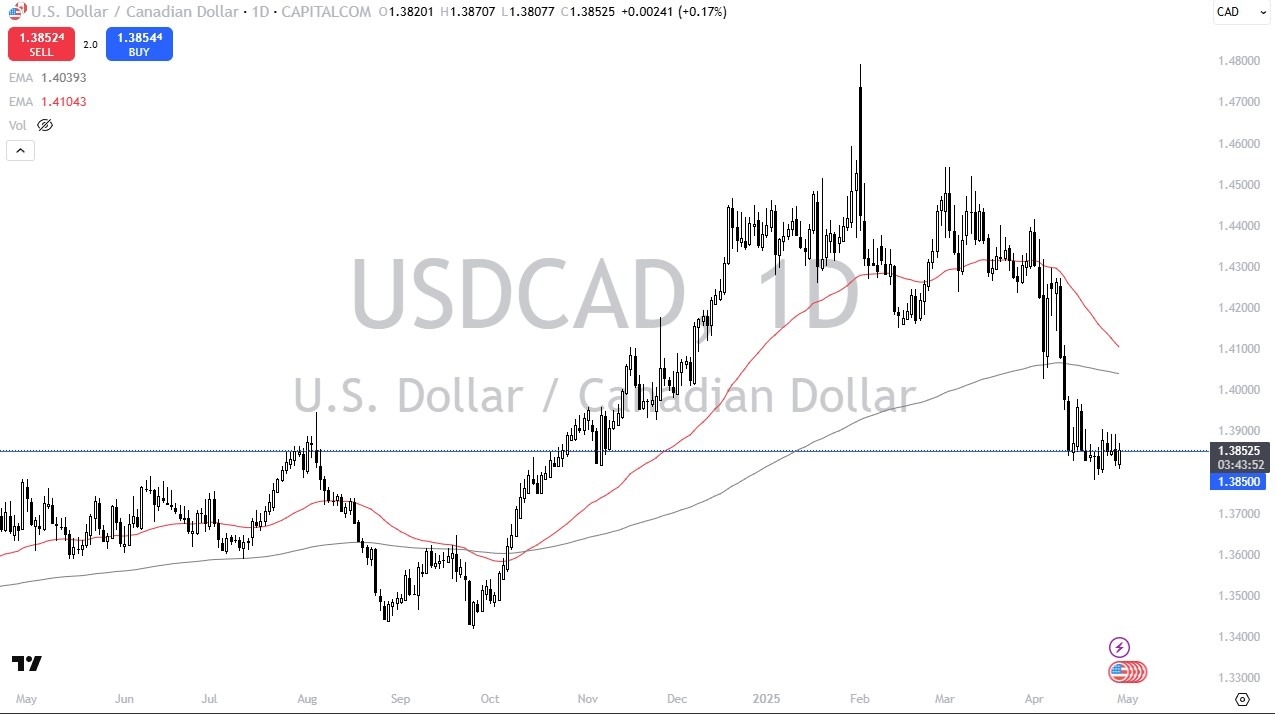

Potential signal:

- I would be a buyer of this pair at the 1.40 level, with a stop loss at 1.3850.

- I would be aiming for the 1.42 level at that point, trailing my stop once we got 50 pips in profit.

The US dollar has risen a bit against the Canadian dollar during trading on Tuesday, as we continue to see a lot of questions asked about where we are going next with the tariff situation.nWith the election of Mark Carney, the world waits to see how the Americans in the Canadians will treat each other. Ultimately, this is a market that is typically very choppy and sideways overall, so the last couple of weeks will have been more of the norm than what we had seen previously.

- With that being said, this is a market that typically is very choppy and difficult to hang onto.

Technical Analysis

The technical analysis for this market is somewhat neutral, as we have seen over the last week or 2 play out. That being said though, we are at an area that had been massive resistance previously, so you would have to assume that eventually the so-called “market memory” comes into the picture, and traders will look to that area as to a potential guide for support. The fact that we have hovered just above this area does make quite a bit of sense at the moment, and I think we have a scenario where traders are simply waiting for the next major announcement or event to start trading on. Ultimately, I think at this point in time we probably settle into a “wait and see” type of mode.

Top Regulated Brokers

If we can break above the 1.40 level, then I think the US dollar more likely than not will start to grind higher. I think the key word here is going to be “grind.” On the other hand, if we were to break down below the 1.38 level, then we could start to drop toward the 1.37 level. This pair tends to move in a very methodical way, so be aware of the fact that impulsive moves are not the norm, and you will have to exercise a significant amount of patience when it comes to trading the USD/CAD pair.

Ready to trade our USD/CAD daily analysis and forecasts? Here's a list of the best Forex Trading platform in Canada to choose from.