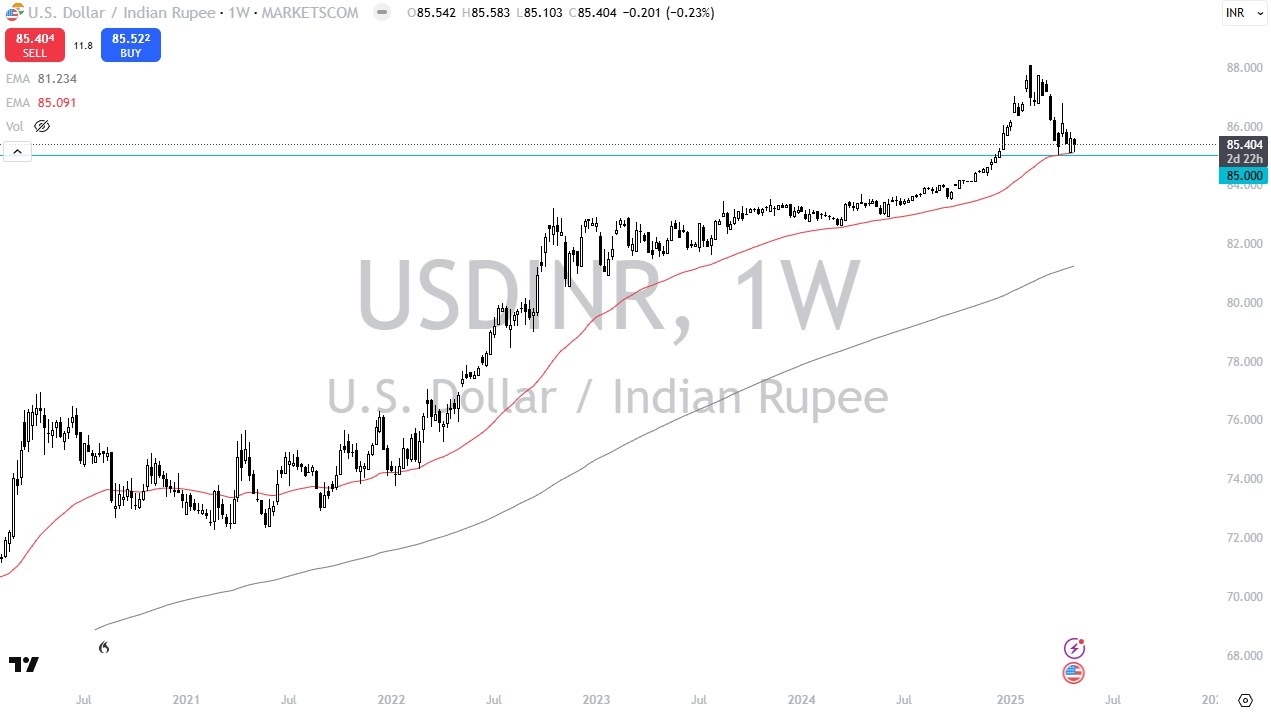

- During the month of April, we have seen the US dollar get somewhat sideways against the Indian rupee, after pulling back from the ₹88 level previously.

- The market is currently sitting at the 50 Week EMA, which of course is an indicator that longer-term traders do tend to pay quite a bit of attention to.

- The ₹85 level seems to be capturing a bit of attention, so it’ll be interesting to see where we go from here.

Trade Tensions and Potential War

India is in a very interesting spot right now as far as investing is concerned, because the trade tensions obviously have a major influence on some of these exporting countries such as India, as it is a bit difficult to understand what the situation will be like with the Americans. However, from the geopolitical standpoint it does make a certain amount of sense that the Indians and the Americans will come together somehow. After all, the Americans will want to isolate the Chinese in that region.

Top Regulated Brokers

Further clouding the situation is the fact that India and Pakistan may be getting ready to flareup yet again, but this time perhaps it might be a little bit more intense. While the outcome of that armed conflict is probably somewhat taken for granted, the reality is that it could cause foreign investors to shun India. In that environment, we could see the US dollar rally against the Indian rupee, simply as a safety play. Furthermore, we are already in an uptrend, so that’s just yet another reason to buy this pair.

The ₹85 level is important, but it’s not the “be all end all” of support. If the market were to break below there, then I would anticipate that the ₹83.50 level will be the next area of significant interest. On a break higher from here, then we could be revisiting the ₹88 level again, although this is a pair that tends to move very slowly, and I think it will be more of a grind than anything else

Ready to trade our monthly forecast? Here’s a list of some of the top forex brokers in India to check out.