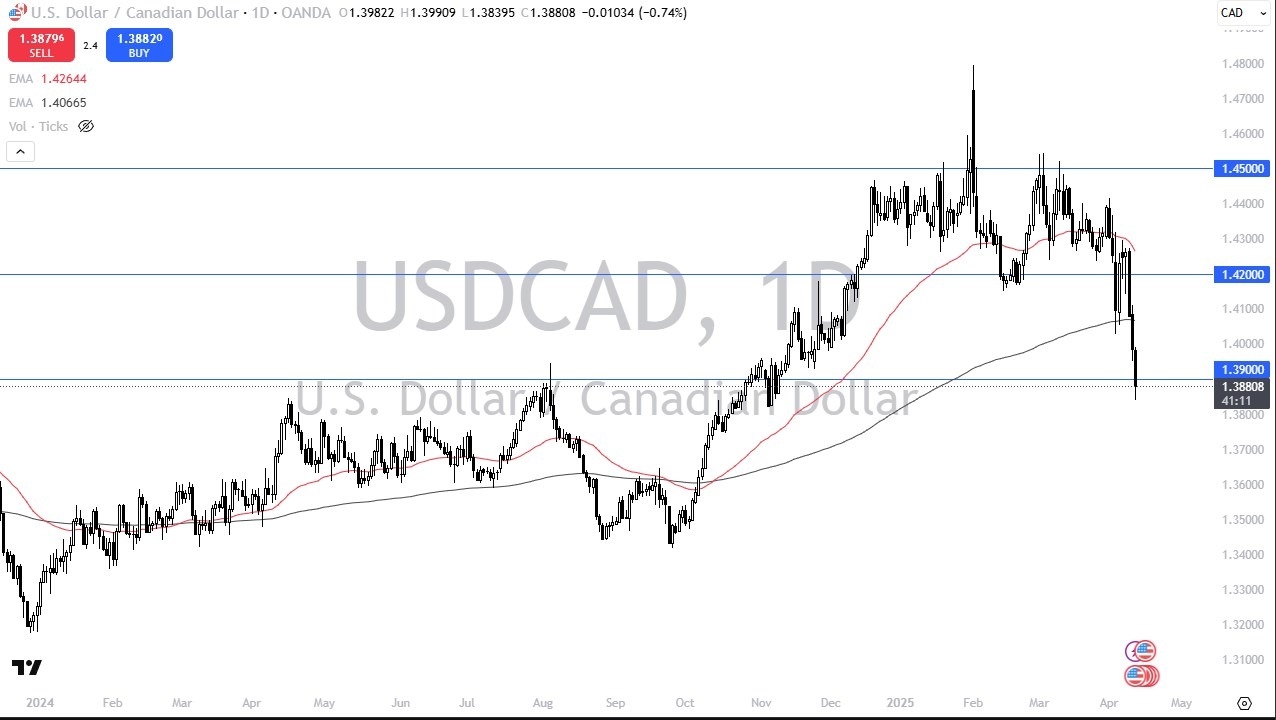

Potential signal:

- I would have a shot at a long in this pair if the USD is going higher on the whole, when it crosses 1.40, with a stop loss at 1.3850, and a target of 1.42

The US dollar has fallen significantly during the trading session on Friday, to break down below the 1.39 level, which is an area that has been important multiple times. All things being equal, I do think this is an area where we might see the US dollar fight back, but we will have to keep in mind that the market is likely to make it a major decision in this area, as we have seen this area offer massive resistance previously. The question at this point in time will be whether or not market memory returns.

Top Regulated Brokers

Technical Analysis

The 1.39 level for me is the most important level on this chart, and we are closing right around there. It is worth noting that we bounced just a bit, and it does suggest that there is at least some fight left in the US dollar in this area. If we could break above the 1.140 level, then I think you will start to see the US dollar recover. However, the 200 Day EMA is sitting right around the 1.4090 level, so that is a barrier that you would have to overcome. If we break down below the lows of the Friday candlestick, then we could drop to the 1.37 level, but it’s also worth noting that sooner or later, we will have to see some type of bounce, mainly due to the fact that interest rates in America are climbing, although not necessarily for a good reason.

The size of the candlestick does tell you that there is at least some interest in this market to the downside, and I think at this point in time we have a situation where there will be a lot of volatility, but I do think that the Canadian dollar may have gotten far too ahead of itself. If we get something over the weekend that sounds more hawkish or belligerent coming out of the United States, we could very well see this market turn right back around. Hang on, things are about to get very interesting in this region.

Ready to trade our USD/CAD Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.