- During the session on Tuesday, the US dollar started to fall against the Canadian dollar, only to turn around and bounce as it looks like more “risk off” than anything else around the world right now.

- The risk appetite came roaring back at the beginning of the session in multiple markets, but we have seen things completely turn around about mid day in the United States.

- If that’s going to be the case, then it makes a lot of sense that we would see a lot of demand for US dollars in order to stay safe.

Technical Analysis

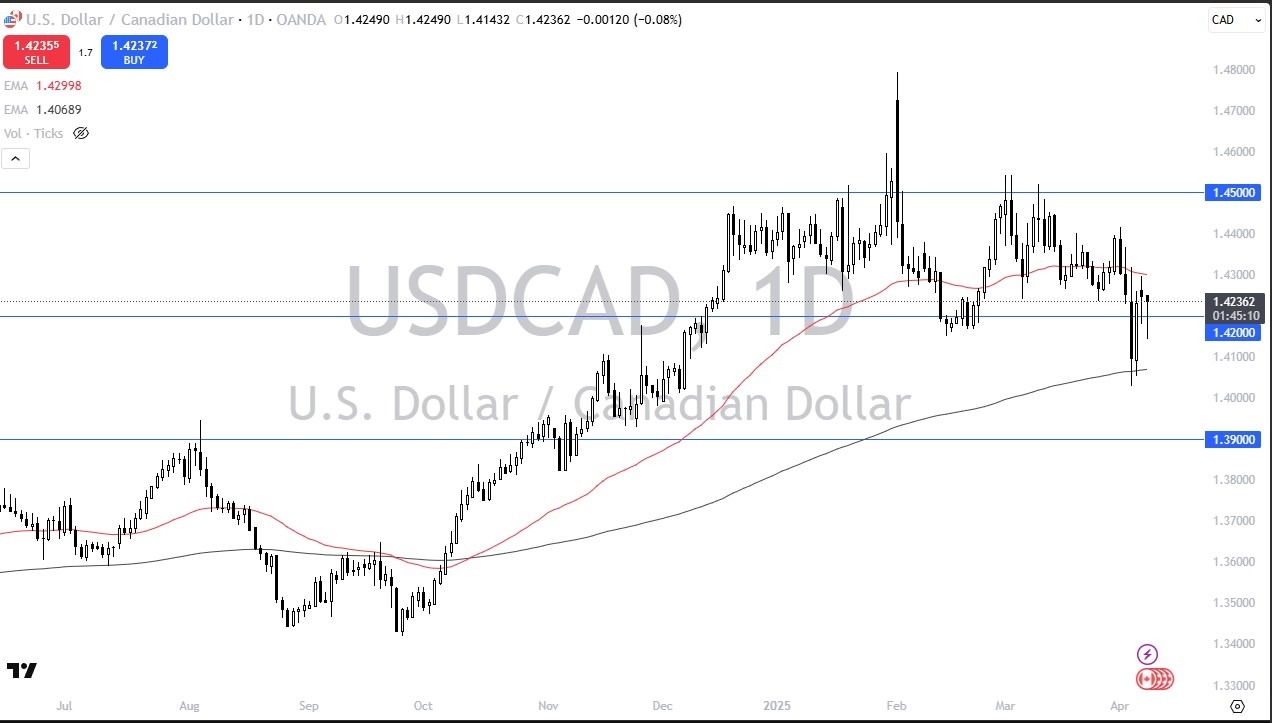

The technical analysis for this market is somewhat sideways from a longer-term standpoint, but also recognize that going out even further, the US dollar has been stronger than the Canadian dollar for some time, and it wasn’t until a few months ago that we started to go sideways. Because of this, I think the risk for the longer-term move is still to the upside, and I do believe that traders will be looking for a potential breakout eventually.

Top Regulated Brokers

However, the 1.45 level above has been like a major barrier for some time, so therefore if we were to take off above that level, the US dollar should swallow the Canadian dollar whole. Furthermore, it’s worth noting that Canada does not look like it’s willing to acquiesce to the demands of the Americans, at least not easily. This is an argument that Canada will lose eventually, the question at this point in time just comes down to how we are going to go about it. Ultimately, the law of large numbers dictates that the Americans win.

That being said, if there is some type of trade agreement that avoids tariffs between the Americans in the Canadians, that might be the sign that the top is in, and we could see this market breakdown. That would actually be a good thing for both countries, but we will have to wait and see if that happens. As things stand right now, we are at the bottom of the overall consolidation area, so the risk is still to the upside from a technical as well as fundamental outlook.

Ready to trade our Forex USD/CAD predictions? Here are the best Canadian online brokers to start trading with.