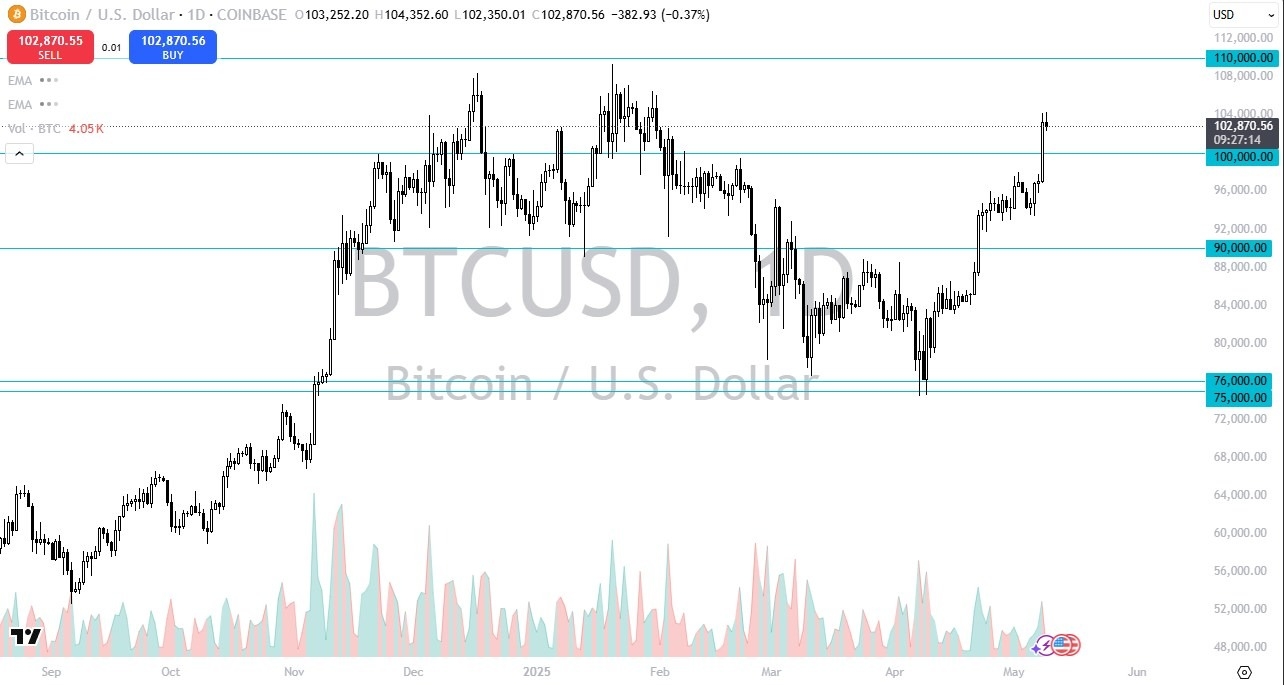

- Bitcoin has stagnated a little bit during the trading session on Friday, which makes a certain amount of sense considering that we have rallied 40 % in the last couple of months.

- That of course is a bit much and then generally means we need to pull back in order to offer enough value for people to get involved and start buying again.

I don't have any interest in shorting Bitcoin, but I do recognize when a market is overbought, you probably need to do something to mitigate some of your risk. So I think a certain amount of profit taking makes sense. And I think that profit taking is probably going to start happening somewhere in this general vicinity. On a pullback, I would look at the $100,000 level as a potential support level.

On a Move Lower

Top Regulated Brokers

But even if we break down below there, I don't think it changes much. It just opens up the possibility of possibly buying Bitcoin at the $95,000 level. This is a market that of course led Wall Street to the downside and then led it back up to the upside. It's very interesting behavior. But if you think about it, it makes a certain amount of sense considering it's an institutional ETF now. So, its behavior is going to be a lot different.

It is acting more like an ETF that mimics the Nasdaq 100 or risk appetite in general and less like some type of currency. The whole idea behind Bitcoin is changing, although the very real problem that we still have with Bitcoin is it's just not used in the real world. So given enough time, I would expect another massive flush, but that's not until institutions decide to hand it off to retail traders. They clearly aren't ready to do that yet. So, at this point, I think a short-term pullback offers value that you'll be taking advantage of.

Ready to trade daily Bitcoin forecast? Here are the best MT4 crypto brokers to choose from.