Signals for the Lira Against the US Dollar Today

- Risk 0.50%.

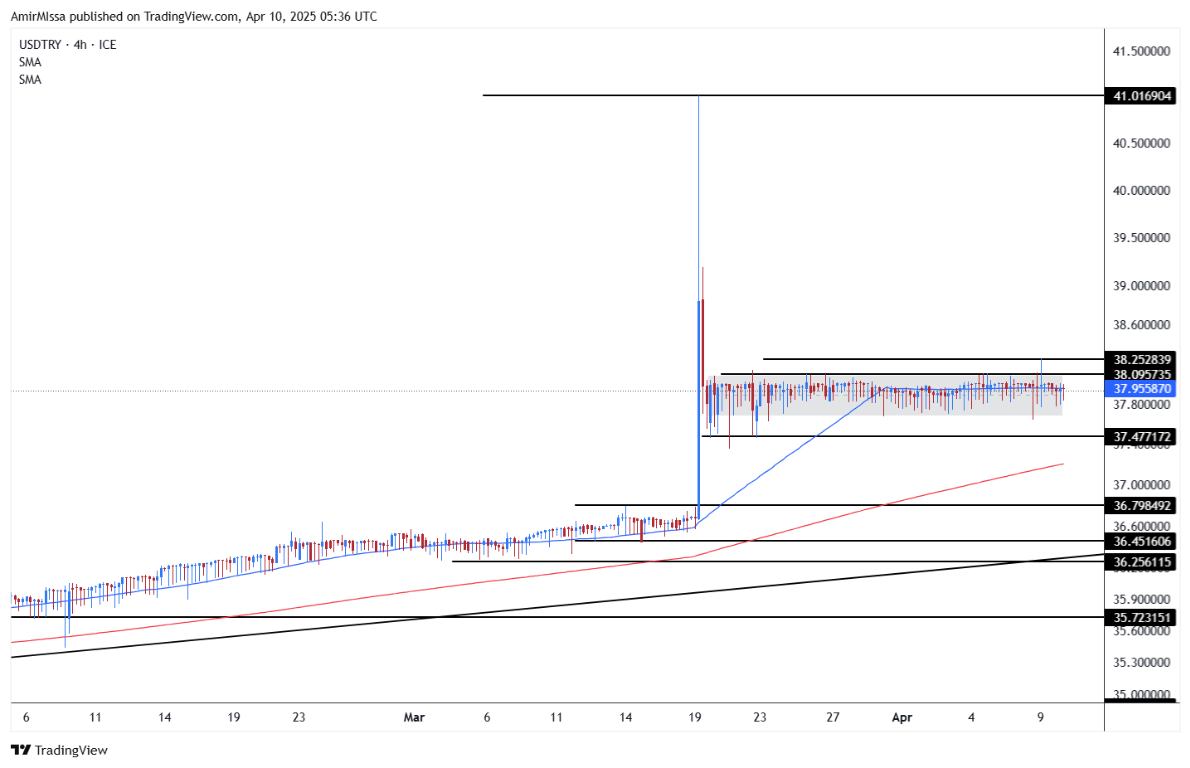

This chart produced by the TradingView platform.

Bullish Entry Points:

- Open a buy order at 37.90.

- Set a stop-loss order below 37.45.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 40.50.

Bearish Entry Points:

- Place a sell order for 40.35.

- Set a stop-loss order at or above 41.50.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 37.15.

Top Regulated Brokers

Turkish Lira Analysis:

The Dollar against the Lira recorded a slight increase, surpassing the narrow trading range it has been trading within over the past few weeks, with the Dollar reaching 38.25 Lira before retreating to the same range it has been moving within.

Obviously, the Lira completely ignored the increasing financial turmoil globally. The Central Bank continues to intervene amidst the sharp fluctuations witnessed in global markets due to statements by US President Donald Trump, ranging from passing tariff increases to postponing them for 90 days. Consequently, these fluctuations have widened a wave of intense foreign capital outflows. During the period between March 14th and 28th, outflows of 14 billion dollars were recorded from foreign investment portfolios.

According to data published on X, the Turkish Central Bank injected approximately 10.7 billion dollars from its foreign currency reserves in just two days, distributed between 7.6 billion dollars on April 7th and 3.1 billion dollars on the 8th of this month. This brings the total amount spent by the Turkish government since the arrest of Istanbul Mayor Ekrem İmamoğlu on March 19th to about 42.7 billion dollars, in an attempt to contain the deterioration of the Turkish Lira and control its exchange rate. Moreover, The Dollar had risen from 36 to 41 Lira since that date before stabilizing at 38 on March 19th.

The net foreign currency position of the Turkish Central Bank, after deducting off-balance sheet derivative instruments, shows a decline to 16.2 billion dollars by April 8th, reflecting a significant depletion of reserves compared to previous levels exceeding 60 billion dollars, raising questions about the sustainability of this defensive policy if pressure on the currency continues.

Meanwhile, the Turkish economic administration continues to control the Lira's movements without change for nearly a month, local and international expectations are growing that the country is heading towards an inevitable devaluation of the currency. Also, this pattern of exchange rate management was previously followed by President Erdoğan's administration before the presidential elections held in mid-2023. At the same time, dollarization rates in investment funds and private pension funds exceeded 40%, reflecting the extent of declining confidence in the Lira domestically.

TRYUSD technical Analysis and Expectations Today:

Technically, the USD/TRY pair has maintained its limited movements around the 38 Lira levels. Recently, the price has returned to trading within the rectangle pattern that pushes the pair to move sideways. Also, the pair is showing divergence around the 50-period moving average on the four-hour timeframe, indicating medium-term stability. Turkish Lira price forecasts include a decline, with the pair targeting resistance levels at 38.50 and 39.00 Lira, respectively.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.