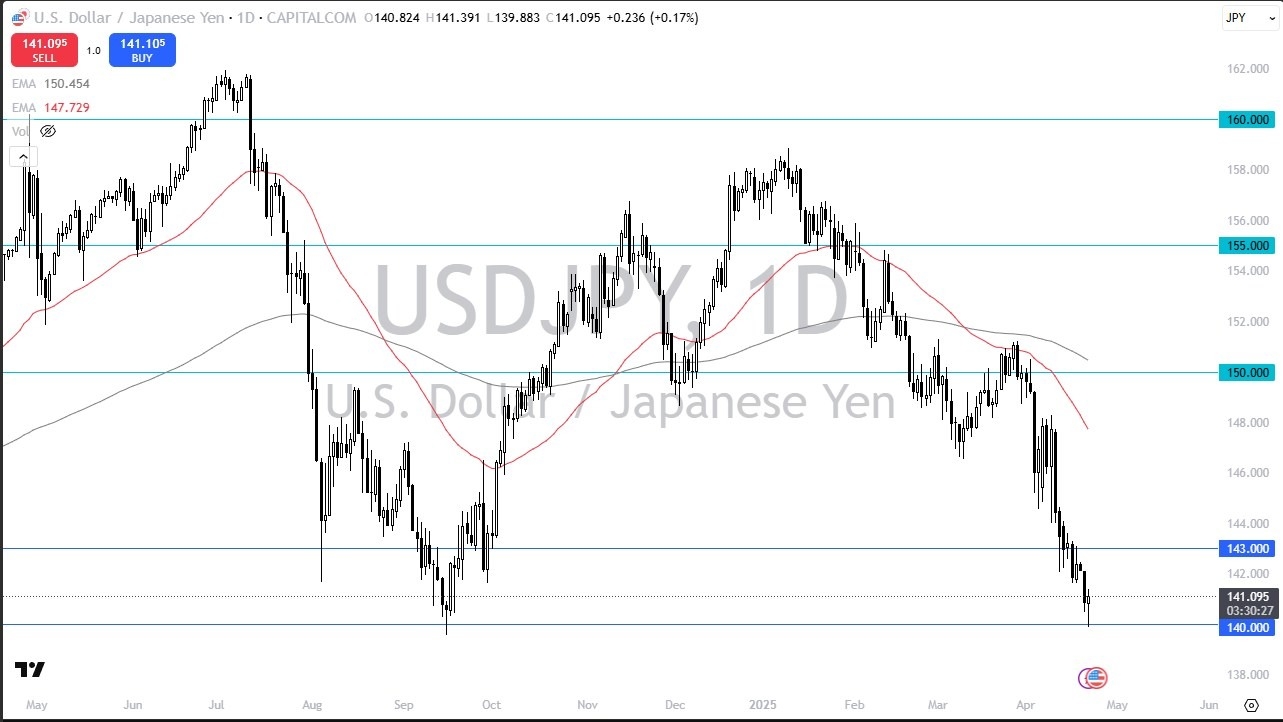

- The US dollar has shown itself to be somewhat resilient during the trading session on Tuesday, despite the fact that we plunged just below the ¥140 level.

- This is a level that of course is a large, round, psychologically significant figure, and a major swing low from previous trading.

- Because of this, I think a certain amount of “market memory” comes into the picture, meaning that we should see a certain amount of support at this point.

Technical Analysis

The technical analysis for this USD/JPY pair is obviously negative, but the ¥140 level is an area that a lot of people will be paying close attention to because it had been such a massive support previously. Furthermore, it looks as if the market is trying to form a hammer for the day, and if it does in fact do that, one would have to assume that there might be buyers willing to get involved. That being said, I prefer to have a little bit more in the way of confirmation with a move like this, and in this environment, I will be waiting for a move above the ¥143 level.

Top Regulated Brokers

If we were to break above the ¥143 level, then I think you have a scenario where we may go looking to reach the ¥148 level again, which is where the 50 Day EMA currently resides. This of course is a technical indicator that a lot of people will be paying close attention for potential resistance. That being said, it is worth noting that market participants continue to look at this through the prism of a market that will be moving on the latest tariff headlines, and of course risk appetite in general. Remember, the Japanese yen is considered to be the ultimate “safety currency” for a lot of traders, and with that being said, this pair will continue to be highly sensitive to the latest headlines involving the tariff war.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.