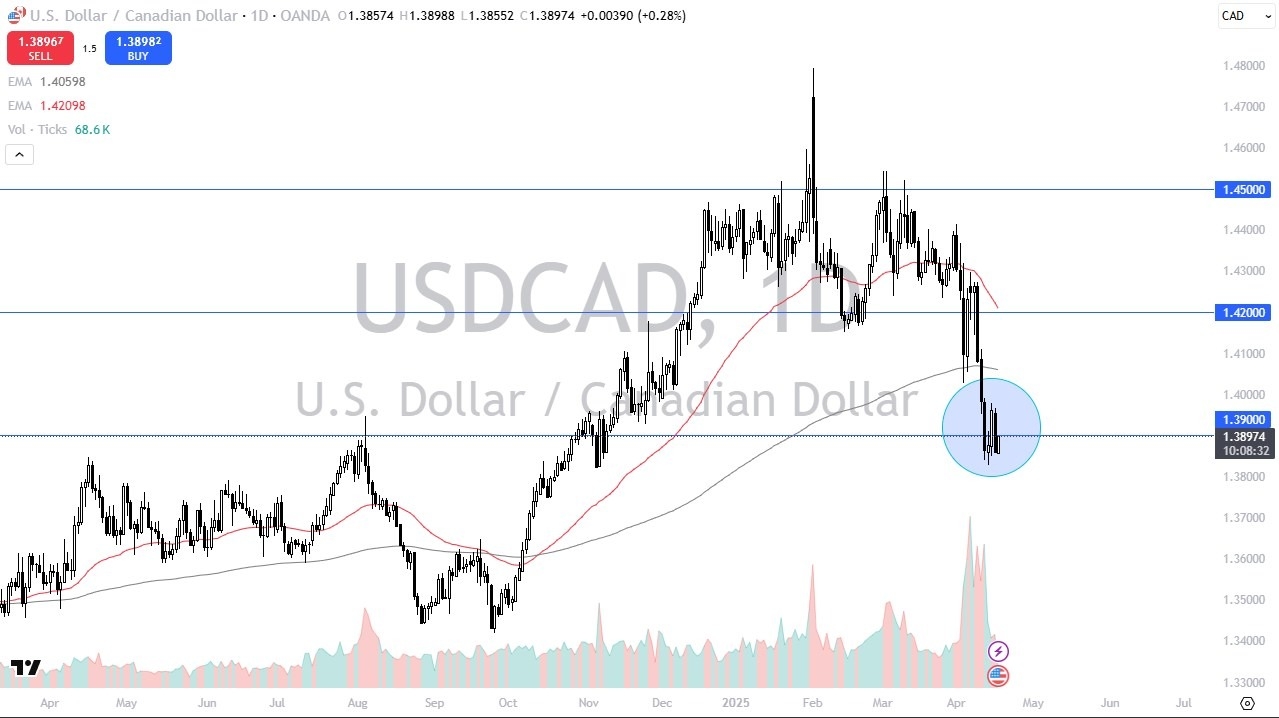

- In the early hours of Thursday, we have seen the US dollar recover a bit against the Canadian dollar, which does make a certain amount of sense as we are consolidating in a relatively tight range at an area that's been important more than once.

- The 1.39 level, of course, is an area that previously had been major resistance, so it does make a certain amount of sense that it could be support here based on market memory.

- Furthermore, we also have the trade tensions between the United States and Canada, which at this point in time, looks like it is going to be stubbornly persistent.

This will eventually cause mass problems in Canada. Yes, it causes some problems in the United States, but at the same time, the Canadians export 85 % of their produced export goods into the US, while the US exports to Canada, but nowhere near that type of positioning.

Top Regulated Brokers

Canada Will Be Vulnerable

So, with that being the case, this does eventually work against the Canadian economy. That being said, we are still going back and forth in this relatively tight range. And I think we need to see some type of explosive or impulsive candlestick in one direction or the other to truly understand where we are going. For what it is worth, we are below the 200 day EMA, so that is bearish.

But I also know that moving averages get sliced through all the time. In fact, you can see a couple of different instances on this chart alone. So, with that, I only read so much into it. If we were to break down below the 1.38 level, then I think you see further weakness. If we were to turn around and break above the 1.40 level, then I think you see further strength.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.