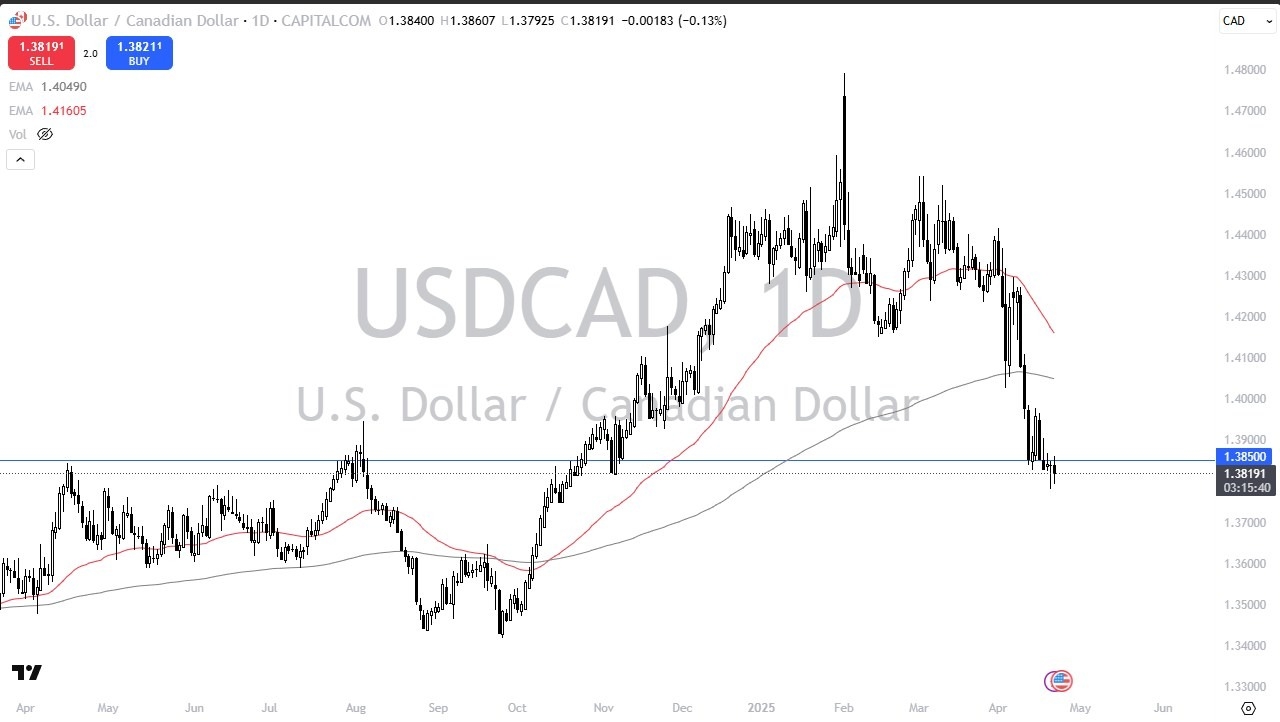

- The US dollar has gone back and forth during the trading session on Tuesday, as we continue to hang around the crucial 1.3850 level.

- The 1.3850 level is an area that’s been important in the past, so I do expect to see a certain amount of “market memory” in this vicinity.

- Furthermore, you also have to keep in mind that this is a pair that is oversold at the moment, so it does make a certain amount of sense that we at least stabilize, if not turn around and bounce completely.

Keep in mind that the trade war between Canada and the United States is still very much front and center, so I think you have to pay close attention to the latest headlines coming out of both of those countries, as any progress should be beneficial for both.

Top Regulated Brokers

That being said, Canada sends over 80% of its exports into the United States, so if the US economy starts to tank, it actually benefit the US dollar and the situation under more circumstances than the other way around, as the market will punish Canada if the United States isn’t buying its goods. However, recently we’ve seen a completely different type of move as the tariffs back continues.

Technical Analysis

The technical analysis for this USD/CAD pair is a bit mixed at the moment, as we are hanging around an area that has been so important. All things being equal, the market is likely to continue to see a lot of volatility in this area, and I would be looking at a couple of different areas right now for hints as to where the market may go.

To the upside, if we were to break above the 1.40 level, then I think you’ve got a situation where the US dollar will rally rather significantly. In this environment, you could even see the USD/CAD pair reach the 1.45 level again, although probably in more of a grind than anything else. On the other hand, if we were to break down below the 1.3750 level, I think it’s very likely that you would see the US dollar trade toward the 1.35 handle.

Ready to trade our USD/CAD daily analysis and predictions? Check out the best currency exchange broker Canada for you.