Potential signal:

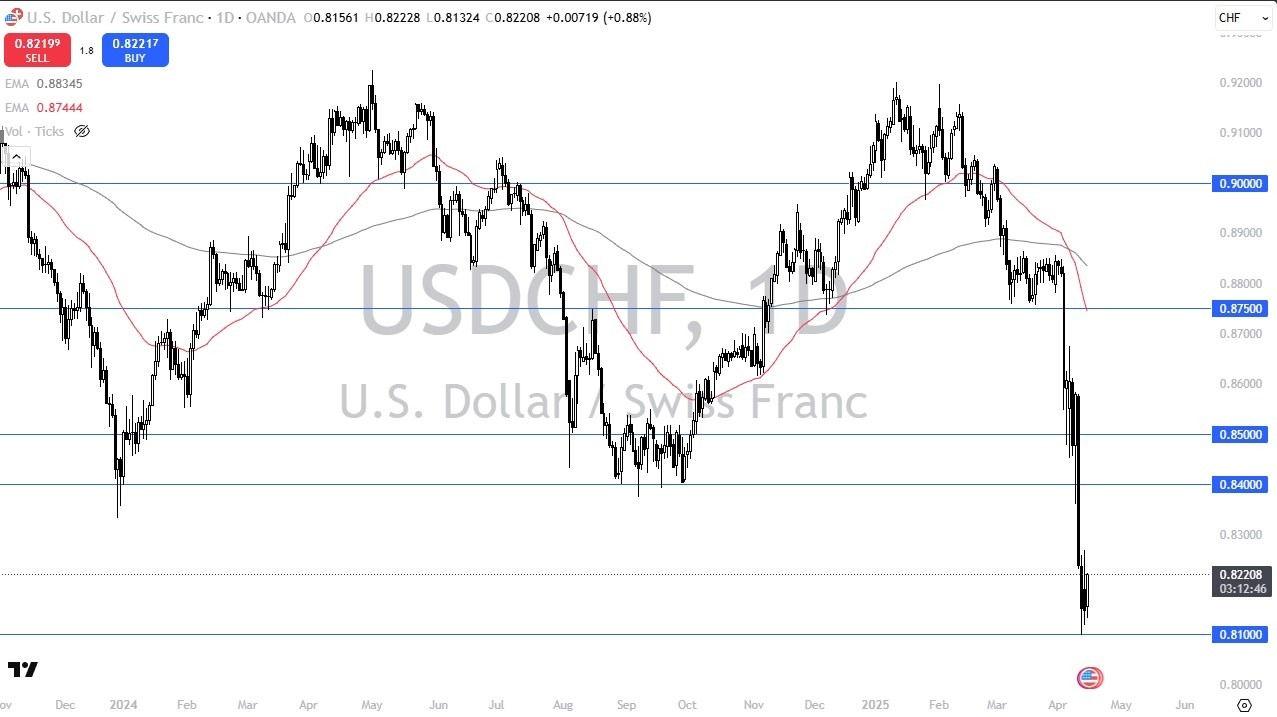

- This is a short-term trade idea, but above the 0.8250 level I would be aiming for the pair to rise to the 0.84 level.

- I would be tight with a stop loss though, only giving it 60 pips.

- Remember, it is going to counter trend so make sure that your position size reflects this.

It’s interesting that the US dollar has rallied a bit against the Swiss franc during the trading session on Tuesday, as it is a rerun of what happened on Monday, with the exception that the US dollar actually can hang onto gains. With that being the case, we may be in the midst of seeing some type of significant bounce just waiting to happen, which does make a certain amount of sense considering that you get paid to hang on to this trade, and while the Swiss franc has seen a lot of inflows due to money moving around the world recently, the reality is that sooner or later, the Swiss National Bank will lose its sense of humor.

Top Regulated Brokers

Massive Floor Underneath?

The question now is whether or not there is a massive floor underneath current levels, specifically at the 0.81 level. It is worth noting that we bounced directly from that level and have not been able to hang onto it since then. With this, I think there’s a very good chance that we get a bounce in this pair, but whether or not it can actually change the trend would be a completely different conversation to say the least. I would need to see this market break above the 0.8250 level to become a little bit more bullish, and at that point I think you could see a run toward the 0.84 level. Whether or not we can get above there will depend on a plethora of moving pieces, so in the short term this is all I’m looking for.

Ultimately, if we break down below the crucial 0.81 level, we could see the market participants really get aggressive to the downside, but I also think Swiss National Bank could get involved, because quite frankly they will lose their sense of humor about all of this massive selling, and they are one of the first central banks out there that will intervene if things get too out of control in the Swiss franc.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.