Potential signal:

- If the market can break above the 143.50 level, then I am going long with a 100 pip stop loss and aiming for as high as the 146 level.

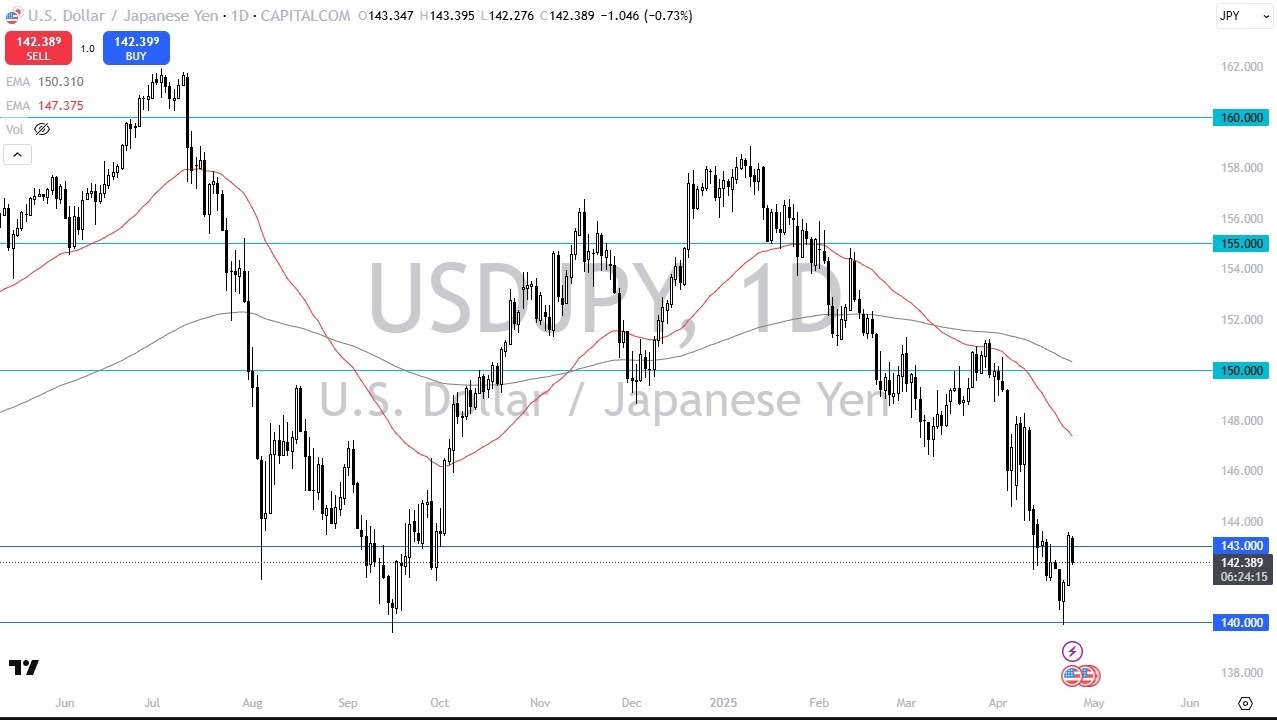

The US dollar has pulled back a bit against the Japanese yen during trading on Thursday, as we continue to see a lot of noise around this general vicinity. Keep in mind that the 140 yen level has kicked off a pretty significant recovery, although we still have a long way to go before the trend would actually change.

The 140 yen level has been important multiple times over the last several years, so it's not a surprise to see a little bit of a bounce here. The 143 yen level is an area where I think a lot of people will be watching, and if we can break above the highs of the last couple of sessions, then we could see the US dollar go looking to the 146 yen level.

Top Regulated Brokers

Keep in mind that the Federal Reserve is very likely to stay tight with its monetary policy, while the Bank of Japan may have to loosen, or at least sit still that will continue to favor the US dollar from an interest rate differential standpoint. But as we continue to go through the tariff situation, there is a lot of noise out there that will be a major problem for US dollar bulls.

This Area Will Be Noise

Nonetheless, it looks like we are going to continue to see a lot of volatility in this area. And even if we are to turn around and rally from here, it makes a certain amount of sense that we would see a little bit of sideways action here in order to build a basing pattern, just like we did in the month of September in 2024. We could see a bit of a repeat and you'll notice that it was a very noisy affair down here last time. With so much uncertainty, that does make a certain amount of sense. However, if we were to break down below the 140 yen level, then it's likely that we will go looking to the 138 yen level in that environment, as you would probably see the US dollar falling against everything.

Want to trade our USD/JPY forex analysis and predictions? Here's a list of forex brokers in Japan to check out.