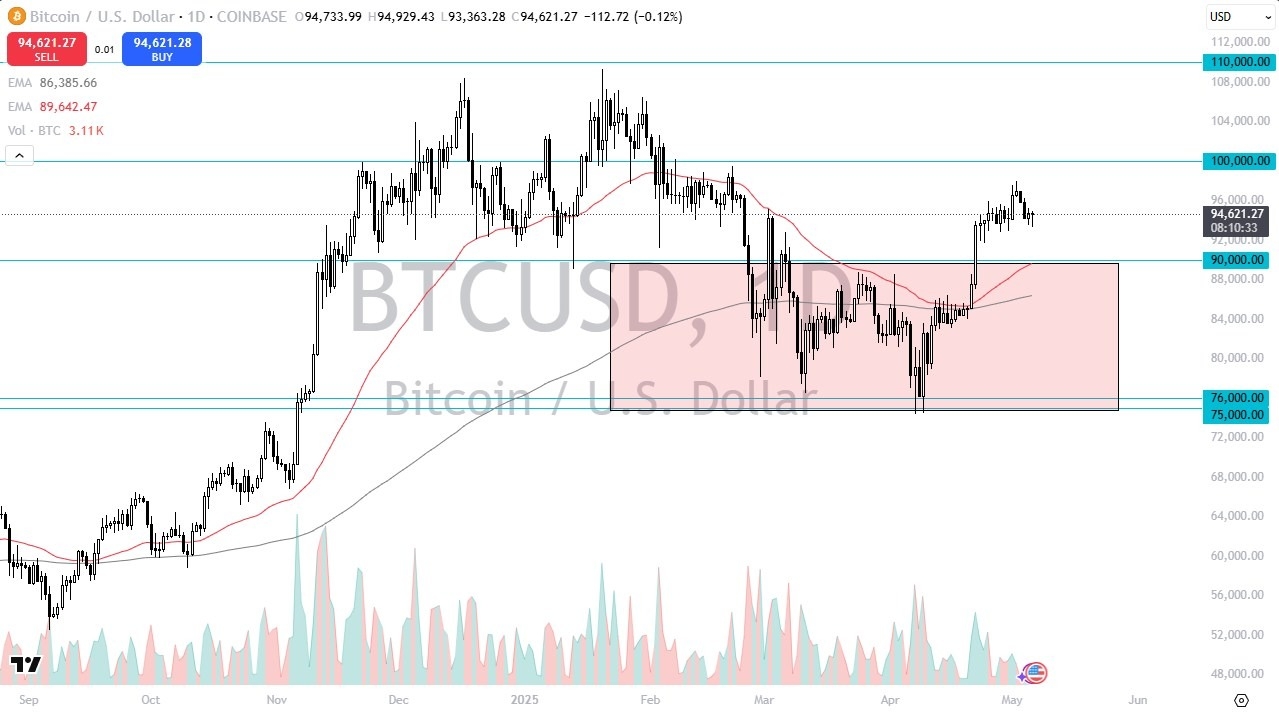

- The Bitcoin market initially pulled back a bit during the trading session here on Tuesday but turned around the show signs of life again.

- By doing so, it looks as if we are going to stay within the consolidation area that we have been in for a while.

- And I also recognize that this is a market that is looking for some type of catalyst to get going one direction or the other.

If we break down from here, the $90,000 level is a large round psychologically significant figure. And that is an area that I think the market will be paying close attention to, assuming that we even get there. It's worth noting that there's a lot of market memory around the $90,000 level as we have seen both support and resistance show up there. We have the 50 day EMA sitting right around that same area as well. And therefore, I think you've got a situation where the market remains very steadfast in defending that area. Now to the upside, I think we have a significant possibility of reaching the $100,000 level eventually. And the key word is eventually.

FOMC

Top Regulated Brokers

Keep in mind though that at the end of the Wednesday session, we have the Federal Reserve and its FOMC meeting minutes, press conference announcement, etc. So, with that being the case, I think you would have to recognize that there could be a significant amount of volatility, but that might end up being the catalyst. Perhaps Jerome Powell says explicitly that they are in fact going to start cutting this summer. If that's the case, that probably helps Bitcoin. But I think most market participants expect this.

The question now is whether or not they are more dovish than expected. If they are more hawkish, then that could be negative for Bitcoin for the short term. But we have seen Bitcoin behave quite differently than it has in the past when there's been a lot of negativity in the markets. It actually led Wall Street lower, and it led Wall Street higher after that. So it was very interesting days.

Ready to trade daily BTC/USD forecast & predictions? We’ve made a list of the best Forex crypto brokers worth trading with.