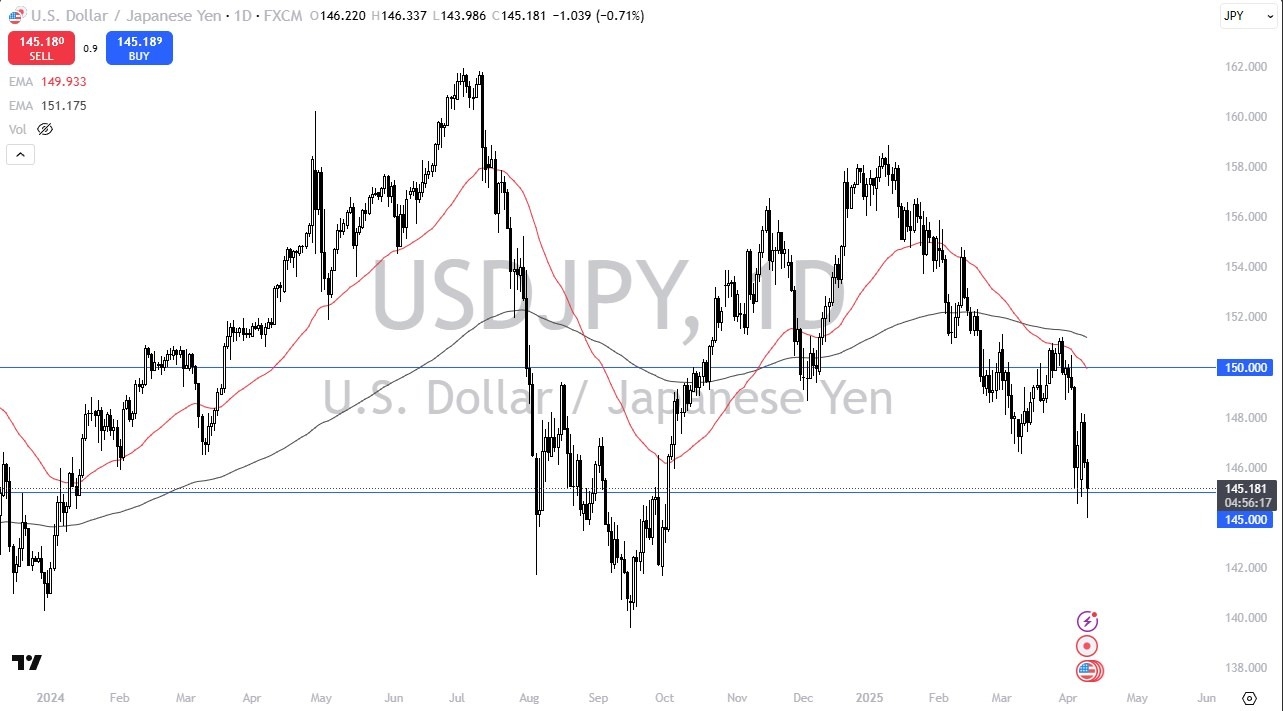

- The US dollar plunged early during the trading session on Wednesday, breaking well below the crucial ¥145 level.

- That being said, it looks like the buyers are coming into at least trying to support the US dollar against the Japanese yen, so it’ll be interesting to see how this plays out.

- The interest rate differential still favors the US dollar, and the way the bond market has been behaving, that’s only going to get more aggressive.

Nonetheless, the Japanese and the Americans are much more likely to come to some type of an agreement then the Chinese and Americans, so do keep that in mind. In other words, it’s very likely that the trade situation in the United States and Japan will probably normalize before it’s all said and done. However, the Japanese yen is also considered to be a major safety currency, and I think that’s part of what you are seeing here. That being said, I think we remain in a downtrend more than anything else, so you probably need to pay close attention to that.

Top Regulated Brokers

Technical Analysis Still Looks Rough

Technical analysis in this market still looks very rough, so keep that in mind. Ultimately, this is a market that given enough time, will have to come to some type of resolution, and if we break down below the bottom of the range for the Wednesday session, we could then see the US dollar trading down to the ¥142 level. However, I also recognize that this is a longer-term “carry trade pair” for those who are willing to step in and take advantage of it. At this point though, it’s obvious that things are way too dangerous for people to think about at the moment, so with that being said, most traders I know are simply sitting on their hands.

The Japanese yen probably continues to do fairly well against most currencies in this environment, and the US dollar itself is going to be a bit of a mixed bag, because there is money leaving the United States, but at the same time, the bonds continue to show higher yields. That interest rate differential is only getting bigger.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.