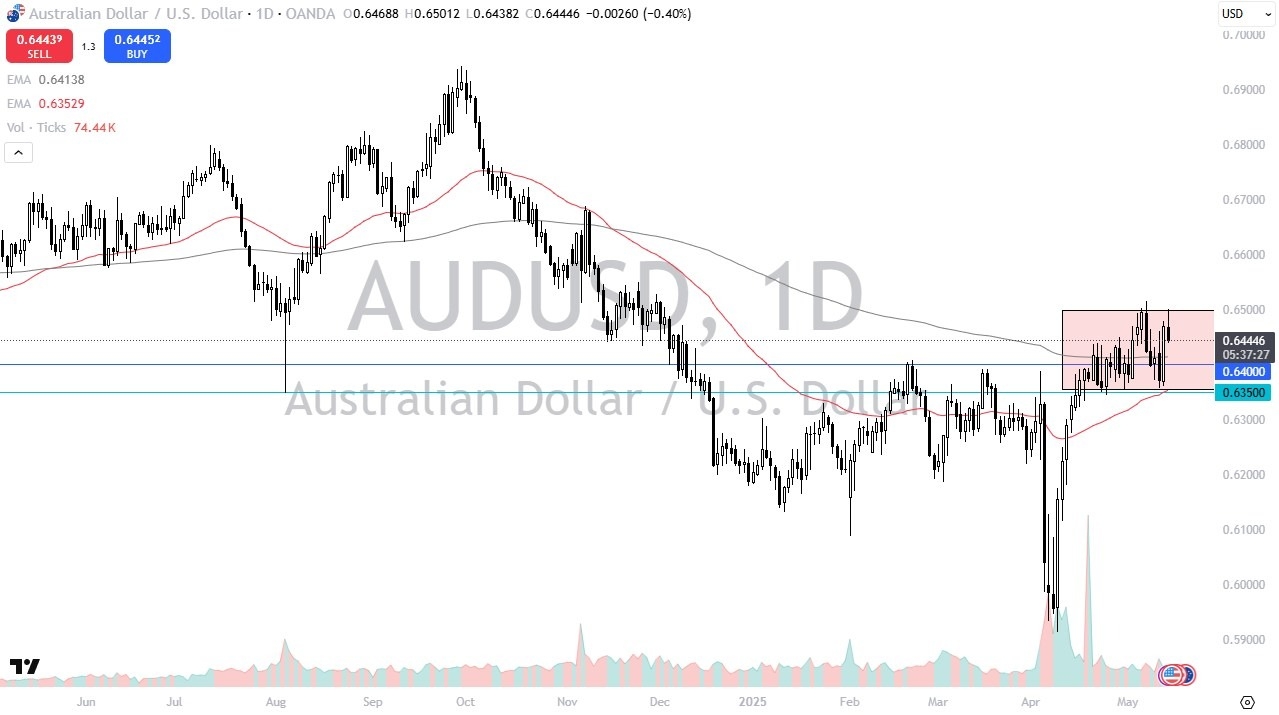

- The US dollar has recovered quite nicely against the Australian dollar as we have seen the Aussie try to break above the 0.65 level only to fail again.

- With this being the case I think you've got a situation where the Australian dollar continues to be very noisy maybe a little bit at the mercy of the situation in China as far as the economy is concerned.

- After all, Australia is highly levered to China. But another thing that you could put into perspective is the fact that interest rates did rise in the United States during the trading session as we continue to see the long end of the curve sell off that's going to make the US dollar a little bit more attractive for some longer term investors.

But at the end of the day, I think really, you've got a situation here where the market is just simply going sideways. It's hanging around the 200 day EMA. And it just doesn't have anywhere to be. As long as that's going to be the case, the market is likely to continue to see sellers near the 0.65 level and buyers near the 0.635 level.

On the Breakout

Top Regulated Brokers

If and when we can break out of this area, then I think maybe you have about a 150 pip move in one direction or the other, as it would line up quite nicely with previous support near the 0.62 level and previous resistance at the 0.67 level if we were to in fact break higher.

With that, if you're a short term range bound trader, this is a great market for you if you are looking for swings, that type of thing you might have to be a bit patient when trading this pair at the moment.

Ready to trade our AUD/USD Forex analysis? Here's a list of the best brokers FX trading Australia to choose from.