Fundamental Analysis & Market Sentiment

I wrote on 6th April that the best trades for the week would be:

- Long of Gold following a daily close above $3,134.31. This set up on the Thursday and ended the week up 1.96% from there.

- Following these expected movements in the Forex market:

- GBP/JPY is likely to rise = +0.43%

- AUD/JPY is likely to rise = +2.75%

- GBP/CHF is likely to rise = -3.16%

- NZD/JPY is likely to rise = +2.98%

- EUR/NZD is likely to fall = +0.18%

- EUR/AUD is likely to fall = +0.47%

- GBP/AUD is likely to fall = +2.48%

- AUD/CAD is likely to rise = +2.49%

- NZD/CAD is likely to rise = +1.57%

- NZD/CHF is likely to rise = +0.55%

The overall result was a win of 10.74%, which was 1.07% per asset.

Last week saw a much calmer market as days and even weeks are now passing without any new tariff bombshells, although President Trump hinted that new automobile tariffs at 25% due to begin in early May might be postponed. Negotiations will be ongoing until the 90-day period ends in early July.

The big news last week was the European Central Bank’s rate cut of 0.25%, which was widely expected, and the optimism that inflation is now well on course to settle long-term at about the target level of 2%. The ECB seems to feel quite confident that it has inflation beaten, and ironically this may be boosting the Euro as a new safe-haven currency.

Another major item was lower than expected inflation in both the UK and in Canada, which is adding to the growing “inflation beaten” narrative.

The Bank of Canada held its Overnight Rate at 2.75%.

US Retail Sales data came in a little stronger than expected.

Finally, President Trump has been publicly criticizing Fed Chair Jerome Powell for not cutting rates more quickly, and is publicly musing on studying replacing him, although it is hard to see how this could be executed. President Trump is trying to talk down the Federal Funds Rate.

Top Regulated Brokers

The Week Ahead: 21st – 25th April

The coming week has a very light schedule of important releases.

This week’s important data points, in order of likely importance, are:

- Flash Services & Manufacturing PMI UA, Germany, UK, France

- Chair of Swiss National Bank Speech

- Canada Retail Sales

- US Unemployment Claims

- UK Retail Sales

Monthly Forecast April 2025

For the month of April 2025, I made no monthly forecast, as at the start of that month, the Forex market was dull and there were only mixed long-term trends.

Weekly Forecast 20th April 2025

As there were no unusually large price movements in Forex currency crosses over the past week, I made no weekly forecast.

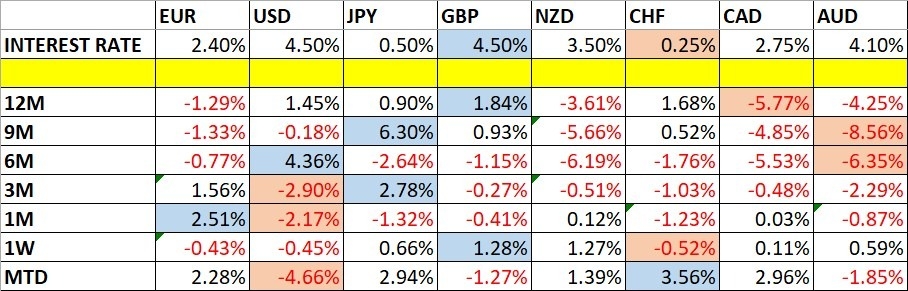

The British Pound and the New Zealand Dollar were the strongest major currencies last week, while the Swiss Franc, the US Dollar, and the Euro were the weakest. Volatility decreased markedly last week, with more than 37% of the most important Forex currency pairs and crosses changing in value by more than 1%. Next week will likely see even lower volatility as there is such a light data schedule

You can trade these forecasts in a real or demo Forex brokerage account.

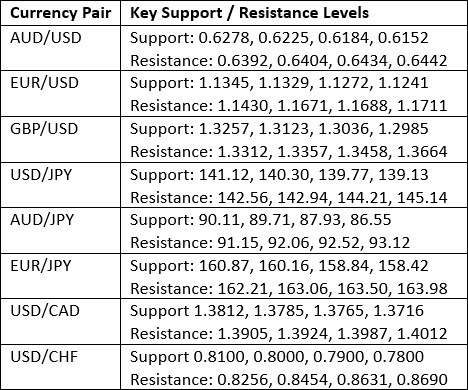

Key Support/Resistance Levels for Popular Pairs

Technical Analysis

US Dollar Index

Last week, the US Dollar Index printed a bearish inside bar pattern which closed near the low of its range. The previous week’s low is close by and represents a 3-year low price. These are all bearish signs and we clearly have a strongly bearish long-term trend in the greenback.

It looks likely that US Dollar weakness will continue as there are no real technical or fundamental reasons why this will reverse, and ongoing tariff concerns are likely to keep the Dollar weak. However, it might be that as we approach the tariff negotiation deadline in early July that we start to hear news of trade deals which might boost the Dollar.

EUR/USD

The EUR/USD currency pair rose last week to make its highest weekly close in a few years, ending the week not far from the high of its range. However, it is worth noting that the resistance level at $1.1430 has continued to hold, and that the price was unable to make a new high last week.

It is likely worth being long here as this currency pair tends to trend slowly but reliably. With a weak greenback and interest in the Euro as a safe-haven currency, there are good reasons to be long here.

If the price can get established above $1.1430 that will probably be a good long trade entry signal, as there are no key resistance levels above that area for a few hundred pips.

GBP/USD

The GBP/USD currency pair rose last week to close very near its high on an unusually large range, well above the previous week’s high. The Pound is the strongest major currency and managed to advance further against the greenback than the Euro did last week, but the price chart below shows the long-term bullish trend is weaker and choppier. However, the short-term bullish momentum is certainly here.

It is likely worth entering long trades here on a short-term basis on bullish breakouts for as long as this short-term momentum persists.

The Pound’s strength is maintained mostly on the back of its relatively large interest rate of 4.50%, which is attracting deposits looking for overnight carry.

Bulls might beware of the area above $1.3380 if it is reached this week.

USD/JPY

The USD/JPY currency pair traded lower for yet another consecutive week, reaching a new 6-month low and closing near the bottom of its weekly range.

There is clearly a long-term bearish trend here, and there has also been short-term bearish momentum due mostly to weakness in the US Dollar.

This major currency pair tends to trend with some reliability, so I like to be short here. We might also start to see the Yen really start to strengthen more itself as Japanese wages continue to rise and make rate hikes more of a possibility at the Bank of Japan.

While other currencies are advancing more strongly against the Dollar, few are breaking to new long-term highs, and that is a good reason to be short here.

Gold

Gold rose firmly last week to reach yet another new record high not far below the round number at $3,400. The weekly close was a little way off the high, but the bearish retracement here has not been especially deep, so everything still looks essentially bullish as the precious metal advances into blue sky.

Gold can advance during periods of crisis like the one we are in now and this is what seems to be happening as its correlation with the US stock market lessens.

It is worth considering Gold as having standalone merit, as a look at the weekly price chart below shows a very strong long-term bullish trend having been underway for almost 1.5 years. Since the start of 2024, the price of Gold against the USD has increased by more than 55%, which is an impressive amount for any asset, and especially so for a precious metal.

I think it is wise to be long of Gold right now, or to enter a new position once we get a new high daily closing price in New York above $3,343.10.

The S&P 500 Index

The S&P 500 Index lost a little ground last week. The big story is the price managing to reclaim some ground after the big selloff a few weeks ago, but bulls ran into the 5,500 area which has acted as strong resistance, and we’ve seen the price fail here and start to turn bearish again.

The price traded in bear market territory (down 20% from the recent peak), and has regained ground, but is still well below the 200-day moving average which is shown in green within the price chart below.

These are all bearish signs, although shorting US equity indices is very risky and probably not advisable to anyone except a very experienced trader.

I believe there is going to be more turbulence in the stock market over the coming months as we approach the 90-day tariff deadline in early July, so I am happy to be out of stocks for now.

Bottom Line

I see the best trades this week as:

- Long of the EUR/USD currency pair.

- Short of the USD/JPY currency pair.

- Long of Gold following a daily (New York) close above $3,343.10.

Ready to trade our Weekly Forex forecast? Check out our list of the best Forex brokers.